Apple, Microsoft, and Tesla have all enjoyed tremendous gains since going public. However, they do not claim the top spots among the best-performing stocks in the S&P 500 index over the last 10 years. Surprisingly, semiconductor stocks like Nvidia, Advanced Micro Devices, and Broadcom reign in the top three positions during this period. Let’s delve into the reasons behind this unexpected revelation.

Broadcom: An Innovator Redefining Presence

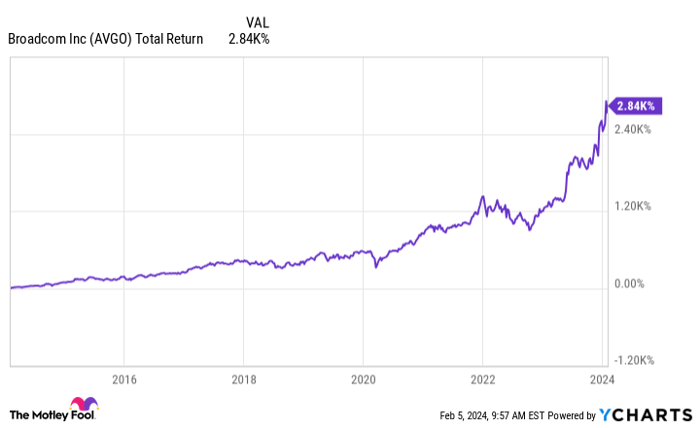

AVGO Total Return Level data by YCharts

Founded in 1991, Broadcom has ushered in a multitude of computing and electronics milestones, such as the optical mouse sensor and infrared transceivers for wireless data exchange across various devices. Its merger with semiconductor giant Avago Technologies in 2016 transformed it into a conglomerate with a robust foothold in several segments of the tech industry.

Beyond the Avago merger, Broadcom significantly expanded its portfolio through acquisitions, including semiconductor device supplier CA Technologies for $18.9 billion in 2018, cybersecurity giant Symantec for $10.7 billion in 2019, and cloud computing software powerhouse VMware for a staggering $69 billion in 2023. VMware, renowned for its cloud software enhancing enterprises’ computing infrastructure in the era of high-demand technologies like artificial intelligence, is a landmark addition to Broadcom’s offerings.

Notably, Broadcom achieved a record $35.8 billion in revenue in 2023, and with VMware’s revenue now consolidated with the conglomerate’s, a substantial 40% increase to $50 billion is projected in 2024. These developments affirm Broadcom’s standing as one of the best-performing stocks, showcasing its unwavering growth trajectory.

Advanced Micro Devices: Revolutionizing Computing Power

AMD Total Return Level data by YCharts

Renowned for designing acclaimed central processing unit (CPU) and graphics processing unit (GPU) chips, Advanced Micro Devices powers leading gaming consoles and electric vehicles. Leveraging its data center business, AMD’s MI300 series of chips is tailored for handling AI workloads, propelling the company’s robust growth.

MI300 is pivotal in catering to a growing customer base that includes tech titans like Microsoft, Oracle, and Meta Platforms, with even Tesla expressing interest in utilizing these chips. Furthermore, AMD’s entry into the AI chips market for personal computers has garnered unprecedented success, with the Ryzen 7000 series CPUs driving a significant year-over-year revenue surge in the client segment during Q4.

Continuing its momentum, AMD anticipates the release of next-generation variants that boast threefold speed enhancements over their predecessors, underscoring the company’s ongoing quest for innovation and dominance in the tech landscape.

The Meteoric Rise of Nvidia: A Stock to Watch in 2024

Nvidia: A Decade of Magnificent Performance

The last 10 years have been nothing short of remarkable for Nvidia. The company has emerged as the best-performing stock, charting a seismic gain of 17,900%. A mere $1,000 investment a decade ago would have burgeoned to an eye-popping $179,000 today, catapulting Nvidia into the elite stratosphere of stock market success.

At the heart of Nvidia’s triumph is the H100 GPU, which reigns supreme as the world’s leading AI data center chip. The scorching demand for this cutting-edge technology has sent Nvidia’s data center revenue skyrocketing, tripling to a record-high $14.5 billion in the recent fiscal 2024 third quarter.

The Road Ahead: Innovations and Projections

Amidst this resounding success, investors eagerly await the release of Nvidia’s new H200 chip, poised to hit the market midyear. The H200 chip promises to deliver up to twice the performance of its predecessor in inferencing, all the while consuming half the energy. This innovative leap is a potential game-changer, offering higher performance at a reduced cost for data center operators.

If Nvidia’s fiscal 2024 full-year revenue projection of $58.8 billion materializes, it will represent an astounding 1,323% growth over the last decade. The company’s meteoric rise is not merely a consequence of speculative fervor but is unequivocally backed by its robust financial performance.

Looking to the Future

While the law of large numbers poses a challenge for Nvidia to perpetuate its astronomical growth rates indefinitely, Wall Street analysts remain sanguine about its prospects. Projections suggest that the company’s revenue and earnings per share could expand by 58% and 69%, respectively, in the upcoming fiscal 2025 full year.

Furthermore, the vast potential of AI to add trillions to the global economy over the next decade underscores the fertile ground for Nvidia’s future growth. Although the company faces escalating competition from the likes of AMD, its data center chips stand as the gold standard, signaling potential upside for its stock price in the years to come.

Investing Considerations

Before plunging into Nvidia stock, consider this critical perspective: The Motley Fool Stock Advisor analyst team, after rigorous analysis, has identified the 10 best stocks for investors to buy now. Notably, Nvidia did not make the cut. This insight underscores the dynamic nature of stock market evaluations and the need for investors to weigh various viewpoints before committing to investments.

The Stock Advisor service, renowned for providing a blueprint for investment success, boasts an impressive track record, outperforming the S&P 500 by threefold since 2002. This illuminates the significance of seeking informed counsel when navigating the complex landscape of stock market investments.