Every investor knows that finding stocks with a strong upward momentum can be a path to potential profits. Here are three companies that not only have a Zacks Rank #1 but also boast strong momentum characteristics. This article seeks to shed light on these potential gems for investors to consider on January 26.

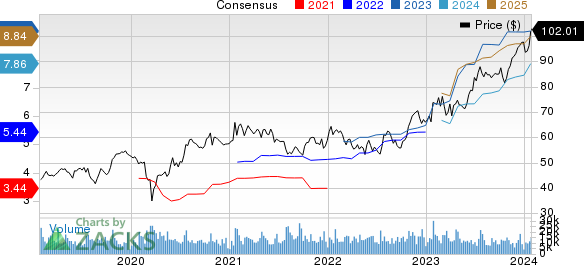

PACCAR Inc (PCAR)

PACCAR Inc, a renowned truck manufacturer, has seen its Zacks Consensus Estimate for current year earnings rise by 5.1% in the last 60 days. The company’s shares have surged by 22.5% over the past three months, surpassing the S&P 500’s growth of 18%. With a Momentum Score of A, PACCAR Inc appears to be on a bullish trajectory.

Inhibikase Therapeutics, Inc. (IKT)

Inhibikase Therapeutics, a pharmaceutical company, has also been making waves. Its Zacks Consensus Estimate for current year earnings has soared by 16% over the last 60 days. The company’s shares witnessed a remarkable growth of 195.5% over the last three months, outperforming the S&P 500. With a Momentum Score of A, Inhibikase Therapeutics seems to be marching ahead with strong momentum.

PagerDuty, Inc. (PD)

PagerDuty, a digital operations platform company, is not to be left out. It has a Zacks Rank #1 and has seen its Zacks Consensus Estimate for current year earnings surge by 16.1% over the last 60 days. The company’s shares have gained 21.8% over the last three months, outperforming the S&P 500. With a Momentum Score of B, PagerDuty appears to be a compelling choice for investors.

As you navigate the opportunities in the market, remember that a strong momentum can sometimes be a precursor for substantial future gains. Consider delving into these stocks to potentially capitalize on their upward trajectory.

Remember – as always, it’s important for investors to conduct thorough research and exercise caution, as investing always carries its inherent risks. Utilize fundamental analysis, and historical context to build a holistic view and make informed investment decisions.