Decoding Kraken’s Defense

Kraken, a prominent player in the realm of cryptocurrency exchanges, has recently taken a bold step by filing a motion to dismiss a lawsuit brought against it by the U.S. Securities and Exchange Commission (SEC). This legal maneuver underscores a crucial battle brewing at the intersection of digital assets and regulatory oversight.

Laying the Groundwork

In its motion, Kraken made a defiant stand, contending that the SEC failed to substantiate any claims of actual fraud or harm inflicted upon its consumers. With this move, Kraken has entered a high-stakes arena where the rules of engagement are far from crystal clear.

Significance Amidst Contention

Within the broader landscape of the crypto domain, Kraken’s legal tussle is but one thread in a rich tapestry of lawsuits that are capturing the attention of industry observers. Notable cases involving other major players like Coinbase and Binance.US are also under scrutiny, portraying a shared narrative questioning the extent of the SEC’s jurisdiction over digital currencies.

Unveiling the Details

Delving deeper into the specifics of Kraken’s defense strategy, it becomes evident that certain arguments put forth echo sentiments previously expressed by industry peers like Coinbase and Binance.US. Kraken’s pushback against the SEC’s allegations reveals a nuanced dance between regulatory interpretation and marketplace practices, adding complexity to an already intricate legal landscape.

The Road Ahead

As the legal saga unfolds, with the Coinbase case unfolding in the Southern District of New York and Binance.US’s battle taking place in the District of Washington, the stage is set for a protracted series of legal maneuvers. The introduction of Legit.Exchange into the mix further muddies the waters, hinting at a prolonged journey through multiple judicial channels and potential appellate reviews.

Seeking Clarity in Uncertainty

Amidst the legal wrangling and courtroom drama, a central question looms large: what lies ahead for these crypto giants embroiled in legal skirmishes? The prospect of eventual involvement by the Supreme Court of the United States casts a long shadow over the proceedings, underscoring the gravity of the decisions that lie ahead.

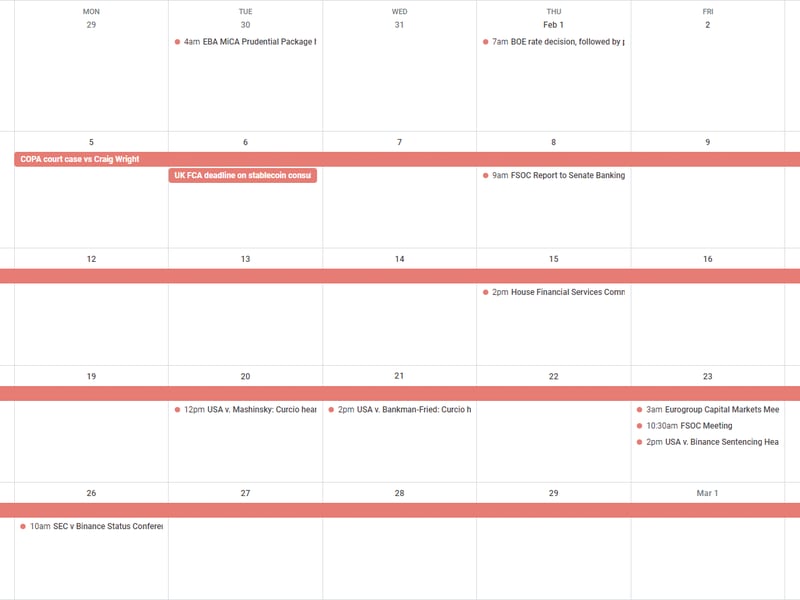

Tuesday

- 17:00 UTC (12:00 p.m. ET) The judge overseeing the U.S. case against Alex Mashinsky held a hearing to confirm he was okay with his attorneys also representing Sam Bankman-Fried.

Wednesday

- 19:00 UTC (2:00 p.m. ET) The judge overseeing the U.S. case against Sam Bankman-Fried held a similar hearing to confirm the same. Bankman-Fried confirmed his trial lawyers would no longer be representing him.

Friday

- 14:30 UTC (10:30 a.m ET) The Financial Stability Oversight Council met in a closed session.

- 19:00 UTC (11:00 a.m. PT) The judge overseeing the U.S. case against Binance signed off on the proposed plea (note: the same judge is overseeing the U.S. case against former Binance CEO Changpeng Zhao, but that sentencing hearing was rescheduled for April).

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!