The recent surge of Nvidia, with its over 260% growth in revenue in the last quarter of 2023, signifies the thriving landscape that AI technology is paving. While many are fixated on the current success of Nvidia, the true visionaries in the industry have already shifted their focus to the next monumental leap: AI 2.0.

Firmly believing that AI 2.0 will lead the course of AI development, major players such as Microsoft, OpenAI, Amazon, Tesla, Samsung, Elon Musk, and Jeff Bezos are heavily investing in this emerging field. The dawn of a new era in AI is upon us, urging investors to join this formidable cohort in embracing the potential of AI 2.0.

The Dawn of the AI 2.0 Revolution

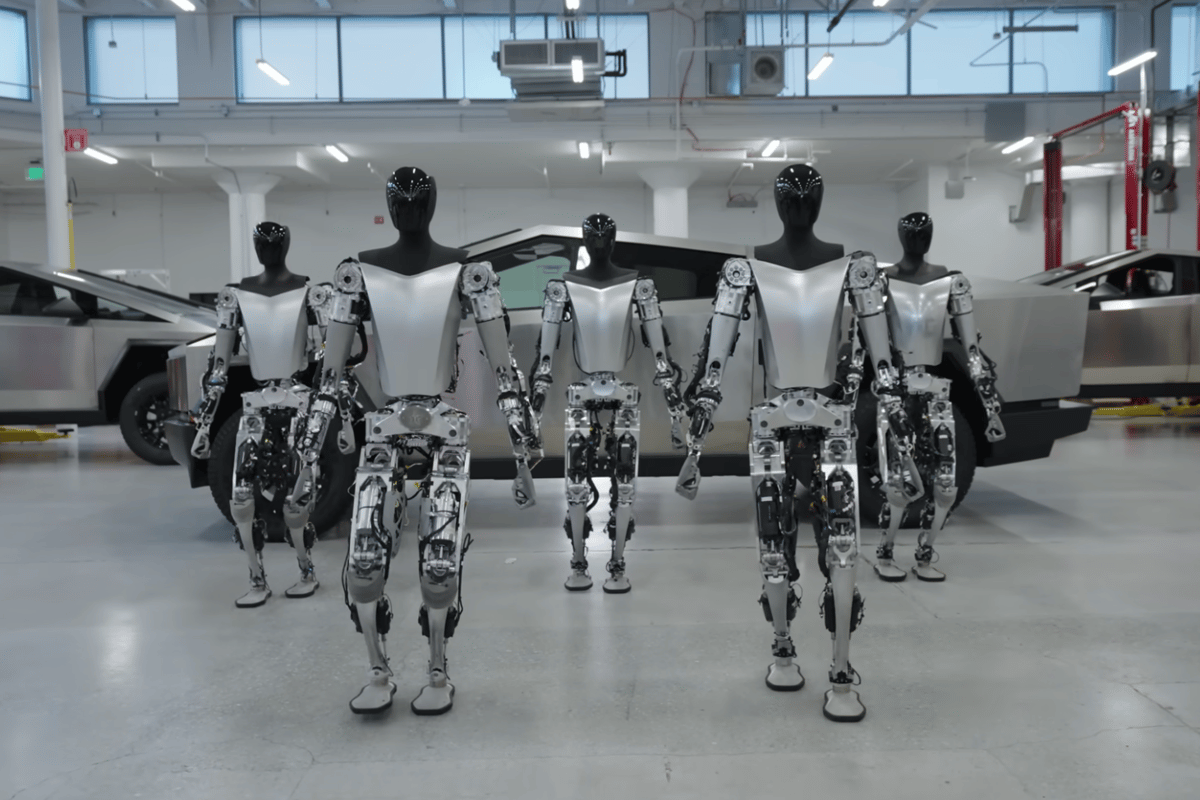

What exactly defines AI 2.0? It materializes AI technologies through humanoid robots, resembling the futuristic beings depicted in sci-fi classics like “iRobot.” The once far-fetched notion of humanoid robots reigning as the forefront of AI is now a reality. Tesla’s Optimus robot, capable of intricate tasks like folding clothes, cooking, exercising, and dancing, exemplifies the present state of AI 2.0.

Tesla envisions a future where these robots permeate daily life worldwide, aiding in menial tasks and industrial operations, alleviating labor shortages and revolutionizing efficiency.

Embracing the Next Phase

Visionaries like Elon Musk and Jeff Bezos foresee a landscape teeming with humanoid robots, transcending beyond novelty to become integral to daily life. Bezos’s hefty $100 million investment in FigureAI, alongside Microsoft, Nvidia, Intel, and Samsung, underscores the collective belief in the limitless potential of AI 2.0.

Seeing the bigger picture, these industry behemoths are strategically positioning themselves to capitalize on the impending rise of AI-powered humanoid robots, revolutionizing industries and redefining the future of AI innovation.

Seizing Your Opportunity

The trajectory is clear – AI-powered humanoid robots are not mere science fiction fantasies; they represent the vanguard of AI innovation worldwide. The commitment of industry giants and leading AI innovators towards AI 2.0 is palpable, with substantial investments fueling its growth.

This marks the pinnacle of the AI Boom, urging investors to act swiftly and secure their stake in this burgeoning domain. The time is now to embrace AI 2.0 and shape the future of artificial intelligence.

Ensure you ascertain the wisdom of this evolvement and position yourself strategically in the transformative world of AI 2.0.