Reasons to Consider Amazon Stock

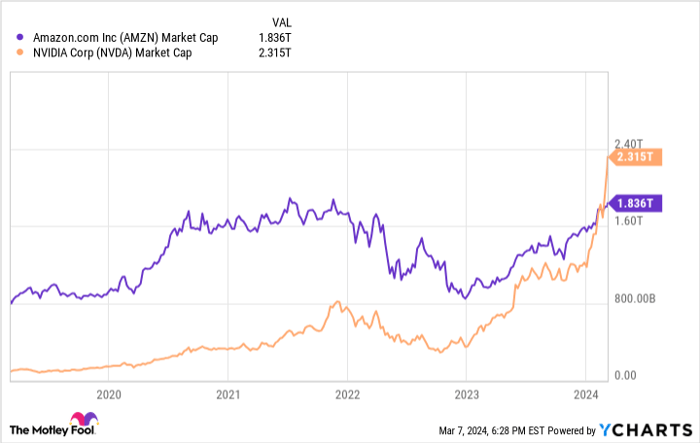

The S&P 500 recently marked new heights, fueled by the meteoric rise of Nvidia, which surpassed Amazon in market cap for the first time. While Nvidia’s feat is commendable, Amazon’s potential should not be underestimated. Here are four compelling reasons to consider adding Amazon stock to your portfolio.

1. AWS Resurgence

Last year, Amazon Web Services (AWS) faced skepticism as its growth rate decelerated. However, signs point to a revitalization in 2023. Factors that hindered growth are dissipating, and the surge in generative AI software demand bodes well for AWS. An uptick in growth could be a significant catalyst for Amazon’s shares.

2. Strengthening Free Cash Flow

Challenges impacting Amazon’s free cash flow in 2022 have been overcome, leading to a robust resurgence. The cash influx positions Amazon for strategic investments and potential share buyback programs, enhancing shareholder value.

3. Impressive Advertising Segment

Amazon’s advertising segment, a rapidly expanding revenue stream, has garnered attention for its efficacy in reaching customers with high purchasing intent. The trajectory of ad sales showcases significant growth potential, outpacing Prime subscription revenue. As budgets loosen in 2024, this segment is positioned for further growth.

4. Positive Consumer Sentiment

Despite concerns over rising interest rates and waning stimulus, consumer sentiment remains buoyant, indicating strong potential for continued consumer spending. This trend is pivotal for Amazon’s e-commerce business. With inflation on a downtrend and economic stability, the outlook for consumer behavior is optimistic.

Amazon stock, though appreciating significantly, trades below its historical averages based on sales and cash flow metrics. The favorable conditions outlined above suggest a compelling long-term investment opportunity.