In just over ten years, Bitcoin has cultivated a fervent following and soared to remarkable heights – it stands now as the premier cryptocurrency. Its trajectory has been a spectacle unlike any other; an ascent that echoes through the chambers of finance and beyond, poised on the precipice of eclipsing its own zenith in 2024.

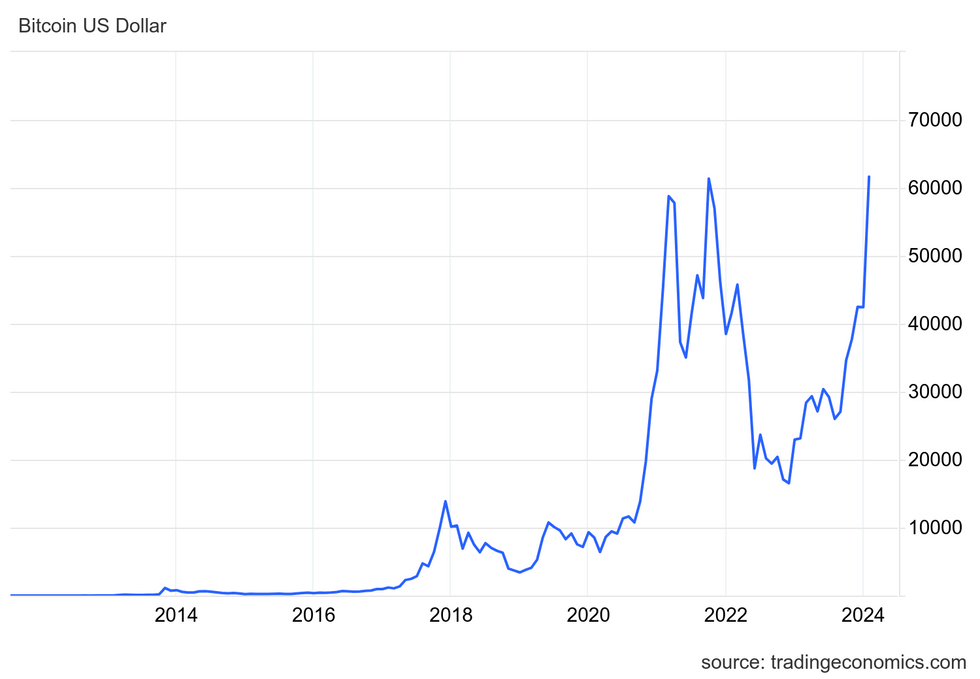

Bitcoin, the poster child of cryptocurrencies, set a historic record, reaching an all-time high of US$68,649.05 on November 10, 2021. The period between March 2020 and November 2021 witnessed an astonishing surge of over 1,200 percent in the price of Bitcoin, fueled by abundant liquidity in the market and growing investor fascination, before encountering a stumble in 2022.

The Genesis of Bitcoin

Bitcoin emerged in response to the tumult of the 2008 financial crisis, venturing into volatile territories by peaking at US$19,650 in 2017 and then languishing under US$10,000 for years. Debuting in late 2008 through a white paper titled, “Bitcoin: A Peer-to-Peer Electronic Cash System,” authored by the enigmatic Satoshi Nakamoto, the cryptocurrency aimed to overhaul the financial landscape.

This cryptographic marvel designed a transparent and censorship-resistant peer-to-peer payment system, harnessing blockchain’s might to craft an immutable ledger thwarting double spending. Early Bitcoin enthusiasts were enticed by its potential to democratize financial control, shifting power from entrenched financial institutions to the masses.

As the reverberations of the 2008 collapse reverberated worldwide – erasing US$7.4 trillion from the US stock market in 11 months and shrinking the global economy by an estimated US$2 trillion – Bitcoin’s allure only intensified.

The Finite Universe of Bitcoin

Unlike conventional currencies susceptible to inflation from printing presses, Bitcoin is capped at 21 million units. Presently, 19,144,112 Bitcoins are in circulation, leaving under 2 million awaiting excavation, a fundamental feature hardwired into Bitcoin’s algorithm to mitigate inflation by preserving scarcity.

