It’s not the quantity of earnings reports that counts, but the quality – and next week, we’re in for a real showcase. Five of the ‘Magnificent Seven’ top-tier stocks will be unveiling their performance, along with the two largest American energy firms – an event sharing some of the world’s greatest economic insights.

Thus far, the earnings season has been buoyant, with most stocks beating both earnings and revenue expectations.

The Big Tech Players

According to Sheraz Mian, head of research at Zacks, the Technology sector’s Q4 earnings are expected to rise by 18.7% from the same period last year, driven by a 6.8% surge in revenues. Without the substantial contribution from the Tech sector, Q4 earnings for the rest of the index would be down by 5.9%, rather than the current uplift of 0.6%. The ‘Big 7 Tech Players’ – Amazon, Alphabet, Apple, Microsoft, Nvidia, and Tesla – are set to start reporting Q4 results. The group’s total Q4 earnings are projected to soar by 38.3%, with revenues climbing by 12.5% compared to the same period last year.

It’s truly remarkable. Despite ample chatter about the burgeoning influence of mega-cap tech stocks within the S&P 500, the compelling sales and earnings growth they’ve delivered is simply irrefutable.

On Tuesday, after the market closes, Microsoft, and Alphabet will release their earnings, followed by Thursday’s reports from Apple, Amazon, and Meta Platforms.

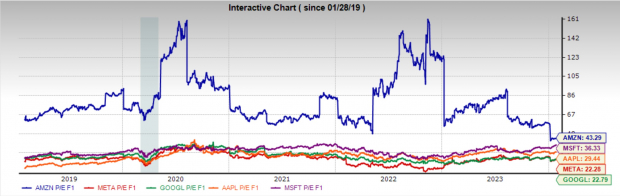

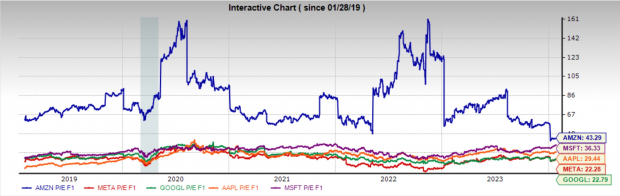

The valuations on the five tech stocks reporting next week are worth noting. Interestingly, none of them carry exorbitant valuations, with a couple even presenting attractive figures, dispelling the popular notion that ‘it’s only the big 7 driving the market higher.’

Valuation Insights

Amazon and Microsoft boast the loftiest forward earnings multiples, while Meta Platforms and Alphabet have the lowest, and Apple falls mid-range. Both Meta Platforms and Alphabet are trading below their five-year median valuations, with projected annual EPS growth of 21% and 17% over the next 3-5 years, respectively. Conversely, Microsoft and Apple are trading above their historical benchmarks, albeit not excessively so. Amazon, with the most premium valuation, is actually the farthest below its five-year median, backed by its projection of an impressive 28.5% annual EPS growth over the next 3-5 years.

Image Source: Zacks Investment Research

Based on valuations, Meta Platforms and Alphabet stand out as attractive investments, while Microsoft and Apple may need to reconcile their premium multiples before they become equally compelling. Amazon also appears appealing due to its promising high earnings growth expectations.

Microsoft, Amazon, and Meta Platforms hold a Zacks Rank #2 (Buy), while Apple and Alphabet carry a Zacks Rank #3 (Hold) rating.

Energy Sector under the Lens

On the flip side, energy stocks are poised for some of the most significant earnings declines in Q4, alongside Autos, Basic Materials, Medical, and Transportation sectors. The downturn is attributed to the easing of oil prices over the past year, which has been a drag on energy stocks. However, despite expectations of a year-on-year earnings drop, the sector remains surprisingly appealing and merits investor consideration due to its cyclical nature.

Amidst this backdrop, US oil majors Exxon Mobil and Chevron are set to report their earnings before the market opens on Friday.

Undeniable Valuations in Energy Sector

Like the technology stocks, when examining energy from a historical valuation perspective, it is hard to overlook the appeal. Both Exxon Mobil and Chevron are trading at very reasonable valuations of approximately 10 times forward earnings, a substantial drop from the three-year highs near 30 times. However, they are also below the 10-year medians, which both stand at around 17.7 times.

Chevron and Exxon Mobil also both pay substantial dividends of 4% and 3.7% respectively and possess structural tailwinds. The structural tailwinds are primarily a broad underinvestment in oil and gas infrastructure, which is likely to keep oil supply low for the coming years.

Both Exxon Mobil and Chevron have been given a Zacks Rank #3 (Hold) rating.

Image Source: Zacks Investment Research

Final Thoughts

The energy and technology sectors offer two very different outlooks regarding earnings, yet both may be appealing based on valuations. Because they are such critical and leading industries in the country, discerning investors would be wise to hold some mix of the stocks shared.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report