Mobileye Global Inc. (MBLY) is gearing up for the release of its fourth-quarter 2023 results on Jan 25, ahead of market open. Analysts’ forecast for the to-be-reported quarter’s earnings per share is 27 cents and $636.38 million in revenues.

The consensus estimate for Mobileye’s quarterly earnings per share has recently been adjusted upward by 4 cents. Its bottom line is expected to hold steady compared with the year-ago figure.

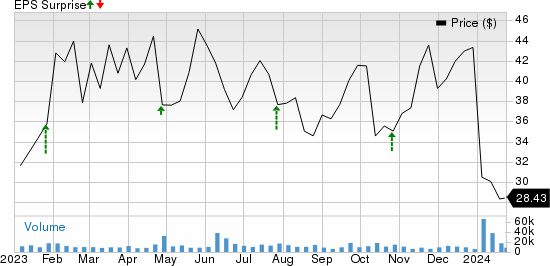

On the revenue front, analysts anticipate a year-over-year increase of 12.6%. Mobileye has a history of surpassing earnings estimates, with an average surprise of 29.47% over the past four quarters.

Q3 Performance Overview

Mobileye exceeded the Zacks Consensus Estimate in its third-quarter 2023 earnings.

Its adjusted earnings per share of 22 cents surpassed the consensus metric of 17 cents and reflected growth from 15 cents per share reported in the year-ago quarter.

Consolidated revenues came in at $530 million, up 17.7% from the corresponding quarter of 2022, albeit narrowly missing the Zacks Consensus Estimate of $531 million.

Factors Influencing Q4

Mobileye is grappling with the impact of escalating operating expenses, which are putting pressure on margins. In the first nine months of 2023, operating expenses surged by approximately 18.4%.

The company’s ongoing investments in various ventures, including SuperVision and Chauffeur launch, sixth and seventh generations of EyeQ, and facility expansion, are driving up operating expenses and capital expenditures.

Intense competition from automotive chipmakers such as Qualcomm and NVIDIA is also adding to the company’s challenges. The combination of rising expenses and significant competition is likely to weigh on the upcoming results.

Mobileye’s plans to introduce the second generation of the supervision domain controller in the fourth quarter are anticipated to lead to a lower average selling price (“ASP”). While a lower ASP could eventually bolster gross margin from the second quarter of 2024 onward, it is expected to have a near-term adverse impact on margins.

Earnings Prognosis

Based on our analytical model, the likelihood of Mobileye outperforming earnings estimates in the upcoming quarter is not definitive, mainly because it lacks the ideal combination of two key factors for an earnings beat. The detailed analysis is provided below:

Earnings ESP: Mobileye has an Earnings ESP of 0.00%, attributable to the Most Accurate Estimate aligning with the Zacks Consensus Estimate. Delve into potential stock investments before they’re disclosed using our Earnings ESP Filter.

Zacks Rank: MBLY currently carries a Zacks Rank #4 (Sell).

Front-Runners in the Auto Domain

Amid the upcoming earnings blitz, several players in the auto space are poised to deliver an earnings beat, as per our model.

Lear Corporation (LEA) is set to unveil its fourth-quarter 2023 results on Feb 6, armed with an Earnings ESP of +1.36% and a Zacks Rank #3. The Zacks Consensus Estimate for Lear’s upcoming quarter’s earnings and revenues is $3.08 per share and $5.64 billion, respectively.

Ford Motor Company (F) is also scheduled to release its fourth-quarter 2023 results on Feb 6, carrying an Earnings ESP of +4.93% and a Zacks Rank #3. The Zacks Consensus Estimate for Ford’s upcoming quarter’s earnings and revenues is 12 cents per share and $36.39 billion, respectively.

BorgWarner Inc. (BWA) is lined up to unveil its fourth-quarter 2023 results on Feb 8, supported by an Earnings ESP of +2.44% and a Zacks Rank #3. The Zacks Consensus Estimate for BorgWarner’s upcoming quarter’s earnings and revenues is 91 cents per share and $3.59 billion, respectively.

Track upcoming earnings announcements using the Zacks Earnings Calendar.