The Role of Brokerage Recommendations

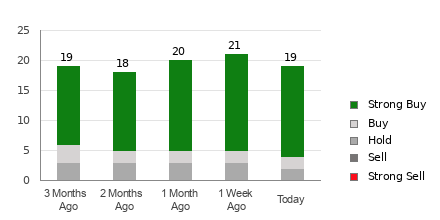

Before discussing if UnitedHealth Group (UNH) is a buy, sell, or hold, it’s crucial to consider the opinion of the Wall Street analysts. The average brokerage recommendation (ABR) for UNH currently stands at 1.33, suggesting a moderate buy sentiment based on 20 brokerage firms’ recommendations. However, does this rating hold water?

Reliability of Brokerage Recommendations

While the ABR advocates buying UnitedHealth, historical data raises questions about the accuracy of brokerage recommendations. Studies reveal these recommendations have limited success in guiding investors towards stocks with genuine price appreciation potential. This lack of efficacy stems from the inherent positive bias of brokerage analysts due to their firm’s vested interest in the stocks they cover.

However, investors can leverage the Zacks Rank, a tool based on earnings estimate revisions that has demonstrated reliability in predicting a stock’s near-term price performance.

Comparing ABR and Zacks Rank

It’s crucial to differentiate between the ABR and Zacks Rank. While ABR relies solely on brokerage recommendations and may carry a biased tone, the Zacks Rank is a quantitative model driven by earnings estimate revisions. Historical data supports the strong correlation between near-term stock price movements and earnings estimate trends.

Evaluating UNH’s Investment Potential

The Zacks Consensus Estimate for UnitedHealth’s current year earnings has dipped by 0% over the past month, indicating a growing pessimism among analysts. This trend, coupled with other factors, has resulted in a Zacks Rank #4 (Sell) for UNH, debunking the previous buy-equivalent ABR.

Therefore, investors are wise to scrutinize the Buy-equivalent ABR for UNH with caution, recognizing the Zacks Rank as a more reliable indication of a stock’s future performance.

Zacks Investment Research