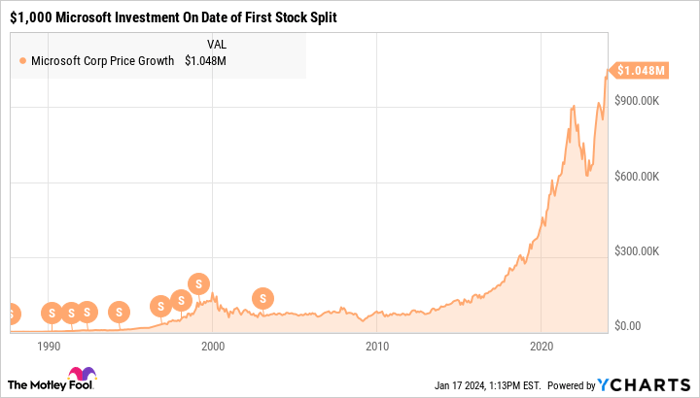

Tech-giant Microsoft (NASDAQ: MSFT) has a storied history of executing nine stock splits since its initial public offering (IPO) in 1986. If an investor had purchased a single share on the day of Microsoft’s IPO and held it through the subsequent splits, that lone share would have grown to a substantial 288 shares today. A $1,000 investment in Microsoft at the time of the first stock split in 1987 would be valued at $1.05 million today.

It’s been nearly two decades since Microsoft last executed a stock split in February 2003, causing many to wonder if the tech titan is due for another split in the near future.

While there are no guarantees, a stock split often signifies the board of directors and management’s confidence in the company’s continued growth. This confidence is generally seen as a positive sign by investors, albeit a split doesn’t inherently create additional value or new investment opportunities.

Trading at $389 per share with a market capitalization of $2.9 trillion, Microsoft’s stock price remains at a lofty height, prompting speculation about the company’s future potential moves.

It’s the same delicious pizza pie whether you slice it in eight pieces or 16. Image source: Getty Images.

Microsoft’s AI Dominance

Microsoft’s stock performance has been exceptional in the wake of OpenAI’s introduction of the ChatGPT system. The company’s significant $13 billion investment in OpenAI, coupled with the integration of AI capabilities into its Azure platform and enterprise software, has positioned Microsoft at the forefront of the AI revolution.

This aggressive AI strategy has yielded tangible results, with Azure AI services experiencing rapid growth and the potential for revenue upticks from AI-enhanced products such as Microsoft 365. Bill Gates once remarked that the development of AI is as pivotal as the advent of the microprocessor, the personal computer, the internet, and the mobile phone, suggesting that Microsoft’s leading role in the AI revolution could propel its long-term growth to unprecedented heights.

Furthermore, Microsoft’s recent acquisition of video game giant Activision Blizzard is expected to drive substantial changes throughout the company’s entire business.

With these developments in mind, a stock split in 2024 seems plausible as Microsoft stands at the cusp of a new business era.

Impact of a Stock Split on Shareholder Value

In the modern era, where most brokerages support fractional share trading and transactions are typically fee-free, the impact of a stock split on shareholder value may be less significant than in the past. Whether or not Microsoft opts to initiate a stock split, investors have easy access to fractional share trading, allowing for comparable investment opportunities.

While Microsoft’s future actions remain uncertain, potential investors are advised to conduct due diligence and rely on their own analyses when making investment decisions, and not rely solely on the possibility of a stock split.