A recent ruling by a federal appeals court has reignited the legal battle between Binance and a group of U.S.-based crypto investors in relation to allegations of allowing the buying and trading of unregistered securities through certain cryptocurrencies. While the ruling didn’t definitively settle the securities status of the tokens, its implications extend far beyond this particular case in the realm of securities litigation.

A Noteworthy Reversal

The appeals court decision overturned a previous dismissal by a district judge, highlighting errors in jurisdictional grounds and the statute of limitations. Binance, long contending its decentralized nature shielded it from U.S. laws, faced a reality check as the judges affirmed the application of domestic securities regulations even on foreign-based exchanges.

The Significance Unveiled

This pivotal ruling underscores that geographical boundaries do not shield exchanges from regulatory oversight where U.S. interests are involved. The decision could have profound implications not only for the ongoing SEC vs. Binance lawsuit but also for establishing legal precedents that shape future litigation in the cryptocurrency space. The weight of an appeals court ruling elevates its impact compared to a district court ruling.

An Unpacking of Legal Complexities

The crux of the ruling lays in the connection between the disputed transactions and the U.S., with judges pointing to transaction origination, payment location, and terms of service acceptance all within U.S. territories. The court’s emphasis on the timely nature of the claims and the nexus with domestic laws sets a compelling stage for the plaintiffs to pursue their case further.

“First, Plaintiffs have adequately alleged that their claims involved domestic transactions because they became irrevocable within the United States and are therefore subject to our securities laws,” the judges emphasized. They further stated that the lawsuit was filed within the statute of limitations, countering Binance’s jurisdictional arguments.

Attorneys from the SEC swiftly incorporated the ruling into their own case against Binance, challenging the exchange’s defense tactics and highlighting the broader ramifications of the appeals court’s decision.

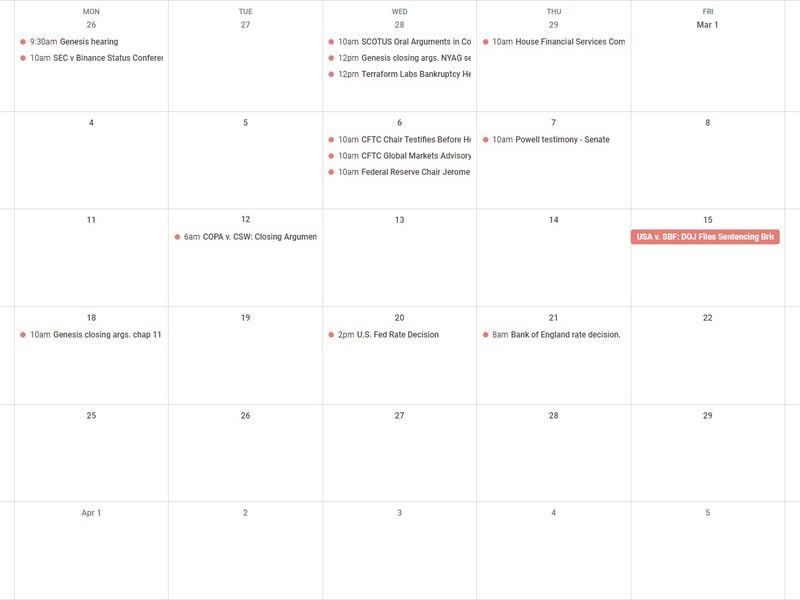

Tuesday

- 10:00 UTC (10:00 a.m. GMT) Attorneys representing the Crypto Open Patent Alliance initiated closing arguments in their case against Craig Wright.

Friday

- The Department of Justice will file its own briefs on Sam Bankman-Fried’s sentencing.

- (The Wall Street Journal) Binance Head of Financial Crime Compliance Tigran Gambaryan and regional manager for Africa Nadeem Anjarwalla were detained by Nigerian authorities, potentially implicating Binance in a local currency crisis.

- (The Daily Beast) Despite improvements in flight safety, United Airlines faced a tumultuous week with multiple incidents, highlighting operational challenges.

- (The New York Times) Recent audit failures by Boeing and Spirit Aerosystems underscore ongoing regulatory concerns in the aviation industry.

- (Puck News) CEO Jack Dorsey’s bitcoin donation plans reveal interesting dynamics in political fundraising.

If you have thoughts, questions, or suggestions for future discussions, feel free to reach out via email at nik@coindesk.com or connect on Twitter @nikhileshde.

Engage in group discussions on Telegram and stay tuned for more insights next week!