Tesla (NASDAQ: TSLA) stock reached its zenith in 2021, catapulting the company’s valuation beyond $1 trillion. However, the subsequent 52% freefall has shackled Tesla amid economic tempests like soaring inflation and escalating interest rates, compelling consumers to cinch their spending belts.

The electric vehicle (EV) sector is emerging from its embryonic phase, with Tesla shedding its erstwhile image as a disruptive startup, and now dispensing millions of cars annually. Consequently, its growth rate has waned while contending with competitive onslaught from new EV players and traditional automakers across the globe.

Electric Vehicle Demand Struggles amid Escalating Competition

Tesla’s sales tally of 1.2 million Model Y EVs in 2023 crowned it the year’s best-selling car across all categories. The aggregate EV sales, exceeding 1.8 million units, marginally outpaced prior projections but failed to sustain its perch as the world’s top EV manufacturer. In Q4, China-based BYD wrested the sales crown from Tesla.

Unrelenting competition characterized 2023, as legacy automakers like Ford Motor Company and General Motors escalated EV production alongside budding upstarts like Rivian Automotive. This proliferation coincided with a moderation in industry sales growth.

Notably, EVs command higher price tags than internal combustion engine (ICE) vehicles, hence the economic headwinds I alluded to earlier appear to be contributing factors. Evidently worried, manufacturers have realigned their strategies. Toward the end of last year, Ford postponed $12 billion earmarked for its EV segment due to feeble demand, subsequently downsizing production of its F-150 Lightning. Similarly, GM reneged on its 400,000-unit EV production target for 2024 and withdrew from a $5 billion EV alliance with Honda Motor.

Throughout 2023, Tesla incessantly pared prices. By December, the average price of a new Tesla plummeted by a staggering 25.1% annually (as per Cox Automotive). Although the company marginally surpassed its sales forecast, the victory came at a substantial cost, a topic I will delve into shortly. The price slashes have endured into 2024, with Tesla already lowering prices in China and Europe.

Tesla’s Q4 2023 Financial Quandary and Subdued 2024 Outlook

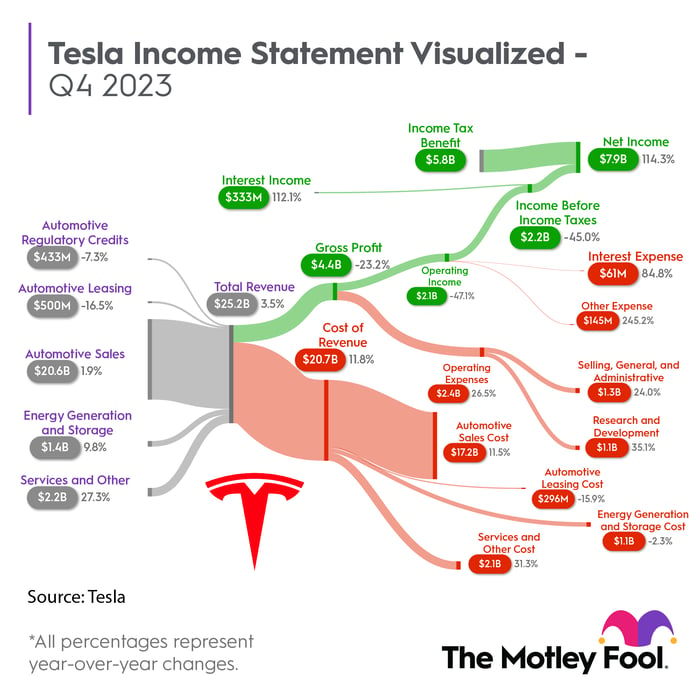

Analysts prognosticated Tesla’s fourth-quarter 2023 revenue at $25.6 billion, but the impact of the price slashes eclipsed expectations, culminating in a $25.2 billion revenue. The company’s full-year 2023 revenue notched a record high of $96.7 billion but fell shy of Street estimates.