Through the meticulous effort of Bitcoin miners deploying specialized software to validate transaction blocks on the Bitcoin blockchain, roughly 900 new Bitcoins are minted daily. The protocol mandates a halving event every 210,000 blocks; the next scheduled for mid to late April 2024. Halvings serve as both a countermeasure to inflation and a pillar supporting Bitcoin’s worth, with miners bagging 6.25 Bitcoin per completed block, set to halve to 3.125 post-April 2024.

The Ebb and Flow of Bitcoin Amidst COVID-19

The dawn of 2016 marked the commencement of Bitcoin’s price uptrend, launching from US$433 to conclude the year at US$959, marking a 121 percent surge over twelve months. In stark contrast, 2017 heralded a watershed moment of mainstream Bitcoin adoption, propelling the crypto from US$1,035.24 to an astronomical US$18,940.57, propelled by fresh attention, new crypto entrants, and mainstream financial media coverage.

Amid the ensuing plunge in value post-2017 highs, Bitcoin found a floor above US$3,190, a level it has yet to revisit. The year 2020 witnessed a stress test of Bitcoin’s resilience as a financial bulwark, enduring a 30 percent freefall in March from US$6,950.56 to US$4,841.67, only to regain its footing post-selloff, clinching a spot as a sanctuary asset akin to the trusty metal, gold.

Gold, the juggernaut among commodities in 2020, mounted a 38 percent rally post-March, vaulting to an undisputed all-time high of US$2,060 per ounce by August.

The Pinnacle of Bitcoin

In 2021, Bitcoin scaled to its apogee, cresting at a record US$68,649.05 in November, posting a staggering 98.82 percent upswing from January figures. Wrapping up the year at US$47,897.16, Bitcoin upheld a commendable 62 percent year-over-year surge.

What propelled this meteoric rise to an all-time high? Notable catalysts included a surge in risk-on investor sentiment and Tesla’s (NASDAQ:TSLA) landmark acquisition of US$1.5 billion in Bitcoin, accompanied by intentions to enable Bitcoin payments for its electric vehicles. An array of factors coalesced to propel Bitcoin to unprecedented heights, underlining its evolution into a financial force to be reckoned with.

Bitcoin’s Rollercoaster Ride: A Deep Dive into Cryptocurrency Trends

Bitcoin’s Environmental Journey

In 2021, facing pressures from both investors and environmentalists, the electric car maker announced plans to assess the level of renewable energy utilized in mining cryptocurrency before accepting it as payment. However, fast forward to September 2023, and the same company suggested that the renewable energy threshold in the crypto industry had been met. This flip-flop exemplifies the volatile nature of the relationship between cryptocurrencies and environmental concerns.

The Rise and Fall of NFTs

Alongside the success of Bitcoin, 2021 witnessed the emergence of non-fungible tokens (NFTs) – unique crypto assets involving blockchain technology. With a market exceeding US$40 billion in 2021, NFTs experienced a meteoric rise fueled solely by cryptocurrency payments. Despite a subsequent decline to US$7.39 billion by November 2023, recent figures as of February 2024 show a staggering rebound to US$58.71 billion.

