The Sentencing Memo

Sam Bankman-Fried’s legal team has filed a sentencing memo arguing against a recommendation of 100 years in prison following his conviction on fraud and conspiracy charges last November. They propose a more reasonable range of 5 to 6.5 years, emphasizing his potential to return to a productive role in society.

Significance of the Recommendation

The Probation Officer’s recommendation of a century-long sentence has been deemed “grotesque” by Bankman-Fried’s attorneys, who are fighting for a shorter term. Despite facing a potential 115 years, legal experts anticipate a more moderate tenure of 10 to 20 years. The defense team deems the 100-year proposal as “barbaric.”

Evaluating the Defense’s Position

Bankman-Fried’s legal counsel asserts that while unintended harm was caused, it does not warrant a life sentence. The memo highlights the dire consequences of the conviction on Bankman-Fried’s personal and professional life, leaving him devoid of assets and mired in legal challenges that will persist indefinitely.

The supporting documents also include character references and testimonials underscoring Bankman-Fried’s positive attributes, work ethic, and philanthropic endeavors. Among these is a heartfelt account from his family and an unexpected letter from a former New York Police Department officer.

Challenges and Next Steps

Despite the defense’s efforts, the looming presence of Judge Lewis Kaplan, who oversaw the trial and threw Bankman-Fried in jail pre-trial, poses a significant obstacle. The Department of Justice is expected to provide a response by March 15, paving the way for a likely appeal post-sentencing.

As the legal saga unfolds, nuances such as Bankman-Fried’s ability to defend himself from prison and medical evaluations, such as a psychiatrist’s opinion suggesting autism spectrum disorder, will play a crucial role in shaping the final verdict.

Reflections on Recent Events in Crypto Financial Landscape

A Week in Review

As the sun set on another tumultuous week in the world of blockchain and cryptocurrencies, a slew of significant events unfolded, painting a vivid image of the current financial landscape.

Legal Battles and Bankruptcies

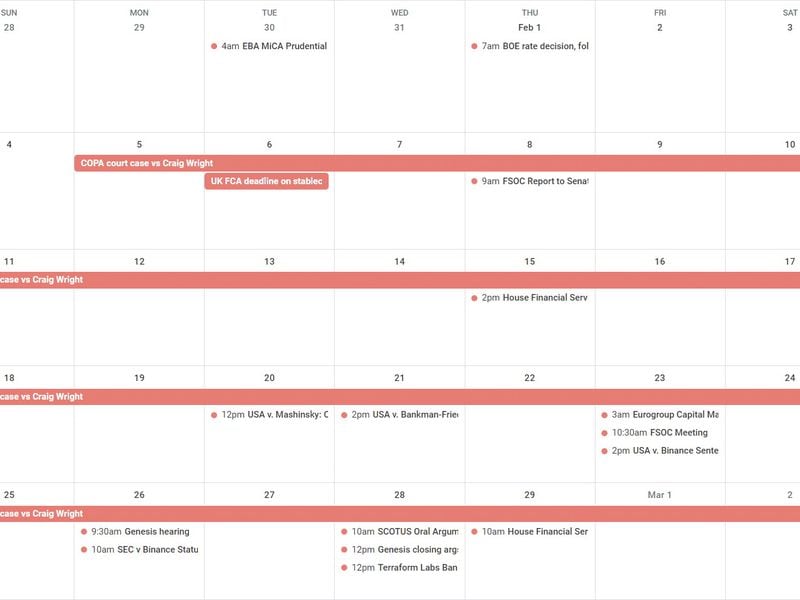

On Monday, the financial arena witnessed a Genesis bankruptcy hearing, symbolizing a poignant moment in the aftermath of the FTX collapse. Soon after, a status conference hearing in the SEC’s case against Binance took center stage. According to a minute order, the parties engaged in discussions revolving around pressing discovery issues.

Supreme Court Drama

Wednesday delivered a dose of legal drama as the U.S. Supreme Court delved into arguments in Coinbase v. Suski. This marked the second Supreme Court hearing in a year for the exchange, with a spotlight on intricate details concerning arbitration agreements. Meanwhile, the bankruptcy court presiding over Genesis heard closing arguments on the company’s proposed settlement with the New York Attorney General’s office. Additionally, Terraform Labs’ bankruptcy hearing added to the day’s legal tapestry.

Legislative Maneuvers

Thursday saw the House Financial Services Committee gearing up for a markup on several bills, notably addressing crypto issues. These bills include the Combating Money Laundering in Cyber Crime Act, aimed at providing the U.S. Secret Service with more resources to combat crypto-related illicit activities, and the Financial Services Innovation Act, designed to establish sandboxes for regulators to experiment with innovative approaches. Furthermore, a resolution disapproving of the Securities and Exchange Commission’s Staff Accounting Bulletin 121 loomed over the legislative landscape, hinting at potential regulatory shifts.

A Glimpse Beyond the Financial Horizon

Amidst the financial whirlwind, external ventures made waves in the news. Fortune unveiled attorney John Deaton’s daring announcement to challenge incumbent Elizabeth Warren in the Massachusetts Senate race, injecting a dose of political intrigue into the media frenzy. Meanwhile, NPR reported on Salesforce CEO Marc Benioff’s clandestine acquisition of “hundreds of acres of land” in Waimea, Hawaii. The peculiar details of these purchases, along with Benioff’s revelations during an interview, added a touch of enigmatic allure to the unfolding narrative.

Parting Thoughts

As we bid adieu to the week’s whirlwind of events, the echoes of legal battles, legislative maneuvers, and surprising acquisitions resonate in the financial landscape. The volatile world of cryptocurrencies continues to unfold with twists and turns that keep both enthusiasts and skeptics on the edge of their seats. Stay tuned for the next chapter in this ever-evolving saga.

If you have insights to share or topics you’d like to see covered in the future, feel free to reach out via email at nik@coindesk.com or connect on Twitter @nikhileshde. Engage in group discussions on Telegram for a deeper dive into the state of crypto finances.

Until next time, stay informed and stay curious!