The significance of Wall Street’s verdict on stocks is ingrained into the bedtime stories of countless investors. But like a wobbly compass, are brokerage recommendations reliable guiderails for investment decisions or merely fictions in fancy suits?

Before we embark on an odyssey into the realm of brokerage brilliance, let’s peek at the coronation of Amazon (AMZN) by the financial sages of Wall Street — and then dissect the reliability of their oracle while we’re at it.

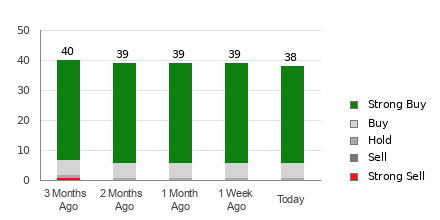

An average brokerage recommendation (ABR) of 1.11 currently envelops Amazon on a scale of 1 to 5, akin to a gravitational lurch between Strong Buy and Buy. This majestic pronouncement is birthed by a symphony of 46 brokerage firms, with 42 singing the hymn of Strong Buy and three offering their benediction as Buy. Together, they compose 91.3% and 6.5% of the harmonious chorus, respectively.

Brokerage Fragments: The Symphonic Ballad of Amazon

A pilgrimage into investing solely based on this solemn decree may prove perilous. Countless tales have unfurled about the fallibility of brokerage recommendations; they wield the dull edge of a butter knife in forecasting bountiful stock price ascents.

Why, you ask? The biases of brokerage firms, deeply entwined in the stocks they cover, twirl a honeyed lasso around the neck of their analysts, drawing them into ratings as cheery as a spring morning. Our historical exposition reveals that for every “Strong Sell” enunciation, brokerage firms unspool a tapestry of five “Strong Buy” proclamations.

Thus, the blinkers of these institutions often veer away from the broad visage of retail investors, gloomily dim in illuminating the next act in the stock’s theatrics. It’s essential to view this enunciation through the prism of your own analysis or a tool with a proven knack for stock augury.

With feathers ruffled and quizzical glares unleashed, let’s pivot to our very own Zacks Rank, a stock rating talisman unfurling its accolades in the presence of an externally audited lineage. This totem, a nexus of five stock alphabets swaying from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), stands as a benchmark for a stock’s immediate choreography of prices. Dinners with the Zacks Rank and ABR could emancipate your coffers from the shackles of fickle fate.

The ABR: A Syncopated Sojourn from the Zacks Rank

Friend, know that the Zacks Rank and ABR, akin in scale and discrete in essence, are not twin souls brokering the same tale. Enthroned by brokerage recommendations, the ABR shines as a decimal-laden specter, quaint in its display of 1.28 or the ilk. It stands in stark contrast to the Zacks Rank, a quantitative artisan chiseling its craft from the bedrock of earnings estimate revisions, signaling its presence in whole numbers

While brokerage analysts gild their epitaphs with rosy intimations, earnings estimate revisions form the marrow of the Zacks Rank. Historical tomes are replete with a waltz of empirical truths, revealing the intimate tandems of earnings estimate revisions and stock price minuets. Moreover, the Zacks Rank extends its tendrils alike to all stocks veiled under the oracle of brokerage analyst earnings guesses.

The cadence of time too coins discrepant lore. The ABR, a fiscal diorama somewhat shrouded in yesteryears, may garble the present day in its elegy. Meanwhile, brokerage analysts, tethered to the ship’s prow of earnings estimate revisions, frolic in the present, their pirouettes hewing close to the horizon of future price peregrinations.

A Glimpse into the Oracle: Is Amazon the El Dorado of Profits?

Amazon’s earnings estimate revisions, a chimeric fable of sorts, have swelled by 1.6% in the past month, culminating in a Zacks Consensus Estimate of $2.70 for the current year. The clairvoyant zeal of analysts, orchestrating a magnum opus in harmony, is reflected in their earnest concord over the ebullient swell of EPS estimates. Within this opera of numbers, a Zacks Rank #2 (Buy) is unveiled, roping Amazon into the charmed circle of profits.

Thus, the Buy-evoking ABR, akin to a shepherd’s crook leading its flock, may yet prove to be a guidepost amid the labyrinth of investment deliberations.