The Price Swings of Bitcoin

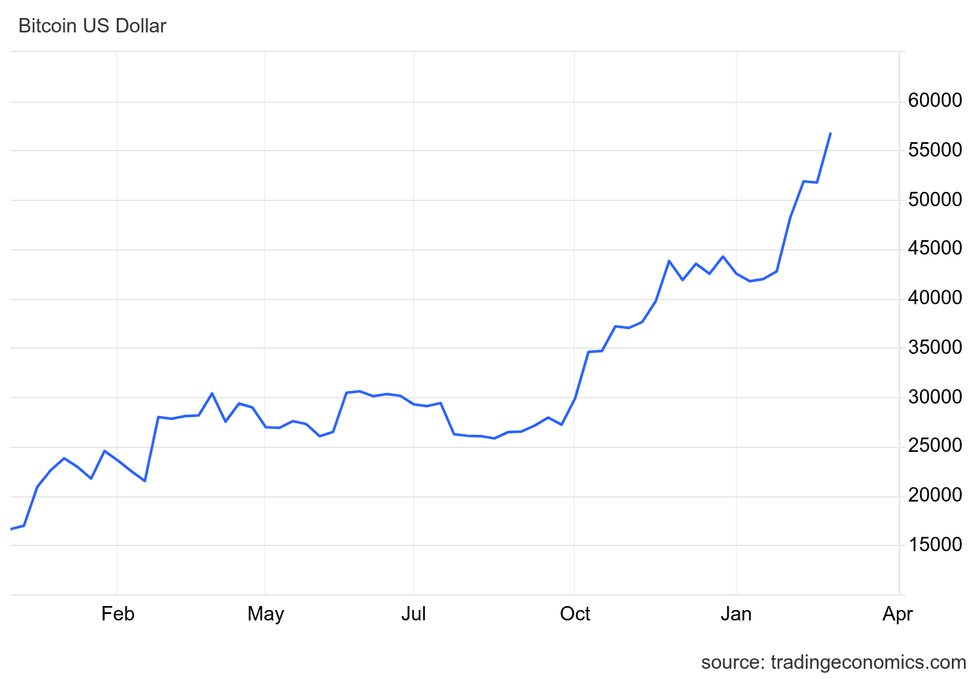

Bitcoin, the first and most well-known cryptocurrency, has garnered attention for its notorious price volatility. The coin witnessed a significant drop in 2022, with values sinking below US$20,000 in the second quarter and further plummeting to under US$17,500 by year-end. Despite these fluctuations, Bitcoin’s resilience was evident in its upward trajectory throughout 2023 and into 2024.

Institutional Influence on Bitcoin Prices

Chart via TradingEconomics.com.

As Bitcoin prices surged in late 2023 and early 2024, institutional investment played a significant role, particularly with the anticipation of SEC approval for various spot Bitcoin exchange-traded funds. With rising institutional interest and investment, Bitcoin prices soared to US$61,113 per BTC by the end of February 2024.

Insights into Blockchain and Bitcoin Investment

What is a blockchain?

A blockchain is a decentralized digital ledger of all cryptocurrency transactions, constantly expanding with newly recorded blocks. The widespread adoption of blockchain technology across various sectors like finance, cybersecurity, and healthcare has positioned it as a promising investment avenue.

How to buy Bitcoin?

Bitcoin can be acquired through different crypto exchange platforms and peer-to-peer trading apps, with storage facilitated by digital wallets offered by platforms like Coinbase Global, Binance, and Gemini.

What is Coinbase?

Coinbase Global stands as a secure online cryptocurrency exchange that simplifies the buying, selling, and storage of digital assets for investors.

A Deep Dive Into the Intersection of Bitcoin and Banking

The Ripple Effect of Cryptocurrency on Traditional Banking

Cryptocurrencies have emerged as a tempting escape from the conventional realms of banking, luring individuals intrigued by assets existing beyond mainstream frameworks. An analysis of data from Statista unveils that a noteworthy 53 percent of crypto holders fall between the ages of 18 and 34, signaling a gravitational pull towards decentralized digital alternatives by the younger demographics.

The allure of privacy coupled with the liberation from intermediaries like central banks acts as a magnet for cryptocurrency aficionados. Moreover, transactions within the crypto realm, spanning acquisitions, sales, and transfers, often transpire swiftly and with diminished associated fees compared to their counterparts within the traditional banking apparatus. As cryptocurrencies, helmed by Bitcoin, persist in their migration towards mainstream acceptance, numerous financial institutions have initiated forays into the realm by investing in cryptocurrencies and blockchain enterprises.

