Lucid (NASDAQ: LCID) suffered a significant drop in Thursday’s trading, with share prices closing the daily session down 4.7%, plunging as much as 8.3%, according to data from S&P Global Market Intelligence.

The decline in Lucid stock came on the heels of Tesla’s announcement of a 5,000 euros price cut for its Model Y vehicle in Germany and similar reductions in France, Norway, and the Netherlands, magnifying concerns about softening EV demand in the market. The move by Tesla, a top player in the electric vehicle industry, suggests significant headwinds for other companies in the space, including Lucid.

Assessing the Lucid Stock’s Prospects

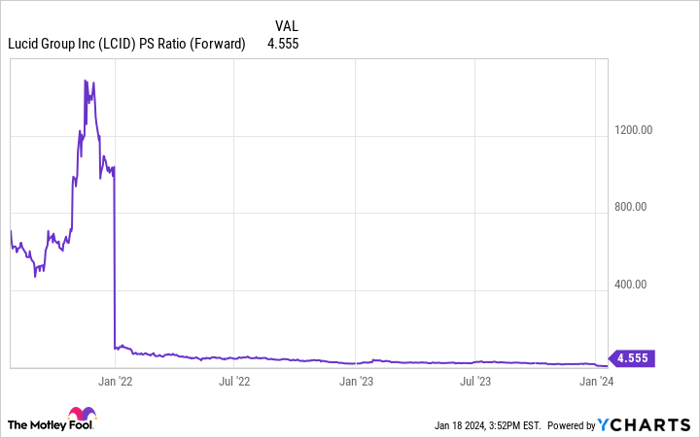

As a relatively new entrant in the EV sector that went public through a merger with a special purpose acquisition company (SPAC) in July 2021, Lucid’s share price has now tumbled approximately 95% from its peak.

LCID PS Ratio (Forward) data by YCharts

However, despite the steep valuation decline, the company is still trading at about 4.6 times the expected sales for the year. Furthermore, Lucid is far from achieving profitability, even with an optimistic business trajectory.

Despite posting revenue of $137.8 million on 1,457 vehicle deliveries in the third quarter of 2023 and holding approximately $4.4 billion in cash, equivalents, and short-term investments, Lucid’s net loss in the period stood at about $752.9 million. The company’s long-term viability is contingent on a substantial increase in vehicle production and sales, as well as maintaining strong pricing power in the ultra-luxury market.

With Tesla once again reducing vehicle prices and major automakers like General Motors and Ford scaling back EV productions, Lucid faces an increasingly challenging demand environment in the short term.

Despite the sharp decline from its peak, Lucid stock remains highly risky. Should the company manage to overcome the upcoming challenges and move towards profitability, its stock could potentially witness significant gains from current price levels. However, investors need to recognize that the business confronts daunting odds, and its already devalued stock might experience further declines.

Before considering an investment in Lucid Group, take into account that the Motley Fool Stock Advisor analyst team identified 10 stocks with strong potential for enormous returns – and Lucid Group did not make the list. The Stock Advisor service has significantly outperformed the S&P 500 return since 2002 and offers guidance on building a successful portfolio and regular updates from analysts, along with two new stock picks each month.

*Stock Advisor returns as of January 16, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

“`