Bitcoin ETF Approval Sparks Market Surge and Subsequent Dip

The cryptocurrency market welcomed 2024 on a promising note, buoyed by a remarkable rally in the previous year. A game-changing development occurred on Jan 10 when the U.S. Securities and Exchange Commission (SEC) approved rule changes permitting the creation of spotbitcoin exchangetraded funds (ETFs). This decision is poised to pave the way for the launch of 11 spot bitcoin ETFs in the course of this year.

The SEC’s move, long awaited by individuals, money managers, and financial institutions, grants them exposure to the world’s largest cryptocurrency without requiring actual ownership. The momentum was catalyzed when the SEC lost a lawsuit to Grayscale in August 2023, altering the regulatory landscape for spot bitcoin ETFs.

Following the announcement, the price of bitcoin (BTC) surged past the $47,000 mark, reaching $47,893.70. However, the price has since tumbled, with Bitcoin trading 3% lower at $39,854.61 on Jan 22, marking its lowest level since December 2023, albeit retaining significant potential.

Market Dynamics and Institutional Thrust Propel Cryptocurrency and Technology Sectors

Against this backdrop, the SEC’s landmark decision stands to position the crypto space as a pivotal component of mainstream finance. This regulatory tailwind is complemented by the Federal Reserve’s indication of a potential interest rate cut in 2024, the first since March 2020 during the onset of the pandemic, which bodes well for high-growth sectors like technology and cryptocurrency.

Furthermore, institutional investors have been a driving force behind the crypto surge, while the impending Bitcoin Halving in the first half of 2024 is expected to bolster the cryptocurrency’s value due to reduced supply arising from halving-induced scarcity.

Stocks Gearing Up for Growth Amid Bitcoin Market Volatility

NVIDIA Corp. (NVDA) is positioned as a powerhouse in the semiconductor industry, thriving on its prominent role in graphic processing units (GPUs), which are integral to data centers, artificial intelligence, and crypto asset creation. The company boasts an expected earnings growth rate of 63.1% for the current year, with a Zacks Rank #1 (Strong Buy).

Coinbase Global Inc. (COIN) offers financial infrastructure and technology for the crypto economy, enabling consumers, institutions, and developers to engage with crypto assets. With an expected earnings growth rate of 35.1% and a Zacks Rank #2 (Buy), COIN is poised for growth in the current year.

Block Inc. (SQ) operates as an online digital and mobile payment platform, facilitating Bitcoin transactions through its Cash App. With an anticipated earnings growth rate of 53.9% and a Zacks Rank #3 (Hold), SQ is positioned to capitalize on the crypto market’s potential.

Robinhood Markets Inc. (HOOD) runs a financial services platform in the U.S. that allows users to invest in various assets, including cryptocurrencies such as Bitcoin and Ethereum. HOOD is primed for growth, with an expected earnings growth rate of over 100% for the current year and a Zacks Rank #3.

CME Group Inc. (CME) offers cryptocurrency options and futures contracts, contributing to the financial infrastructure for digital assets. Operating with an anticipated earnings growth rate of 2.5% and a Zacks Rank #3, CME is optimizing its position to benefit from the evolving crypto landscape.

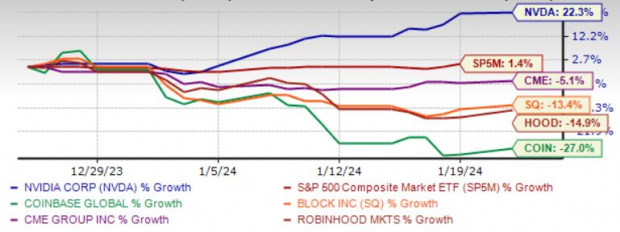

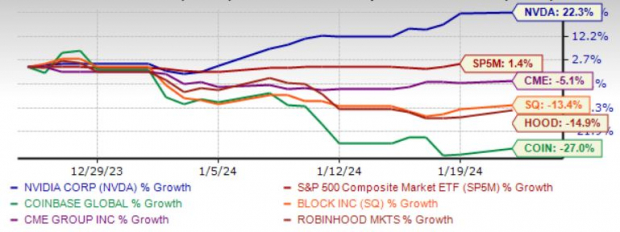

Visualizing Stock Performance in the Past Month

Image Source: Zacks Investment Research

Conclusion

The recent volatility in Bitcoin’s price should not be overlooked, and it presents an opportune time for investors to evaluate potential growth avenues in the cryptocurrency market. While Bitcoin’s price fluctuations may seem turbulent, astute investors can capitalize on the evolving regulatory landscape and institutional interest to explore investment opportunities in stocks poised to benefit from the crypto surge.