Amidst the bustling landscape of e-commerce giants, a quiet but significant shift has occurred: Walmart (NYSE:) has reached new all-time highs before its rival, Amazon (NASDAQ:), could achieve the same feat.

Benefitting partially from a recent 3-for-1 stock split, Walmart now stands at approximately $59, soaring past its previous peak of over $56 from November ’23. In contrast, Amazon encountered a “double-top” around $188 in both July and November ’21, struggling to reclaim that level over the past 27 months.

Remarkably, Jeff Bezos’ pivotal CEO resignation coincided with Amazon’s peak in July ’21, a move some might interpret as the founder inadvertently “top-ticking” his own company’s stock.

Insight into Walmart and Amazon Earnings Reports

Walmart’s recent earnings trajectory paints a fascinating picture. Initially viewed as a margin-focused narrative, Walmart surprised with a remarkable gross margin increase in fiscal Q4 ’24, rising 122 basis points year-over-year to a robust 23.97%. Notably, this uptick was primarily attributed to advertising, which saw a 28% annual growth to reach $3.8 billion.

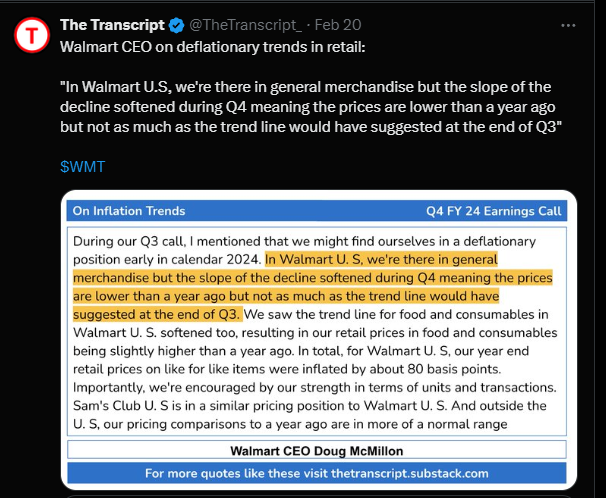

During the earnings conference call, a poignant discussion on grocery inflation caught analysts’ attention. Despite concerns, Walmart exhibited a steady rise in revenue estimates, showcasing resilience and market confidence.

Key Takeaways: Walmart’s Trajectory

Looking ahead, Walmart is emerging from challenges in 2021 and 2022 related to excess inventory. With a return to normalized balance sheet metrics in recent quarters, the retail giant, known for “mid-single-digit” revenue growth and “high-single-digit” operating income and EPS expansion, has the potential to further solidify its presence in the grocery sector. Recent growth in grocery sales furthers this narrative.

Amazon’s Performance and Pivots

Amazon, on the other hand, delivered commendable growth in Q4 ’23 despite facing tougher year-over-year comparisons. Noteworthy is Amazon’s strategic shift towards bolstering margins, akin to Walmart’s trajectory.

Advertising and Amazon Web Services (AWS) were pivotal in driving Q4 ’23 results, with the e-commerce behemoth exceeding operating income expectations by 26%. Morningstar highlighted Amazon’s best 7.7% operating margin in a 4th quarter over the past ten years.

Analysis and Reflection

Set against the backdrop of Walmart’s leadership surpassing that of Amazon, a compelling narrative unfolds. Speculation arises on whether mature tech titans like Amazon, Alphabet (NASDAQ:), and Apple (NASDAQ:) are ceding the growth mantle to emerging sectors such as AI stocks.

An intriguing tidbit of comparison lies in the revenue generation and operational efficiency of Amazon and Walmart. Amazon’s $575 billion in revenue in 2023, coupled with $85 billion in cash flow from operations, showcases its prowess. Meanwhile, Walmart’s $648 billion revenue in fiscal ’24, translating to $36 billion in cash flow, demonstrates consistent performance and a narrowing e-commerce gap.

As we navigate these market dynamics, a measured approach is essential. Historical performance does not guarantee future results, emphasizing the importance of risk assessment and portfolio adjustments based on individual risk tolerance.

Thank you for engaging with the analysis.