The recent hiccups in the stock market notwithstanding, the year has kicked off on a promising note, with the S&P 500 registering a healthy 7% uptick in performance by the close of markets on March 6. However, a closer examination reveals that some major stocks are currently feeling the pressure.

The so-called “Magnificent Seven” – comprising tech giants like Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOG, NASDAQ: GOOGL), Meta Platforms (NASDAQ: META), and Tesla (NASDAQ: TSLA) – collectively contribute a substantial 29% to the S&P 500. The fortunes of these behemoths wield significant influence over the broader market landscape.

Alphabet, with a 6% dip year-to-date, has recently joined Apple and Tesla in slipping below its 200-day moving average. The implications of this development are worth monitoring. While not a definitive indicator for buy or sell decisions, it certainly adds an intriguing dimension to market analysis.

Tracking Historical Trajectories

The 200-day moving average essentially represents the mean closing price of a stock over the past 200 trading days. It provides traders with insights into a stock’s momentum.

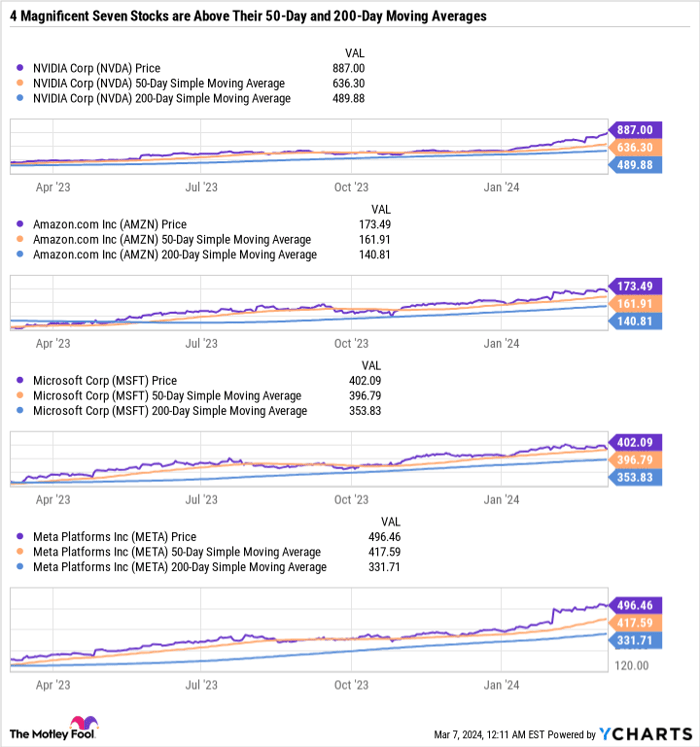

For instance, a “golden cross” occurs when the 50-day moving average surpasses the 200-day moving average, signaling a bullish sentiment among investors. Notably, the current prices of four Magnificent Seven stocks are comfortably above both the 50-day and 200-day moving averages, signaling a strongly bullish outlook.

The 200-day moving average often serves as a crucial support level. Should a stock’s price dip below this average, it typically indicates a bearish sentiment prevailing among investors.

The 200-day moving average might present a significant deviation from the midpoint between a stock’s 52-week high and low points.

In Apple’s case, for instance, its 200-day moving average is merely 8% below the 52-week high, while resting nearly 25% above the 52-week low. Such metrics suggest either a fleeting low or a sustained high for the stock over recent periods.

Gauging Market Sentiments

A pronounced divergence is observable within the Magnificent Seven, with certain stocks basking in favor while others face waning popularity. Understanding market sentiments around a stock can aid in navigating volatility, though it does not necessarily translate to a clear buy or sell signal.

The market is not infallible, as evidenced by the remarkable turnaround of Meta Platforms. Having surged by over 310% since late 2022, after enduring a brutal 64% decline in 2022, Meta Platforms’ trajectory defies conventional market wisdom.

A similar narrative unfolded with Target (NYSE: TGT), spiraling to a three-year low in November 2020, only to catapult 62.5% in a mere four months – a stellar ascent for a stable dividend-yielding stock.

In essence, moving averages offer valuable insights into prevailing market trends, potentially leading to accelerated buying or selling activity.

Strategizing with Moving Averages

The prudent approach to leveraging moving averages involves interpreting market reactions and aligning them with personal convictions. For instance, if one deems Alphabet to be facing challenges, yet the stock sliding below its 200-day moving average seems unwarranted, it could present an opportune moment to enter the market.

Conversely, if confidence in Nvidia’s performance is high but the stock’s current price commands an 80% premium over its 200-day moving average, a cautious stance on purchasing the stock might be warranted.

Evaluating a stock’s price relative to its 200-day moving average allows investors to gauge market sentiments. Oversold stocks might offer compelling buying prospects, while concurrence between market pricing and individual beliefs may signal that potential gains are largely priced in.

The most lucrative opportunities often arise when market sentiments turn negative on a stock without a fundamental shift in the investment thesis. While challenges may loom, the ensuing sell-off could be unduly exaggerated.

Instances of market sell-offs abound – from tech sector turmoil in 2022 to pandemic-induced crashes and the 2018 U.S.-China trade war fallout. Such episodes underscore the propensity of markets to overshoot in turbulent times.

The current scenario likely harbors stocks that have ascended excessively quickly, alongside others grappling with unwarranted criticism.

Insights from Alphabet’s Market Behavior

A pivotal lesson gleaned from the recent gyrations among the Magnificent Seven is that the broader market can continue its ascent even as heavyweight stocks witness corrections.

Apple’s erstwhile market supremacy, Alphabet’s former top-three status, and Tesla’s trillion-dollar valuation, coupled with its standout performance in 2020, are all juxtaposed against their current bearish trends.

The market now showers its favors on companies exhibiting growth, robust earnings, and promising AI monetization prospects, while penalizing entities that lag in the AI space

Alphabet Faces Market Turbulence

Market Overview

Amidst the ebb and flow of market dynamics, tech giants like Alphabet have found themselves navigating a tumultuous sea. The recent performance of Alphabet, Apple, and Tesla has been a cause for concern, as market watchers speculate on their potential impact on the broader market.

Market Resilience

Despite the challenges posed by Alphabet’s declining performance, the market as a whole has shown resilience. Sectors such as industrials, financials, and consumer staples have been shining beacons of success, hitting new 52-week highs. This diversification of strength across sectors has helped to offset the losses faced by tech giants.

Technical Indicators

Alphabet’s recent dip below its 200-day moving average has raised red flags for investors, signaling a potential wave of selling pressure. However, for those who maintain confidence in the fundamental investment thesis of Alphabet, this technical indicator may be disregarded in favor of a long-term perspective.

Investment Considerations

Before diving into Alphabet stock, investors are urged to consider various factors. While some analysts may not view Alphabet as a top pick, there are still promising opportunities elsewhere in the market.

Stock Advisor offers investors valuable insights and recommendations, with a track record of outperforming the S&P 500 since 2002. This service equips investors with a robust blueprint for success, regular updates, and new stock picks each month.

Final Thoughts

In the intricate dance of the stock market, Alphabet finds itself amidst turbulence. As historical market trends have shown, navigating volatility requires a keen eye, strategic decision-making, and a steadfast belief in the underlying value of investments.