Amdocs Limited DOX, a leader in providing software and services to communications and media companies, has introduced its End-to-End Service Orchestration (“E2ESO”) solution. This innovative offering is designed to streamline business intent delivery and boost operational efficiency for service providers in the ever-evolving landscape of communications and media.

Amdocs plans to showcase the E2ESO platform, along with other solutions, at the Mobile World Congress Barcelona from Feb 26 to Feb 29, 2024. This move underscores the company’s commitment to simplifying network complexity and empowering service providers with advanced solutions in an era of rapid technological advancements.

A Breakthrough in Service Orchestration

The E2ESO solution, already deployed across multiple customers, serves as a crucial bridge connecting desired business outcomes with the necessary network resources and configurations. By intelligently orchestrating various actions and abstracting network complexity, E2ESO simplifies interactions between service providers and their customers.

Cutting-Edge Technology Adoption

This solution is a significant shift for Communication Service Providers (CSPs) as it harnesses the power of cutting-edge technologies such as virtualization, cloud, 5G, slicing, edge technologies, Network-as-a-Service and API Exposure. These capabilities enable service providers to go beyond traditional connectivity models and explore innovative monetization avenues, such as marketplaces and B2B2X.

Amdocs’ E2ESO solution offers a host of benefits, including a substantial reduction in time to market and the total cost of ownership. Its agile, open, microservices-based architecture ensures scalability and flexibility, allowing seamless operation across domains, vendors and technologies such as NaaS, SD-WAN and 5G. The intent-driven design of E2ESO operates cohesively, following a standard-aligned approach. The integration of TEOCO’s service assurance solution, a recent acquisition by Amdocs, completes the end-to-end service orchestration with a comprehensive closed-loop approach.

Leadership in Automation Portfolio

The company’s automation portfolio, fortified by strategic acquisitions and in-house developments, has solidified its position as a trusted vendor for numerous CSPs. Anthony Goonetilleke, the Group President of Technology and Head of Strategy at Amdocs, emphasized the scalability and vendor-agnostic nature of the E2E2SO platform. He highlighted its new capabilities, including generative artificial intelligence (AI), aimed at reducing time to market for network service introduction and enhancing user experiences by minimizing fallout.

Amdocs is benefiting from its three-fold AI strategy that includes the integration of AI into its Customer Experience Solutions platform. Secondly, it is leveraging generative AI and its telecommunication expertise to address the challenges prevailing in the industry. Lastly, it is collaborating with the industry leaders in the AI field to expand its reach. Moreover, the company believes that investment in generative AI-enabled solutions will provide it with more opportunities for margin expansion in the long run.

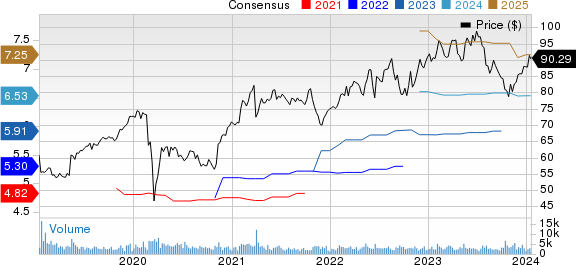

However, DOX’s near-term prospects might be hurt by softening IT spending, high inflation and interest rates negatively affecting consumer spending, and enterprises postponing large IT spending plans due to a weakening global economy. Amdocs previously pointed out that current macroeconomic uncertainty has begun to weigh on customers’ spending decisions, presenting headwinds to revenue growth. This does not bode well for this Zacks Rank #4 (Sell) company’s prospects in the near term.

Stocks to Consider

Some better-ranked stocks from the broader technology sector are Zoom Video Communications Inc. ZM, Amazon.com AMZN, and NVIDIA Corporation NVDA. While Zoom sports a Zacks Rank #1 (Strong Buy), Amazon and NVIDIA each carry a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Zoom’s fiscal 2024 earnings has been revised upward by 28 cents to $4.94 per share in the past 60 days, suggesting year-over-year growth of 13%. The long-term estimated earnings growth rate for the stock stands at 33.5%. Shares of ZM have risen 1.7% over the past year.

The Zacks Consensus Estimate for Amazon’s 2023 earnings has been revised upward by 2 cents to $2.69 per share in the past 30 days, which calls for an increase of 278.9% on a year-over-year basis. The long-term expected earnings growth rate for the stock is pegged at 28.5%. AMZN stock has returned 61.8% over the past year.

The consensus mark for NVIDIA’s fiscal 2024 earnings has been revised upward by 2 cents to $12.31 per share over the past 30 days, indicating a whopping 269% increase from fiscal 2023. It has a long-term earnings growth expectation of 13.5%. In the trailing 12 months, NVDA stock has surged 234.1%.