A Dip After Reaching New Heights

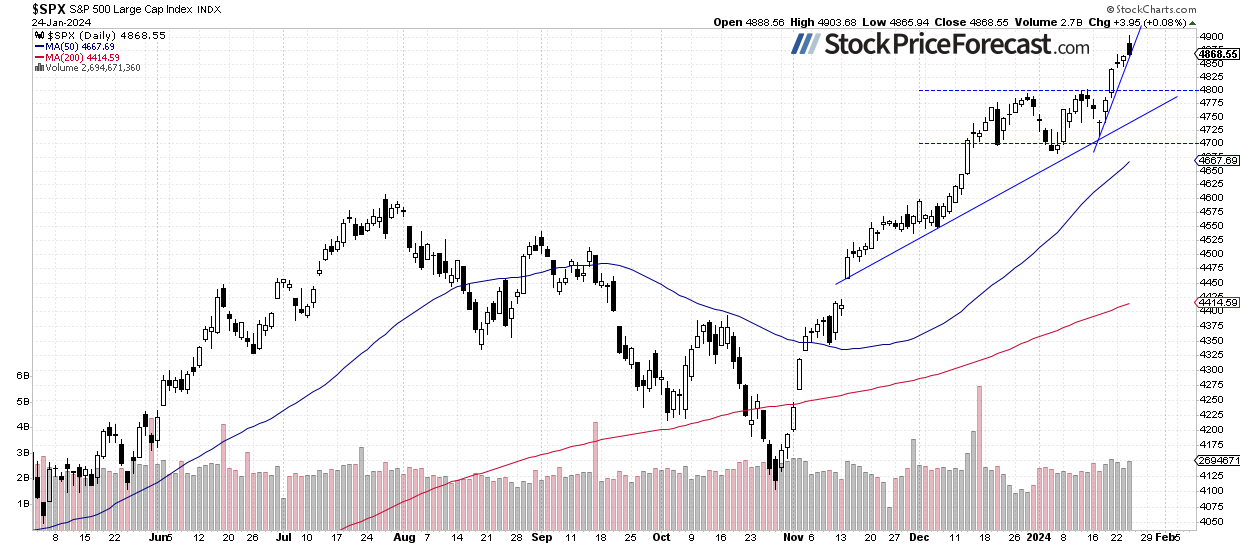

As the stock market skittered forward to a new record recently, it hit 4,903.68 before gaining a mere 0.08% at close. However, the previous strong uptrend no longer seems as assured, and those holding a bullish sentiment are now urged to consider at least a partial closure of positions. Reaching a new high did little to dispel this return of uncertainty.

Surprisingly, the AAII Investor Sentiment Survey indicated a slight downturn, with only 39.3% of individual investors showing bullish signs, down from the previous week. This may suggest an excessive complacency and a lack of fear in the market, raising some caution flags. Nevertheless, investor sentiment remains historically bullish as earnings releases and expected monetary policy easing by the Fed loom on the horizon.

Last Friday, stock prices shattered their month-long trading range, nullifying any potential medium-term topping pattern scenarios. Although the new high may suggest an onward journey, a correction scenario could be imminent. It’s a challenging task to predict a correction, but some level of caution may be wise as a downturn might be lurking.

The S&P 500 firmed by 0.2% after Tesla’s quarterly earnings release, mitigating the impact of the company being almost 9% down in pre-market trading. Better-than-expected economic data has indeed boosted the index’s spirits, hinting at a possible retracement of its intraday decline. Investors eagerly await more crucial earnings reports as the market navigates these unsteady waters.

The retreat from the 4,900 level is evident when observing the daily chart.

Nasdaq On Shaky Ground

The technology-focused Nasdaq reached a new all-time high at 17,665.26, and this morning it is expected to hold 0.3% higher despite Tesla’s quarterly earnings disappointing the market. The looming technical overboughtness implies an impending correction. Nonetheless, it had rallied and closed above the significant daily gap down in January, but caution should be exercised, as the market is hanging on the edge of the overbought territory.

VIX: A Change in Destiny?

A sudden dip in the VIX, or the fear gauge, had been noted below the 14.50 level, only to escalate suddenly yesterday by almost 5%. Historically, a descending VIX heralds a decline in market dread, and an ascending VIX correlates with stock market slumps. However, a plummeting VIX may foreshadow an impending market downturn.

Apple: Symbol of Market Fluctuations

Moving to an individual stock, Apple, a key market mover, underwent a sharp sell-off in early January before successfully rebounding near the $180 support level. It recently collided with the $195-200 resistance level and could potentially pause there as it braces for the quarterly earnings release on February 1.

Futures Contract Fluctuations

Observing the hourly chart of the S&P 500 futures contract, which is currently trading above the 4,900 level, it retraced yesterday’s intraday rally to around 4,933. No confirmed negative signals have surfaced so far; underlying support stands firm at 4,880-4,900, demarcated by recent consolidation.

In Summary

Stocks appear set to open slightly higher today, buoyed by Tesla’s earnings release and robust economic data. The Advance GDP exceeding expectations by a margin is another positive sign, although investor sentiment remains elevated, hinting at a potential correction or consolidation in the future.

Back in December, the market was filled with uncertainty after the early-rally and the S&P 500’s breakout above the 4,700 level. Last Friday’s price action disabused any thoughts of potential medium-term trend reversal. The market is swaying in the short term, but predicting a correction has become a precarious task. As for now, the short-term outlook remains neutral.

No positions seem rationally justified from a risk/reward standpoint at this juncture.

Here’s a quick rundown:

- The S&P 500 achieved a new record high, but impending uncertainty looms.

- The break above the recent highs was a positive sign, yet doubts linger about the potential for a pullback. The index seems to be nearing the zenith of a short-term uptrend.

- In the short term, the outlook is neutral, and from a risk/reward perspective, no positions seem warranted.