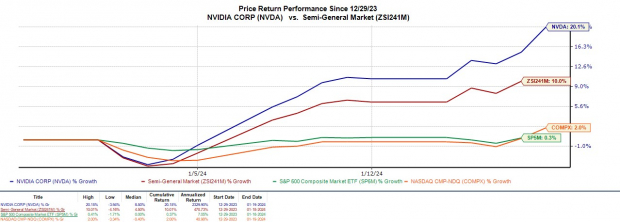

Nvidia (NVDA) has been on fire at the start of 2024, outperforming the broader market and skyrocketing over +200% in the last year.

The chipmaker’s stock has crossed $500 a share, surged over +20% year to date, and is now on the verge of reaching $600 a share. The bullish trend is driven by anticipation surrounding the upcoming HGX H200 AI chip. Nvidia’s stock is poised to maintain its lead over competitors like AMD (AMD) and Intel (INTC).

Image Source: Zacks Investment Research

Recent Momentum

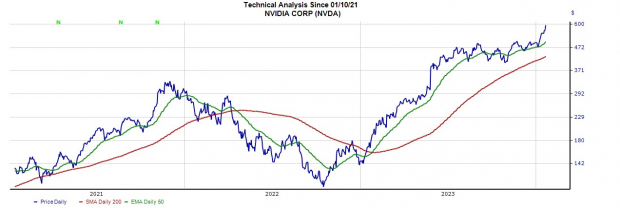

Remarkably, Nvidia’s stock blew past the $500 a share mark last week, continuing its very bullish trend after eclipsing its 50-day moving average and has blown away its 200-day moving average.

The stock is currently closing the trading session up +4% at $595, hitting new 52-week highs. The excitement is fueled by the upcoming HGX H200 AI chip, set to be released during the second quarter, solidifying Nvidia’s dominance in the market.

Image Source: Zacks Investment Research

When Does Nvidia Report Earnings?

Nvidia will be reporting its Q4 results on February 28 and is expected to post another quarter of exponential growth.

Fourth quarter earnings are expected to skyrocket 410% to $4.49 a share versus $0.88 per share a year ago. Quarterly sales are projected to soar 232% to $20.1 billion. Nvidia has now surpassed earnings expectations for four straight quarters, posting an average earnings surprise of 18.99%.

Image Source: Zacks Investment Research

Bottom Line

Nvidia’s stock currently sports a Zacks Rank #1 (Strong Buy) and the Average Zacks Price Target of $649.11 a share still suggests 13% upside. Stellar growth and its position as a leader in powering artificial intelligence could propel Nvidia’s stock even higher leading up to its Q4 report in February.