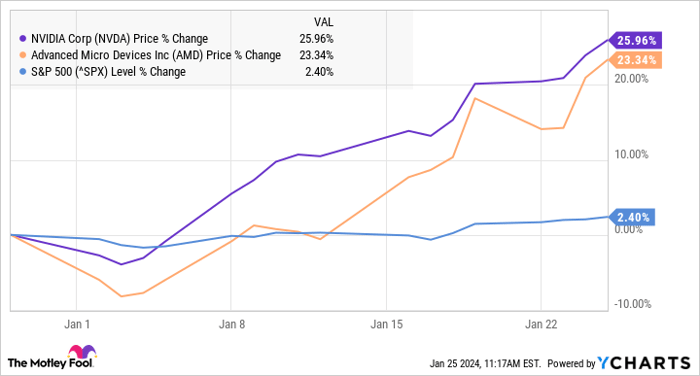

After outperforming the market in 2023, shares of Advanced Micro Devices (AMD) and Nvidia (NVDA) continue their impressive momentum in 2024. AMD’s stock has surged by 23% and Nvidia’s by 26% year to date, far surpassing the S&P 500 index.

Investors are always wary of overpaying for a stock, but there are compelling reasons to anticipate further growth in these top AI stocks in the coming years.

The Rise of Advanced Micro Devices

AMD is a leading supplier of central processing units (CPUs) for PCs and servers, where it has been steadily gaining market share against Intel. The company’s foray into high-performance computing chips has paid dividends, and it is now aiming to leverage its success in CPUs to penetrate the data center graphics processing unit (GPU) market and capitalize on the burgeoning AI market.

While a global semiconductor industry slowdown had hampered AMD’s revenue growth over the past year, Taiwan Semiconductor Manufacturing’s optimistic outlook for 2024 bodes well for AMD, given that TSMC manufactures chips for AMD and other companies. AMD anticipates $2 billion in revenue from data center GPUs this year, and is set to launch the new MI300 chip for AI workloads, with Meta Platforms, OpenAI, and Microsoft already on board as clients.

Additionally, AMD’s CPU business is undergoing a robust recovery. Its EPYC server chips and Ryzen 7000 series CPUs for consumer PCs have shown significant revenue growth. Although the stock is pricier than Nvidia, trading at a forward price-to-earnings (P/E) ratio of 47, the rejuvenation of the CPU market coupled with growth prospects in AI GPUs provide strong reasons for long-term investment in AMD.

Nvidia’s Dominance

Contrary to AMD’s higher valuation, Nvidia stands out as a compelling investment option due to its estimated 90% share of the AI chip market and a more affordable forward P/E ratio of 31 based on this year’s earnings estimate.

Venerated as the brand of choice for PC gamers and an early entrant in the data center arena, Nvidia has invested over $37 billion in research and development, propelling it to the pinnacle of the GPU market. Profiting not just from chip hardware, Nvidia also offers networking equipment, software libraries, and development tool kits to assist customers in addressing industry-specific challenges, thereby maintaining an impressive profit margin of 42% — in stark contrast to AMD’s track record of lower margins.

Moreover, with world data centers gradually upgrading their infrastructure for AI processing, Nvidia’s profitability and growth are expected to steer the stock to new highs over the next few years.

Both AMD and Nvidia exhibit promise, one in CPU-led data centers and the other in high profitability, and together they are set to transform the AI landscape, redefining the benchmarks for future growth and success.