Bitcoin’s current surge marks an impressive 120% increase compared to the same period last year. Yet, according to the prevailing sentiment in the X community, this surge is merely the first step in what many predict will be a bitcoin bull market that stretches into 2025.

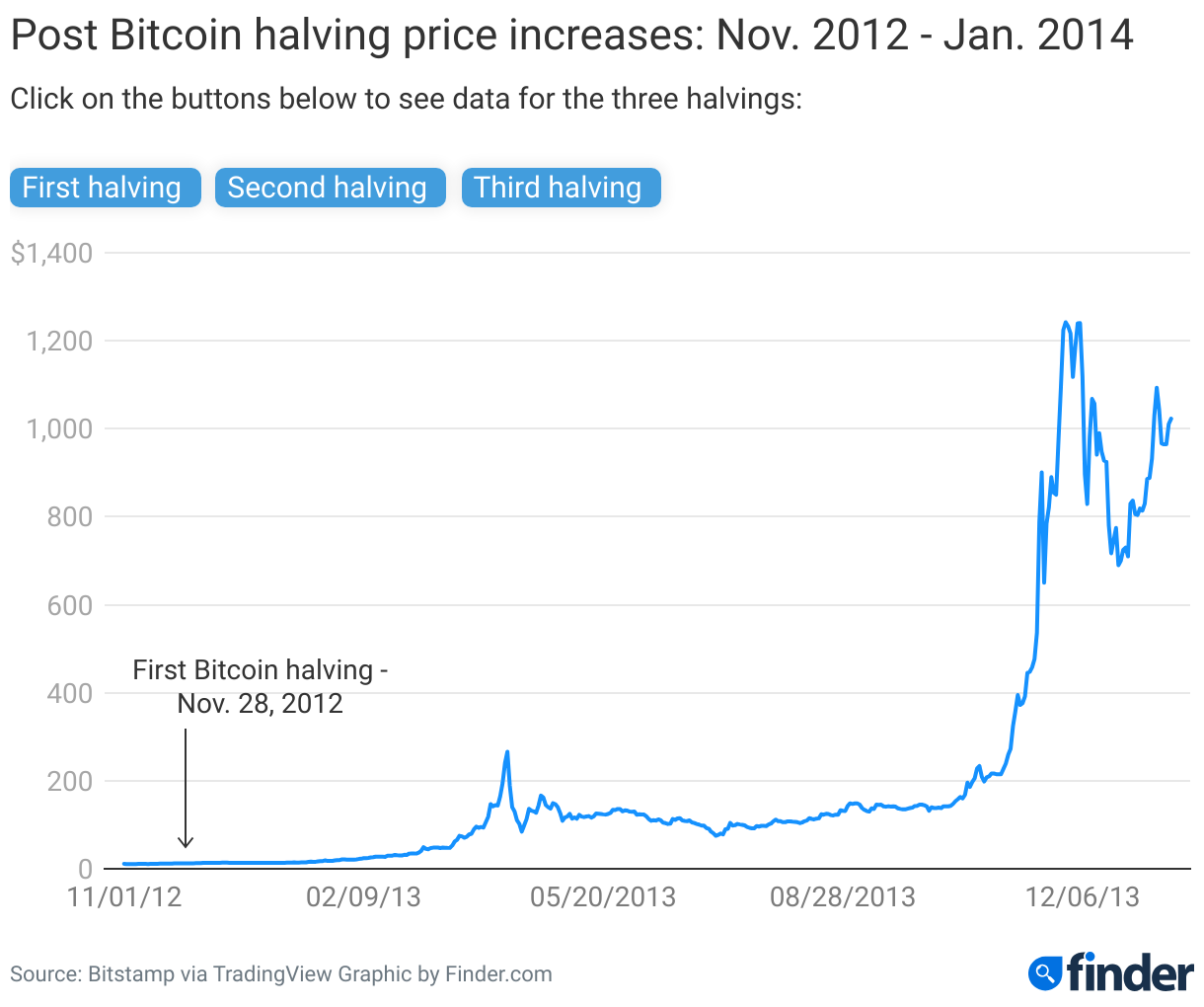

Enthusiasts’ optimism stems from historical trends following Bitcoin halving events. These halvings, occurring every 210,000 blocks or approximately every four years, entail a 50% reduction in rewards for Bitcoin miners. The upcoming fourth halving, scheduled for April 20, 2024, at block height 840,000, is anticipated to ignite a bullish trend due to the constrained supply of new bitcoins entering the market.

Looking back at past post-halving periods, the correlation between reduced supply and increased prices is undeniable.

Further reinforcing this sentiment, close to 60% of analysts surveyed by Finder anticipate that the forthcoming halving will not only trigger a bitcoin bull run but also propel a wider rally across the cryptocurrency landscape.

However, despite these promising forecasts, the road ahead for bitcoin may not be all smooth sailing.

Uncharted Turbulence Ahead?

While speculation suggests that bitcoin could surpass its previous peak of around $69,000 before 2024 concludes, potential hurdles loom on the horizon.

Throughout historical bull markets, it’s common to witness significant pullbacks ranging from 20-30%.

Should we find ourselves amidst a potential “melt-up,” characterized by a rapid rise in asset prices followed by a steep decline, the repercussions could be severe. Coupled with the possibility of a substantial influx of the over $6 trillion parked in money market mutual funds re-entering the market amid a looming regional banking crisis, a drastic correction might materialize sooner than expected.

Considering the ongoing election year dynamics and the likelihood of market interventions by the U.S. Federal Reserve and government, predicting bitcoin’s year-end price remains an arduous task.

Strategies in a Bitcoin Bull Market Landscape

Given the confluence of bitcoin’s post-halving uptrend and the prevailing macroeconomic uncertainties, investors face a challenging decision.

As the future remains uncertain and unpredictable, a proven strategy for navigating any market is dollar-cost averaging.

By executing consistent and recurring purchases

The Art of Investing in Bitcoin: A Tale of Gratitude and Strategy

Establishing a Position Safely

Investing fixed amounts of money, like $200 monthly in bitcoin, can act as a shield in the intensely volatile world of cryptocurrency. It lets you secure a position in bitcoin at various price levels.

If the market is caught in a frenzy, you might be acquiring bitcoin at a premium presently. Nevertheless, by utilizing a dollar-cost averaging approach, you’ll also seize opportunities to obtain it at a discounted rate when the market plunges.

Be Grateful, Not Gluttonous

If you plan to invest in bitcoin in the upcoming months, bear in mind that the history of major bitcoin bull runs signifies that all good things must eventually conclude. Bitcoin’s price has exhibited astronomical surges followed by significant downturns, where it has plummeted by as much as 93% post-bull runs.

Therefore, should you witness a substantial rise in the dollar value of your bitcoin holdings, exhibit gratitude for your enhanced wealth. Rather than being consumed by desires for more profits or going all-in during what may be the peak of the cycle, consider withdrawing some profits.

Seizing opportunities during bitcoin bull runs can indeed be a conduit to wealth accumulation. However, this endeavor necessitates composure and strategic actions, not impulsive sentiments and avarice.