Navigating Market Volatility

As the stock market experiences a well-deserved breather, investors are taking the opportunity to pocket gains after a recent upswing based on a significant short-term moving average. The Nasdaq, slipping below its 21-day threshold once more, historically a bullish support level in 2024.

Anticipated declines to longer-term averages like the 50-day or 21-week were always on the horizon. Whether this correction materializes imminently or further down the line, perceptive investors should interpret the next substantial downturn as an attractive entry point.

Long-Term Value Proposition

Despite slight adjustments in inflation and interest rate forecasts from Wall Street, the bullish sentiment prevails. Investors are inclined to remain engaged in the market through 2024 and continue acquiring stocks, especially those geared towards the long haul.

Identifying stocks with robust upward earnings revisions and exceptional value proposition is a strategic move. The following three companies have not only demonstrated remarkable growth over the past decade but also depicted substantial recent surges.

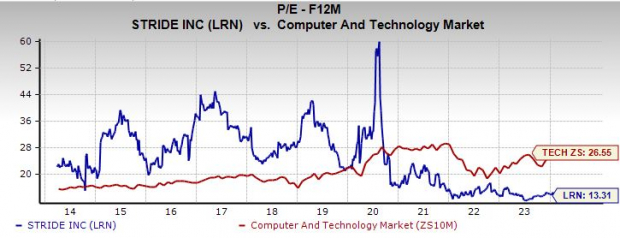

Stride, Inc. (LRN)

With a remarkable 110% climb in the last three years, Stride stock has outpaced the benchmark by a significant margin, including a remarkable 53% surge in the past 12 months. This online education leader has not merely ridden the post-Covid wave but marked an impressive 180% rise in the past decade, aligning with the S&P 500 index.

Trading presently at a favorable level, Stride is positioned 17% below its average Zacks price target and appears attractively priced from a valuation standpoint. The company’s significant growth in digital education services has resonated across various demographics, signaling a promising future.

Toll Brothers, Inc. (TOL)

Distinguished as a luxury homebuilding powerhouse, Toll Brothers has surged an impressive 230% over the last five years, doubling the S&P 500 performance and eclipsing the Zacks Construction sector growth. Despite recent technical overextension, TOL stock trades at an intriguing discount compared to industry averages.

Commanding a presence in multiple U.S. states and markets, Toll Brothers boasts a diverse portfolio that includes in-house architectural, engineering, mortgage, and land development services. Its resilience against market slowdowns and strong earnings revisions underline its robust position.

A Steady Surge: Murphy USA Dominates the Gas Station Market

Murphy USA’s Phenomenal Growth

Murphy USA, a gas station powerhouse, has seen an astounding 930% surge in its stock value over the last decade. In comparison, the benchmark’s 180% rise pales in comparison, while the Oil and Energy sector’s 17% decline looks dismal. Over the past three years, Murphy USA has witnessed a remarkable 220% increase, outpacing its sector’s 43% climb, with a notable 70% growth in the last 12 months, far ahead of Oil and Energy’s 13%.

Steady Ascent

Recently rebounding above its 21-day moving average, Murphy USA is on a trajectory back to its peak levels. The market dynamics suggest a probable test of its 21-week moving average soon. A glance at the chart over the last decade demonstrates the consistent and impressive upward trend of Murphy USA.

Fundamental Strength and Valuation

Trading at its 10-year median and 33% below its peak, Murphy USA shows robust value at 16.2X forward 12-month earnings. Additionally, the company is dedicated to rewarding investors through dividends and buybacks, showcasing a commitment to creating value for shareholders.

Market Presence and Outlook

Murphy USA operates retail stations, strategically positioned near Walmart outlets primarily in the Southeast, Southwest, and Midwest. Serving approximately 1.6 million customers daily, the company owns a crucial line space on the Colonial Pipeline, the largest refined products system in the U.S. Furthermore, Murphy USA’s earnings outlook has steadily improved over the past five years, culminating in a Zacks Rank #1 (Strong Buy) after a positive post-Q4 release.