Amidst the technological revolution, chip stocks have emerged as the limelight performers, especially in the burgeoning field of artificial intelligence (AI). The demand for graphics processing units (GPUs) has surged, with these high-powered chips playing a pivotal role in training and operationalizing AI models. Among the significant players, Nvidia has basked in success with a stock surge of over 280% in the past year, driven by robust chip sales.

While Nvidia has been the flag bearer in GPUs, two formidable contenders, Advanced Micro Devices (AMD) and Intel, are gearing up to challenge its supremacy and potentially reap substantial rewards in the AI market. Both companies are ramping up their investments in AI and may have a greater growth trajectory compared to Nvidia in the long haul, given their nascent stages in the AI journey.

Let’s delve into an in-depth comparison of these tech giants’ businesses to discern which between AMD and Intel stands as the stronger AI stock this month.

AMD’s AI Advancements

AMD stands out as Nvidia’s primary rival in AI, boasting the second-largest market share in GPUs. Although it entered the AI arena slightly after its competitors, AMD has exhibited a strategic shift in its focus towards this burgeoning industry. The company is poised for substantial growth in the upcoming years as it contributes to meeting the escalating demand for GPUs.

In a significant move last December, AMD introduced its MI300X AI GPU, positioning itself as a direct competitor to Nvidia’s offerings. The chip has already garnered attention from tech giants like Microsoft and Meta Platforms, cementing AMD’s position in the industry.

Not content with merely vying for market share in the GPU space, AMD has set its sights on leading AI-powered PCs. With the impending surge in PC shipments – a trend fueled by AI integration according to IDC – AMD is strategically positioned for exponential growth. A Canalys report even predicts that 60% of PCs shipped by 2027 will be AI-enabled, painting a bright future for AMD in the AI realm.

Financially, AMD appears to be in robust health, with free cash flow surpassing $1 billion last year, a stark contrast to Intel’s negative cash flow of over $14 billion. These figures imply that AMD has stronger financial standing and greater reserves to continue investing in AI.

Intel’s Foray into the AI Market

In December, Intel made a splash in the AI sphere by unveiling an array of AI chips, including the Gaudi3 GPU designed to challenge the dominance of Nvidia and AMD in hardware. Additionally, Intel showcased new Core Ultra processors and Xeon server chips, both incorporating neural processing units to enhance the efficiency of AI program execution.

However, Intel has faced setbacks following its recent financial results release. Despite delivering a commendable 10% year-over-year revenue growth in the fourth quarter of 2023, surpassing Wall Street expectations by $230 million – the tech giant’s stock plummeted by over 9%. The weak guidance provided by Intel for its first-quarter 2024 earnings, a meager $0.13 per share compared to analysts’ projection of $0.42 per share, is largely responsible for the stock downturn.

Furthermore, a shifting landscape in the chip market, characterized by a decline in demand for central processing units (CPUs) coupled with a spike in GPU sales, has adversely affected Intel, given its stronghold in CPUs. Despite possessing the infrastructure and brand recognition to thrive in AI eventually, Intel’s journey in this domain may necessitate a long-term commitment from prospective investors.

Choosing the Superior AI Stock: AMD or Intel in March 2024

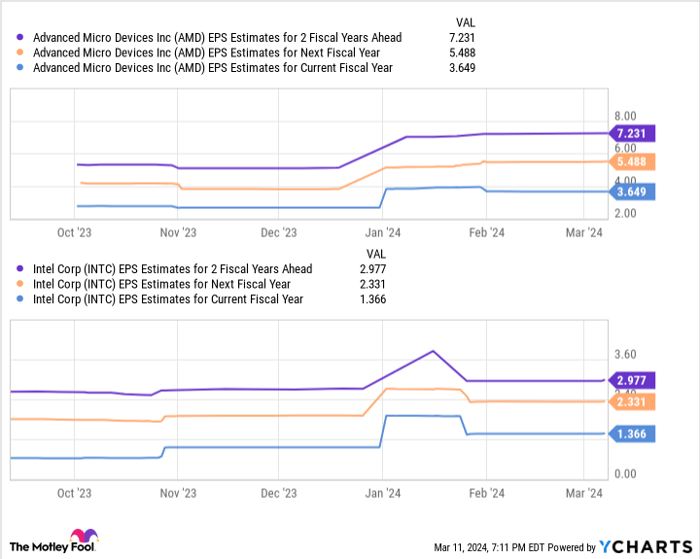

Both AMD and Intel present attractive investment opportunities with considerable growth prospects in the AI industry. Earnings per share (EPS) estimates lend further support to their potential for significant expansion in the near future.

The projection indicates that AMD’s earnings could surpass $7 per share over the next two fiscal years, while Intel’s earnings are forecasted to remain under $3 per share. Factoring in their respective forward price-to-earnings ratios – 55 for AMD and 33 for Intel – results in stock price expectations of $396 for AMD and $99 for Intel.

Considering these projections, AMD’s stock price is anticipated to surge by 97% and Intel’s by 120% by fiscal 2026. While Intel may seem like the frontrunner based on these calculations, AMD’s potential to nearly double in price in addition to its stronger financial position in the AI realm makes it a compelling choice over Intel this month.