Last year’s stock market sell-off in 2022 and resulting economic challenges underscored the value of long-term investing. Despite temporary economic downturns, holding onto reliable growth stocks has proven to be a prudent approach, as exemplified in the rebound of the market in 2023.

Notable companies like Alphabet, Amazon, and Nvidia experienced price dips in 2022 due to inflation, only to surge last year, demonstrating the resilience of these growth stocks. These three companies are poised to reward patient investors with significant gains in the coming year.

Alphabet: Dominance in Advertising and AI

Alphabet has consistently exhibited robust growth, with its stock up 164% since 2019 and annual revenue climbing 75%. The company’s market dominance in search engines has propelled its expansion across various segments, a trend that is expected to continue into 2024.

With popular brands such as Google, Android, and YouTube, Alphabet has amassed billions of users, presenting vast advertising opportunities. Notably, its competitive position in the $740 billion digital advertising industry has been a major revenue driver.

In the third quarter of 2023, Alphabet’s revenue soared by 11% year over year, surpassing Wall Street estimates by $980 million. Benefiting from a resurgent digital ad market, Google Search sales increased by 11%, while YouTube ads saw a remarkable 12% uptick.

Furthermore, Alphabet’s foray into AI presents an exciting prospect for investors in 2024. The impending launch of its highly anticipated large language model, Gemini, is expected to rival OpenAI’s cutting-edge AI engine, GPT-4. Projected to bolster various facets of Alphabet’s business, this move could fortify its foothold in the industry.

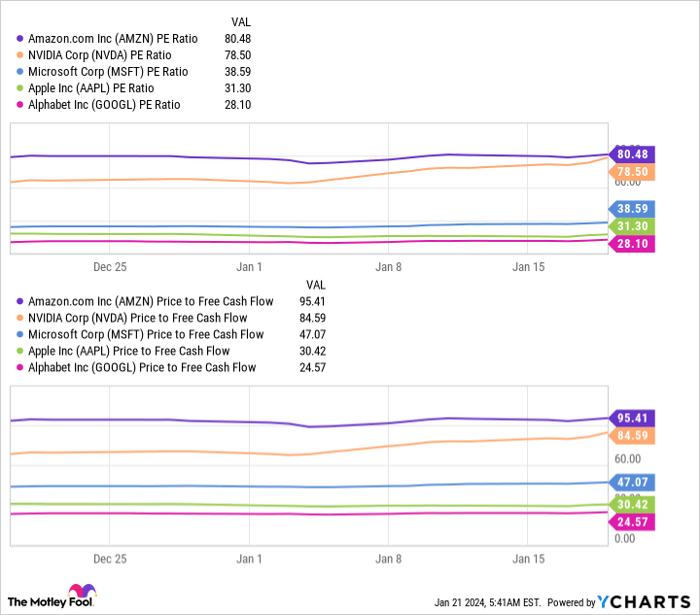

Moreover, Alphabet offers compelling value with lower price-to-earnings ratios (P/E) and price-to-free cash flows, making it one of the most enticing prospects in the tech sector.

Amazon: Reinvigorated Business Strategy

Amazon’s stock has seen a remarkable 60% surge in the last twelve months, propelled by a stellar year of growth. Strategic cost-cutting measures and investments in promising sectors like AI have set the company on a trajectory for substantial long-term gains.

Following setbacks in 2022, Amazon swiftly initiated a restructuring of its operations, prioritizing profitability. Initiatives including the closure of warehouses, mass layoffs, and the discontinuation of unprofitable projects have underpinned the company’s resurgence, leading to a staggering 427% surge in free cash flow over the past year.

Moreover, the company’s thriving e-commerce business and its high-yielding cloud platform, Amazon Web Services (AWS), have significantly bolstered its performance. With a commanding 32% market share in the cloud sector, AWS is well-positioned to reap substantial benefits from the burgeoning AI landscape. Furthermore, its recent foray into chip development signifies Amazon’s emergence as a formidable player in this nascent industry.

Notably, Amazon’s projected earnings per share (EPS) could reach nearly $5 by fiscal 2024, translating to an expected stock growth of 36% over the next fiscal year. Coupled with recent cost-cutting initiatives and a burgeoning presence in AI, Amazon’s stock appears to be an appealing investment in 2024.

Nvidia: Ascendancy in AI Hardware

Nvidia has witnessed exponential growth in recent years, with its stock surging over 1,400% since 2019. The company’s graphics processing units (GPUs) have become the industry standard for AI developers worldwide, underpinning its meteoric rise.

As interest in AI soared in 2023, demand for GPUs experienced a corresponding upsurge, and Nvidia emerged as the primary supplier to the market. The company secured an estimated 90% market share in AI chips, propelling its earnings to new heights.

In conclusion, the compelling narratives of Alphabet, Amazon, and Nvidia position these stocks as prime candidates for investors seeking sustained growth and substantial returns in 2024. With their formidable market positions, innovative strategies, and strong financial performances, these companies are expected to continue their upward trajectory in the new year.

NVIDIA’s Explosive Growth Sparks Investor Frenzy

Rocketing Revenues and Soaring Income

In the third quarter of fiscal 2024 (which ended October 2023), Nvidia’s revenue skyrocketed, achieving a remarkable 206% rise year over year. Simultaneously, the company witnessed a stratospheric surge in operating income, which soared an astronomical 1,600%. These astonishing financial results catapulted Nvidia’s stock to the center stage of investor attention.

AI GPU Sales Propelling the Company’s Fortunes

Nvidia’s exponential growth can be attributed to a meteoric 279% escalation in data center revenue, driven by a flurry of AI GPU sales. This phenomenal performance in the AI segment has added momentum to Nvidia’s overall profitability and firmly established the company as a commanding force in the tech industry.

A Dazzling Future Earnings Projection

Forecasts indicate a dazzling trajectory for Nvidia’s earnings, with projections suggesting it could reach nearly $20 per share in the next fiscal year. When juxtaposed with its forward P/E ratio of 49, these figures imply a potential share price of $980 – a whopping 65% increase from the current valuation. A target of this magnitude may sound lofty, but it is anchored in reasonable financial analyses.

A Tempting Investment Opportunity

Considering the sensational growth and promising future earnings outlook, Nvidia’s stock emerges as an irresistible investment prospect. The company’s robust performance across various tech sectors, including cloud computing, PC, and video game consoles, augurs well for sustained growth and firmly cements its status as a compelling long-term growth stock in the eyes of many investors.

*Stock Advisor returns as of January 16, 2024