Within the ever-evolving realm of decentralized finance (DeFi), the foundation of sustainable lending protocols rests upon the cornerstone of risk management.

Finding the delicate equilibrium between paternalistic risk management, where borrowing thresholds are dictated by DAO governors and risk overseers, and allowing the invisible hand of the market to dictate risk tolerance poses a significant challenge.

As the DeFi sector expands, it becomes imperative to comprehend the inherent trade-offs present in divergent risk management models.

The turbulent trajectory of Euler v1 stands as a compelling testament to the perpetual conundrum between immutable and governed code. While Euler v1 originally espoused a paternalistic protocol design, subject to the governance of decentralized autonomous organizations (DAOs) capable of adapting to economic vicissitudes or bug revelations, the protocol encountered a watershed moment in early 2023, grappling with a $200 million exploit.

Despite meticulous audits, insurance mechanisms, and a substantial bug bounty at its inception, a seemingly innocuous bug surfaced, necessitating a code rectification followed by an additional audit and a DAO vote in the months preceding the cyber-attack. Regrettably, this correction inadvertently exposed a broader attack vector, culminating in the exploit witnessed last year.

While actions were eventually undertaken that resulted in one of the most extensive recoveries in the crypto domain, the lingering question persists: is paternalism within DeFi inherently flawed?

In my steadfast conviction, paternalism pivots on the fulcrum of trade-offs and individual risk thresholds, ultimately urging users to assess perceived risks independently and make informed decisions.

The Nuances of Risk Calibration in Lending Protocols

Envision a lending protocol where borrowers leverage USDC as collateral to secure ETH-based loans. Deciding the optimal loan-to-value (LTV) ratio for such transactions emerges as a formidable challenge. The fitting LTV remains in a state of flux, influenced by asset volatility, liquidity strengths, market arbitrage opportunities, and other variables. In the fast-paced DeFi realm, pinpointing the ideal LTV at a given moment proves infeasible.

Hence, lending protocol configurations necessitate heuristics and practical selections, giving rise to three overarching classifications of risk management structures.

Risk Governance via DAO Oversight

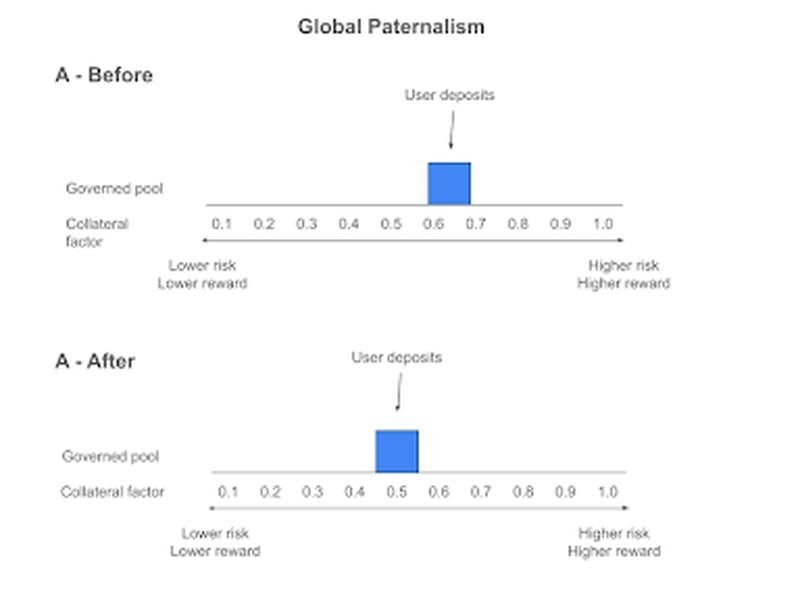

Presently, the prevailing risk management paradigm in DeFi lending protocols embraces the “paternalistic” model under the governance of DAOs and risk management entities like Gauntlet, Chaos, and Warden. Termed as the “paternalistic” model owing to its premise that a governing entity—whether a DAO or analogous organization—possesses a keener insight into the user-centric risk tolerance, this global framework, exemplified by protocols such as Euler v1, Compound v2, Aave v2/v3, and Spark, entails relatively conservative LTV ratio delineation.

If the risk ambience deteriorates, the governance retains the flexibility to recalibrate protocol-wide LTV ratios for all users. This model secures capital efficiency for borrowers and averts liquidity dispersion. Nonetheless, it entails certain drawbacks. DAOs comprise individuals with varied competencies, many of whom might lack the expertise to directly participate in risk parameter voting.

