Nvidia (NVDA) has asserted itself as one of the premier tech stocks globally, thanks to the overwhelming enthusiasm among analysts for the artificial intelligence (AI) upsurge. The semiconductor juggernaut is at the forefront, crafting and distributing chips that power data centers running cutting-edge AI models like ChatGPT.

Nvidia’s Meteoric Rise

The surge in demand for these specialized chips has been nothing short of spectacular, propelling Nvidia’s revenue from $26.9 billion in fiscal 2023 to a whopping $60.9 billion in fiscal 2024 (ending in January). Furthermore, its asset-light approach has enabled Nvidia to more than triple its adjusted earnings per share (EPS) over the past four quarters.

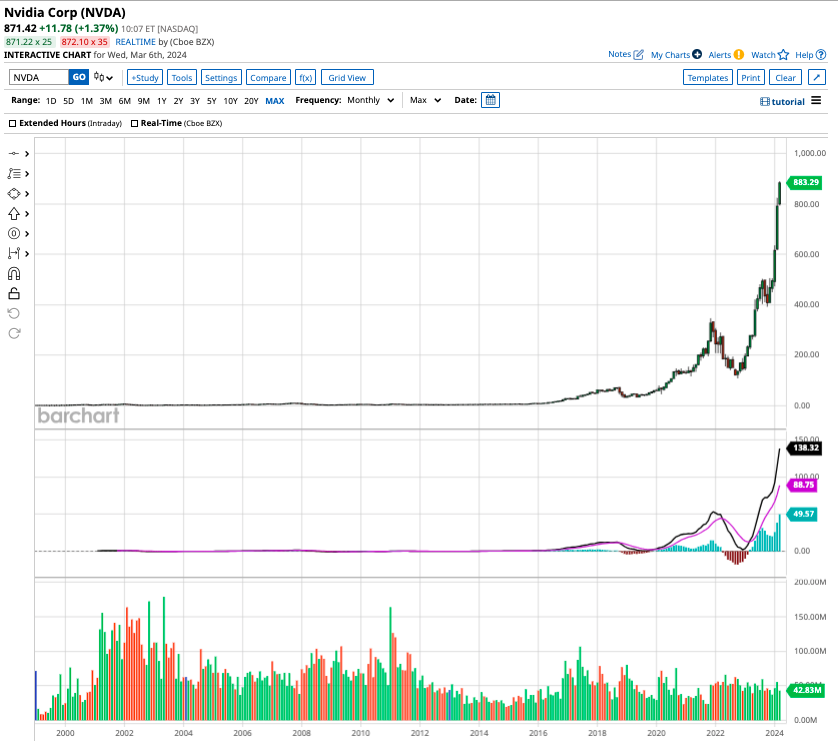

Considering this rapid growth trajectory, NVDA stock has delivered an astronomical 517% return since the inception of 2023. Its recent triumphs have propelled Nvidia stock to a mind-blowing 19,710% surge over the past decade, solidifying its position as the third-largest U.S. company with a market cap of $2.1 trillion.

Addressing the Valuation Conundrum

The staggering market-beating returns on Nvidia stock might hint at an overstretched valuation that could potentially see a significant pullback. Currently trading at 20.7 times forward sales and 39 times forward earnings, NVDA stock might appear dear. Yet, with analysts projecting a remarkable 33.2% annual surge in adjusted earnings per share over the next five years, the valuation seems justified.

Cracking the Code on Nvidia Stock Price Targets

Out of the 39 analysts monitoring Nvidia, an overwhelming 34 recommend a “strong buy,” while two advocate a “moderate buy,” and three suggest a “hold.” The average target price for NVDA stock stands at $838.93, representing a slight 7% discount to the current trading price.

Exploring Diversification Through ETFs

For those seeking exposure to Nvidia stock, investing in Exchange-Traded Funds (ETFs) that encompass shares of numerous related companies can be a prudent strategy. This not only mitigates risk as opposed to a single-stock investment but also offers diversification. Below are three top ETFs tailored for Nvidia stock enthusiasts.

VanEck Semiconductor ETF (SMH)

The VanEck Semiconductor ETF (SMH) tracks the performance of the 25 largest semiconductor stocks listed in the U.S. Given the indispensable role of semiconductor chips in modern computing across various devices, including smartphones, computers, and calculators, the SMH ETF emerges as a prime investment avenue. With over $17 billion in assets under management, the SMH ETF has rewarded shareholders with over 1,000% returns in the last decade.

Global X Robotics & Artificial Intelligence ETF (BOTZ)

The Global X Robotics & Artificial Intelligence ETF (BOTZ) focuses on companies poised to benefit from the widespread adoption of AI, robotics, and automation. Launched in 2016, the ETF has delivered 128% returns to investors while managing total assets worth $2.7 billion. Nvidia stands as the top holding in the BOTZ ETF, commanding 21.5% of the fund.

iShares Robotics and Artificial Intelligence ETF (IRBO)

The iShares Robotics and Artificial Intelligence ETF (IRBO) rounds up the trio. Established in 2018, this forward-looking ETF manages less than $700 million in total assets but has returned approximately 54% to shareholders since its inception. Employing an equal-weighted approach, the IRBO ETF is tailored to minimize stock-specific risks, with Nvidia accounting for just 1.5% of the fund.