Investing in growth exchange-traded funds (ETFs) has been proven as a way to maximize earnings while effectively reducing risk. These investment vehicles are designed to deliver higher-than-average returns by compiling a diverse portfolio of stocks with the potential for above-average growth.

ETFs can be an excellent choice for low-maintenance investment due to their pre-selected stocks, sparing investors the time and effort of extensive research typically required when investing in individual stocks.

However, it’s important to recognize the uncertainty inherent in all investments. Yet, among these uncertainties, there are three growth ETFs that strike a balance between risk and reward and could potentially triple your investment with minimal effort.

1. Vanguard Growth ETF

The Vanguard Growth ETF (NYSEMKT: VUG) is a robust ETF comprising over 200 growth stocks, with over half of them from the tech sector. Notably, this large-cap growth ETF significantly reduces risk by including stocks solely from large companies, which are generally less volatile. Nearly half of the fund’s composition consists of colossal stocks such as Amazon, Microsoft, Apple, Tesla, and Nvidia.

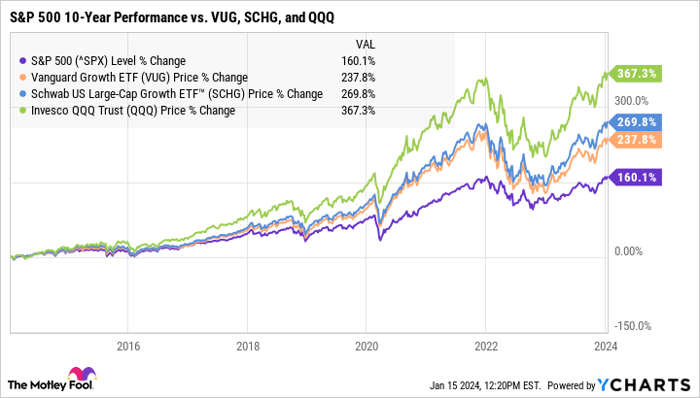

Historically, this ETF has consistently outperformed the market, earning total returns of nearly 238% over the past 10 years, while the S&P 500 (SNPINDEX: ^GSPC) only achieved returns of around 160% in the same period.

Moreover, the Vanguard Growth ETF boasts a rock-bottom expense ratio of just 0.04% per year, potentially saving investors thousands of dollars in fees over time.

2. Schwab U.S. Large-Cap Growth ETF

The Schwab U.S. Large-Cap Growth ETF (NYSEMKT: SCHG) is another growth ETF comprising 251 stocks, with around 44% from the tech industry. Offering more diversification and lower risk than its counterparts, this ETF has also outperformed the Vanguard Growth ETF, boasting total returns of roughly 270% over the past 10 years.

Similar to the Vanguard Growth ETF, it maintains an expense ratio of 0.04% per year, offering investors minimal fees.

3. Invesco QQQ Trust

The Invesco QQQ Trust (NASDAQ: QQQ) is the highest performer among the listed ETFs but also carries the most risk. Despite having the highest expense ratio at 0.20% per year and being the least diversified ETF, it has significantly outperformed both the Vanguard Growth ETF and the Schwab U.S. Large-Cap Growth ETF, earning total returns of more than 367% over the past 10 years.

While this performance is impressive, investors considering the Invesco QQQ Trust should carefully evaluate their risk tolerance, as there are no guarantees of continued high returns.

Tripling Your Money Over Time

Though tripling your investment over time is conceivable, it’s essential to recognize that growth ETFs can be exceedingly volatile in the short term, with no assurance of beating the market at all. Before investing, it’s crucial to assess the level of risk you are ready to assume.

Over the past 10 years, the Vanguard Growth ETF has achieved an average annual return of roughly 14%, the Schwab U.S. Large-Cap Growth ETF nearly 15%, and the Invesco QQQ Trust around 17%. Though it’s important to note that there are no guarantees of sustained high returns.

| ETF | Total Portfolio Value: 10 Years | Total Portfolio Value: 20 Years |

|---|

Unlocking Wealth Potential with Growth Exchange-Traded Funds (ETFs)

High Returns from Growth ETFs

Over the past 30 years, investors have witnessed impressive returns from various Growth Exchange-Traded Funds (ETFs). Based on historical data, ETFs such as VUG, SCHG, and QQQ have demonstrated annual returns of 14%, 15%, and 17% respectively. These returns have translated to substantial financial gains, with initial investments of $7,000, $8,000, and $10,000 ballooning to $102,000, $132,000, and $222,000 over the course of three decades. Such remarkable growth exemplifies the vast potential for wealth creation through judicious investment in Growth ETFs.

Achieving Financial Milestones

To triple your investment with these ETFs, a time horizon of approximately 10 years is the premise. Assuming continued similar returns, the potential for multiplying your initial investment unfolds. Furthermore, prolonging the investment period or incrementally adding funds on a monthly basis could set the stage for even more substantial financial rewards. The possibilities for reaching significant financial milestones abound through the strategic utilization of Growth ETFs.

Weighing Risks and Rewards

While the stock market promises high rewards, the critical importance of assessing one’s risk tolerance cannot be overstated. It is essential to recognize that no investment comes with guaranteed success. However, by embracing a prudent investment approach and nurturing a long-term perspective, the potential for financial gains becomes a tangible reality.

The Question of Invesco QQQ Trust

Contemplating investment in Invesco QQQ Trust warrants careful evaluation. Furthermore, insights from the Motley Fool Stock Advisor analyst team highlight the emergence of 10 stocks that hold the potential for substantial returns in the foreseeable future. This underscores the significance of approaching investment decisions with requisite due diligence, paving the way for prosperous financial outcomes.

Professional Expertise and Investment Guidance

The renowned Stock Advisor service provides investors with a blueprint for success, offering comprehensive guidance on portfolio construction, regular analyst updates, and two new stock picks each month. Notably, the Stock Advisor service excels in delivering a return that has surpassed the S&P 500 by more than threefold since 2002. This exemplifies the potential for harnessing professional expertise in the pursuit of investment success.

Embracing a Forward-Thinking Investment Approach

Ultimately, the endorsement from esteemed industry figures such as John Mackey, former CEO of Whole Foods Market (an Amazon subsidiary), reinforces the significance of adopting an informed investment strategy. Important insights guide investors in handling popular stock options such as Amazon, Apple, Microsoft, Nvidia, Tesla, and Vanguard Index Funds – Vanguard Growth ETF. Navigating the financial landscape with prudence and diligence is the foundation upon which enduring financial success is constructed.