Empowering proficient DAO members through voting delegation strives to consolidate decision-making prowess. However, this methodology tends to centralize decision authority in the hands of a select few, often yielding substantive influence. Even in scenarios where these specialists make judicious decisions, DAO governance encounters delays, impeding prompt implementation in swiftly evolving conditions.

Furthermore, governance mandates protocol users to embrace or refuse a singular risk/reward trajectory, overlooking the diverse risk tolerances among users. This framework potentially ingrains a reliance on paternalistic risk management in users, possibly impeding their capacity to make well-informed risk/reward determinations autonomously in the future.

The Market Dynamics of Isolated Pools

The principles of free market mechanics underpin the “invisible hand” model, empowering lenders to actively affirm their risk/reward inclinations. Coined by economist Adam Smith, the “Invisible Hand” allegory symbolizes the intangible forces steering a free-market economy towards optimal resolutions. Albeit fallible, this serves as the cornerstone of contemporary free-market economies.

Protocols like Kashi, Silo, Compound v3, Morpho Blue, Ajna, and FraxLend offer lenders an array of largely ungoverned, segregated pools, allowing flexibility in LTV ratios founded on free-market ethos. Endowing users with multiple pool choices facilitates lending across diverse LTV ratios and other risk parameters. Some opt for a cautious stance with low LTV ratios, attracting fewer borrowers, while others demonstrate a proclivity for risk and leverage.

This diversification incubates assorted lending and borrowing practices, thereby fostering innovation and adaptability within the ecosystem. At the protocol level, free-market models streamline complexities, enabling the construction of immutable primitives catering to a broader user base. While this doesn’t necessarily alleviate overall system intricacies, it simplifies the trusted codebase intricacies for users content with self-managing risks.

Nevertheless, this methodology is not devoid of challenges, notably liquidity fragmentation, impeding lender-borrower connectivity. Isolated pools not only hinder the matchmaking process for lenders and borrowers but oftentimes elevate borrowing costs, even amid successful pairings. This arises from the prevalent practice in most isolated lending market protocols wherein borrowers employ non-yield-earning collateral (e.g., Morpho Blue, Compound v3, FraxLend).

By embracing multifaceted risk models that embrace either central oversight or decentralized market forces, DeFi endeavors to navigate the dichotomy between paternalism and market autonomy, charting a course that balances prudence with innovation and safety with growth.

Revolutionizing Decentralized Lending with Modularity: A DeFi Perspective

Rethinking Traditional Finance with Decentralized Lending

Borrowers are exploring a new frontier in decentralized finance (DeFi), where the lines between collateral and lending blur to the point where borrowing becomes not just affordable but potentially profitable. This opens the door to interest rate arbitrage through “carry trades,” creating a win-win situation for both borrowers and lenders. However, this path is not without its risks. Lenders must navigate the complexities of rehypothecation risks on all-encompassing lending protocols, a challenge they don’t face with isolated lending systems.

Empowering Users through Aggregators

Aggregators emerge as a key player in reshaping the landscape of decentralized lending. These platforms offer a solution to the limitations of isolated pools, bridging the gap between fragmented liquidity for borrowers and lenders. While aggregators simplify access to diverse risk/reward opportunities by delegating risk management to local managers, they also introduce additional fees and paternalistic constraints. These solutions primarily cater to lenders, leaving borrowers grappling with fragmented experiences and the need for customized risk management strategies.

The Quest for Flexibility and Customization

For DeFi to gain ground against traditional finance, modularity in lending protocols is essential. A one-size-fits-all approach falls short in a diverse ecosystem. While monolithic lending frameworks excel in capital efficiency, they lack varied risk/reward options. Isolated lending markets offer flexibility but suffer from liquidity challenges. Aggregators alleviate some concerns but present their own hurdles.

Protocols embracing modularity are poised to lead the DeFi revolution by enabling highly customizable user experiences. By facilitating the creation of tailored lending vaults in permissionless environments, these platforms cater to the diverse needs of users, allowing seamless transitions between different risk management models.

Fostering Innovation through Flexibility

Flexibility is the cornerstone of innovation in the DeFi space. Protocols like Euler v2 exemplify this ethos, empowering users to switch between risk management models effortlessly based on their preferences. True freedom lies not in a binary choice between paternalism and laissez-faire but in the ability to embrace different models at will. This adaptability fuels growth and innovation, creating network effects as new vault types emerge.

Euler v2’s design philosophy centers around the Ethereum Vault Connector (EVC), a foundational element that promises customizable vault creation. Users can opt for immutable, governance-free vaults or embrace a paternalistic approach led by DAOs or risk management entities. The platform’s neutrality allows users to express their preferences freely, marking a new era of flexibility in DeFi.