Performance Review: Nike’s Bumpy Road to Q3

Sneaker giant Nike (NKE) is gearing up to unveil its fiscal Q3 2024 earnings, with investors bracing for impact after a rocky year so far. With a Year-to-Date loss of nearly 8%, NKE finds itself in the doghouse among the Dow Jones Industrial Average components. Last year mirrored a similar downtrend, as Nike saw its shares plummet by 7.2% despite a bullish run in the broader markets.

In November 2021, Nike hit a record high above $173, only to dwell around 42% below that pinnacle a few months later. The stock has been all red since then, contrasting sharply with the S&P 500 Index’s relentless climb to new peaks.

A Peek Into Nike’s Q3 Earnings Anticipation

Analysts project a 0.8% decline in Nike’s fiscal Q3 revenues, settling at $12.3 billion. The company had signaled in its previous earnings call a lower YoY revenue expectation for Q3, attributing it to tough comparables from the preceding year. Adjusted digital growth plans, currency fluctuations, and soft demand in key regions add to the challenges at hand.

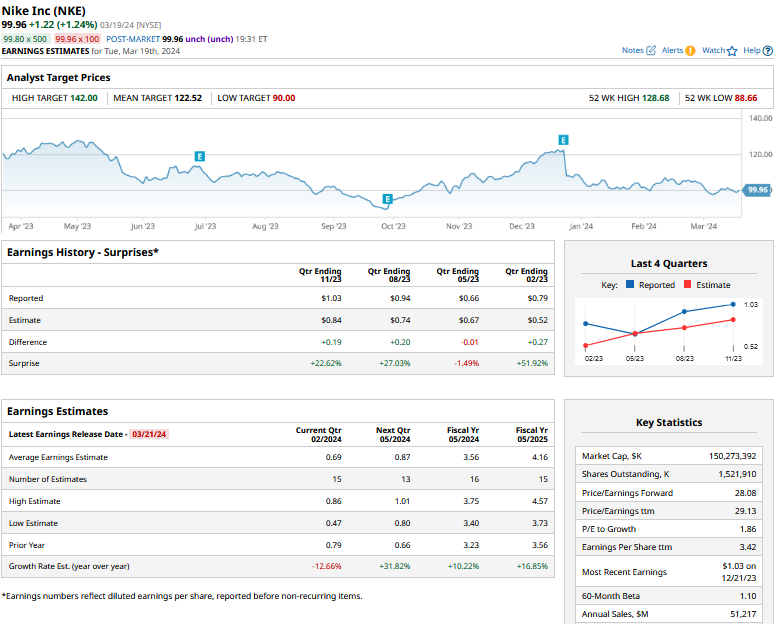

Further dampening the mood, Nike’s earnings per share are forecasted to dip 12.7% in Q3, although a robust 32% Year-over-Year surge is on the cards for the upcoming quarter.

Key Focus Areas for Nike’s Earnings Announcement

When Nike lays out its financial report, focus will be on various aspects beyond the usual metrics, including:

- Guidance: Markets await guidance updates for potential clues on Nike’s path forward after the prior downward revision.

- China Factors: Amid concerns surrounding China’s economic slowdown, Nike’s performance in the region and broader implications will hold significance.

- Jordan Brand & Product Innovation: Analysts are keen to track developments in Nike’s iconic Jordan Brand and new product launches to assess innovation momentum.

Analysts’ Divergent Views on Nike’s Trajectory

Street opinions diverge on Nike, with contrasting views shaping the narrative. While one analyst downgraded the stock, another crowned it as the “best idea” for the year, citing management’s groundwork for product launches and growth acceleration in the pipeline.

Overall, analysts slap a “Moderate Buy” tag on Nike, with price targets indicating a potential 22.5% upside from current levels.

Deciphering Nike’s Investment Appeal

Amid a mixed outlook and subdued market sentiments, Nike’s rebound prospects post-earnings seem plausible, though the China conundrum poses a challenge. With valuations edging lower and strategic moves in the pipeline, optimism lingers for a resurgence in Nike’s growth narrative.

Despite near-term hurdles, Nike’s strategic playbook and cost-saving initiatives paint a hopeful future for the stock in the medium to long term.