Walmart’s Evolution

From humble beginnings in a small grocery store in 1962, Walmart has blossomed into the world’s largest retailer. With a stronghold in the U.S., the retail giant is not just a purveyor of goods but also a pioneer in technological advancements, constantly seeking new horizons and avenues for growth.

Walmart’s Robotic Revolution

With a visionary eye on the future, Walmart is investing heavily in automated warehouses, aiming to revolutionize the way goods are picked, packed, and shipped. By partnering with Symbotic and employing cutting-edge robotics, the company is streamlining its processes and enhancing efficiency. This leap into automation is not merely a step forward but a bold stride towards unprecedented productivity and profitability.

AI Ventures of Walmart

In the bustling realm of artificial intelligence, Walmart is not a mere bystander; it is an active participant, embracing the power of AI to supercharge its sales and customer experience. Through collaborations with Microsoft and OpenAI, Walmart is harnessing the potential of generative AI to enhance its offerings and cater to its vast customer base. In a world rich with data, Walmart is using AI as a guiding light, illuminating pathways to greater success and sustainability.

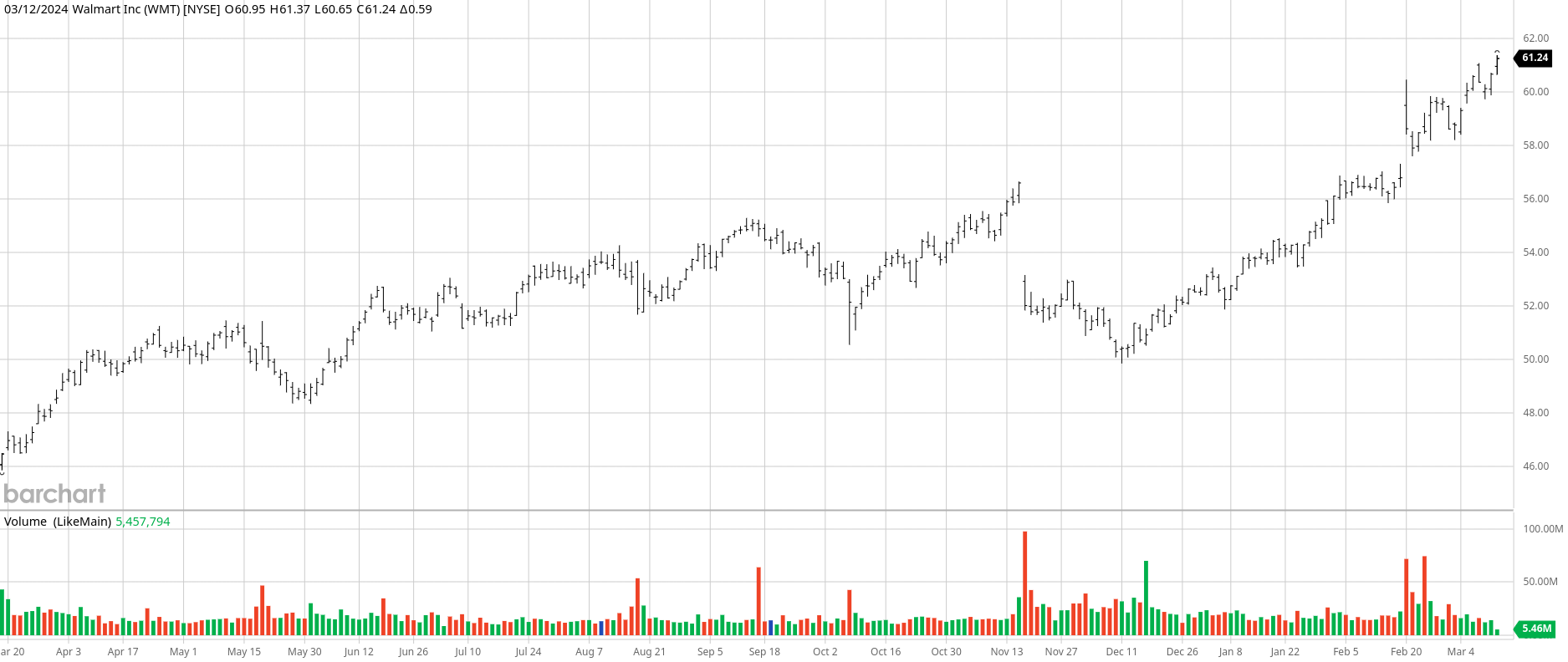

Financial Fortitude of Walmart

Despite economic uncertainties and market fluctuations, Walmart stands firm, reinforcing its position as a stalwart in the retail landscape. With a keen focus on margin expansion and technological investments, the company continues to soar, defying expectations and delivering impressive returns. As the stock hovers near all-time highs, Walmart remains a beacon of stability and growth, offering shareholders a promising outlook amidst a dynamic market.

For investors seeking a reliable anchor in turbulent times, Walmart embodies resilience and potential. With a forward-thinking approach and a commitment to innovation, Walmart is not just a retail giant; it is a testament to adaptability and progress in the ever-changing world of commerce.