However, investors were fixated on the gross profit margin. It customarily reigned supreme in the industry but has been dwindling since its 29.1% apogee in mid-2022, punctuated by the price cuts. Q4 2023 saw it plummet to a dismal 17.6%, hobbling Tesla’s profitability.

Although Tesla’s Q4 2023 net income appeared to double to $7.9 billion, a majority stem from a one-time noncash tax benefit worth $5.9 billion. Subtracting that, Tesla’s net income receded to $2.5 billion, marking a 39% year-over-year plunge. The absence of a specific sales projection in Tesla’s earnings report is conspicuously unprecedented; the company merely signaled notably subdued growth in 2024 compared to 2023. Certain analysts surmise this could culminate in vehicle deliveries of approximately 2.2 million units, reflecting a mere 22% year-over-year upturn.

Ray of Hope amid the Downpour

CEO Elon Musk asserted that scores of potential Tesla buyers are deterred by affordability constraints, arising not just from the lofty vehicle prices but also the exorbitant interest rates. Consequently, Tesla is poised to launch an entirely new car in 2025, catering to a significantly lower price bracket, a move Musk believes will ignite a new growth trajectory.

However, Tesla transcends the realm of mere car manufacturing. It recently unveiled the beta iteration (V12) of its fully autonomous self-driving software, supplanting hundreds of thousands of lines of computer code with artificial intelligence (AI) neural networks. This stride might herald a widespread release and fundamentally transform the company’s economics, potentially transcending car sales in generating revenues over the long haul.

Furthermore, Tesla’s AI-powered humanoid robot, Optimus, has made remarkable demonstrations of its capabilities, with Musk predicting potential shipping as early as next year. Musk contends that Optimus could eventually outstrip the combined value of all other Tesla offerings, given its diverse applications, spanning manufacturing to everyday aid.

Finally, in 2023, Tesla installed nearly 15 gigawatt-hours (GWh) of battery storage, denoting a remarkable 125% surge from 2022.

The Road Ahead for Tesla: Stock Outlook and Market Expectations

Is the electric vehicle (EV) giant Tesla poised to reclaim its lofty position in the $1 trillion market cap club by the close of 2024? A question worth raising in the context of its recent financial performance and future growth potential.

Tesla’s Stock Valuation and Growth Opportunities

With a 40GWh facility in California, Tesla anticipates continued outpacing of growth in its energy storage segment over vehicle sales. Households and businesses pivot towards battery storage, not only for green energy storage but also to bolster energy security, vital in areas experiencing a surge in extreme weather events.

Comparing Valuations

Tesla’s stock, at a price-to-earnings (P/E) ratio of 62.7 and $3.12 in non-GAAP earnings per share for 2023, stands significantly pricier than its counterparts. It trades almost three times higher than the S&P 500 index and double the Nasdaq-100 technology index. Even considering its diverse business initiatives beyond auto manufacturing, Tesla appears overvalued in the current market landscape.

Despite the company’s appeal as a tech stock, its valuation surpasses peers. For instance, established automakers like Ford and GM trade at much lower P/E ratios, 7.1 and 4.9, respectively, underscoring Tesla’s premium valuation in the market.

Tesla’s Growth Trajectory

While long-term catalysts keep investors engaged, it seems unlikely that Tesla’s stock will achieve the 53% gain required to rejoin the $1 trillion club in 2024, given its current valuation at $650 billion. Yet, the horizon may look different in the long term with milestones such as widespread release of full self-driving technology and the market debut of the Optimus robot.

Market Expectations and Investment Insights

Amidst these evaluations, Tesla has found a place among the top ten stocks recommended for investors. However, the decision to invest $1,000 in Tesla or look into other contenders remains subjective, based on individual risk tolerance and long-term expectations.

As investors chart Tesla’s forward trajectory, the car manufacturer’s role as a pioneer in sustainable energy solutions and EV technology, continues to be a focal point, with potential implications for the overall investor sentiment.

Pondering the horse race between presumptions and reality, the path ahead for Tesla seems to demand continued scrutiny for bullish and bearish indicators in the context of its broader market positioning, business maneuvers, and wider industry trends.