Bitcoin Amidst the Shadows of the Banking Crisis

The recent turbulence in the banking sector, both in the United States and globally, has ignited a frenzied pilgrimage towards Bitcoin amongst apprehensive investors. The domino effect commencing with the downfall of Silicon Valley Bank on March 10, 2023, succeeded swiftly by the collapse of Signature Bank two days later, has triggered panic among investors and clientele within the banking realm, fraught with anxieties regarding ensuing calamities.

Despite the apparent fade of the banking crisis from the limelight of economic news cycles, analysts caution against premature reassurance as vestiges of the crisis continue to loom over the regional banking landscape. Originating in the aftermath of the 2008 financial crisis, Bitcoin surfaced as an alternative to the traditional banking sector. Often swayed by narrative and sentiment, Bitcoin’s trajectory remains unpredictable in light of burgeoning regulations and its trademark erratic nature, especially amidst the cascading ripples of the persistent crisis.

The Genesis of Bitcoin: An Economic Anecdote

The incipient Bitcoin transaction, devoid of the founder’s involvement, transpired in the latter half of 2009, as 5,050 Bitcoins exchanged hands for a nominal US$5.02 over PayPal (NASDAQ:PYPL), anchoring the worth of one Bitcoin around US$0.001—merely a fraction of a cent.

Deciphering Bitcoin’s Investment Viability

Although Bitcoin has exhibited an upward trajectory in its value during 2024, its legendary volatility remains a hallmark. Venturesome investors, acclimatized to perils, might find solace in the cryptocurrency sphere, historically known to be a breeding ground for wealth accumulation. While Bitcoin convalesces from its 2022 plunge, a swift downturn is an ever-looming possibility, underscoring a caveat for risk-averse investors to seek alternative investment avenues.

For updated insights on the current landscape of Bitcoin investments, readers are encouraged to explore our article on the propitious time to delve into Bitcoin investments.

Cathie Wood’s Bold Prognostication for Bitcoin’s Future

Cathie Wood, the luminary behind ARK Invest, staunchly champions Bitcoin’s cause, offering sanguine forecasts for the coin’s future trajectory. In a recent dialogue with CNBC post the SEC litigations against Binance and Coinbase, Wood unveiled her pivotal projections, setting a base-case target of US$600,000 for Bitcoin by 2030, with an even more bullish bull-case scenario eclipsing the US$1 million threshold.

The Enigma Surrounding Bitcoin’s Largest Stakeholder

Satoshi Nakomoto, the enigmatic progenitor of Bitcoin, stands as the purported behemoth among Bitcoin holders. Insights gleaned from scrutinizing early Bitcoin wallets unveil Nakamoto’s alleged possession of over 1 million of the nearly 19.5 million Bitcoins in circulation.

Elon Musk’s Cryptocurrency Odyssey

The sagas of Tesla and Twitter maven Elon Musk intertwining with Bitcoin and the iconic meme currency, Dogecoin, have etched themselves into the annals of the cryptocurrency narrative. Musk’s enigmatic digital currency holdings remain shrouded in obscurity, albeit disclosures affirming his personal stakes in Bitcoin, Dogecoin, and Ether have penetrated the digital realm. Noteworthy among Tesla’s trysts with Bitcoin is its significant investment in 2021, followed by a substantial divestiture the ensuing year, culminating in Tesla ranking third in terms of Bitcoin holdings among publicly traded entities.

Warren Buffett’s Stance on Bitcoin

The Oracle of Omaha, Warren Buffett, has avowedly steered clear of Bitcoin and expressed disdain towards cryptocurrencies on previous occasions. Buffett’s unequivocal disinterest in cryptocurrencies manifested visibly during an annual shareholders’ congregation for Berkshire Hathaway (NYSE: BRK.A, NYSE: BRK.B) in 2022, with his acerbic dismissal of Bitcoin’s intrinsic value.

A subsequent interview with CNBC in April 2023 captured Buffett’s candid assessment of Bitcoin as a mere token of speculation bereft of tangible value, akin to a gambling chip enticing individuals towards a game of chance.

This is an updated rendition of an article initially featured by the Investing News Network in 2021.