Unveiling the Market Movement

Today, the broader markets experienced a slight dip following the Producer Price Index (PPI) report, suggesting a 0.6% increase in domestic production costs compared to January. This figure surpassed the predicted 0.3% surge, indicating potential inflationary pressures ahead.

Finding Stability in Low-Beta Stocks

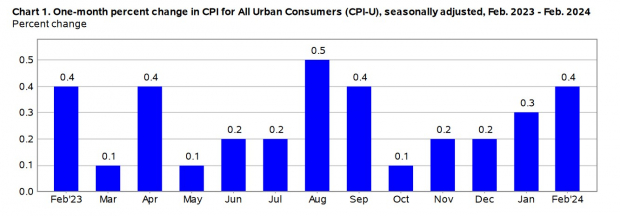

While inflation concerns linger with the Consumer Price Index (CPI) also showing an upward trend recently, low-beta stocks are emerging as beacons of stability in a turbulent market. These stocks, with their minimal volatility, present an attractive proposition for investors.

Organon & Co: A Gem in the Medical Sector

Organon & Co, a medical services company focusing on women’s healthcare, stands out with a low beta of 0.81, indicating significant undervaluation. Despite a notable 27% surge in its stock price this year, trading at $18, the company boasts a modest 4.3X forward earnings multiple. Projections paint a positive picture with an expected 3% EPS growth in fiscal 2024 and a further 3% rise in FY25 to $4.45 per share. Additionally, offering a 6.04% annual dividend yield, Organon outshines many peers in the sector.

Oversea-Chinese Banking: Navigating Low Volatility Waters

Headquartered in Singapore, Oversea-Chinese Banking presents a beta of 0.71, reflecting a stable 52-week trading range of $17.46-$20.49 per share. The commercial bank’s resilience shines through a consistent 5.42% annual dividend yield, increased eight times in the last five years. With a projected 9% EPS growth this year and a 4% rise expected in FY25 to $2.62 per share, Oversea-Chinese Banking offers a lucrative opportunity in a turbulent market.

Southside Bancshares: A Beacon of Resilience

Concluding the list, Southside Bancshares, a domestic commercial bank, boasts an impressively low beta ratio of 0.53. Despite a -11% year-to-date dip to around $27, the stock is gaining attention as a strong buy-the-dip candidate. Earnings estimates have been on an upward trajectory for both FY24 and FY25, with the company trading at an attractive 9.8X forward earnings multiple. EPS is forecasted to increase by 1% in FY24 and by another 4% in the following year, reaching $2.97 per share. Southside Bancshares’ 5.1% annual dividend yield surpasses industry averages, making it an appealing choice for investors seeking stability and growth.

Glimpse into a Promising Future

The robustness of earnings estimate revisions for Organon & Co, Oversea-Chinese Banking, and Southside Bancshares signals a strategic moment to capitalize on these low-risk, high-income stocks. As the market digests inflational data, these opportunities gleam brightly amidst the volatility.