The Warning Bell: Microsoft’s Rich Valuation

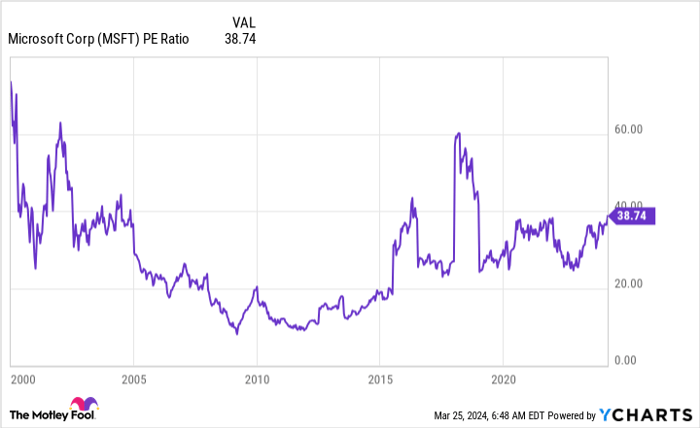

Microsoft (NASDAQ: MSFT), the tech giant and the largest company globally, is currently basking in a pricey glow with a trailing price-to-earnings ratio of 39. This soaring valuation paints a cautionary picture for investors.

Premium Valuation and Market Ripple Effects

The core issue lies in Microsoft’s escalating valuation, soaring to levels unseen since the early 2000s. The driving forces behind this climb are Microsoft’s prowess in the domain of artificial intelligence (AI) and its adept maneuvering in the rapidly evolving AI ecosystem.

Microsoft’s foray into AI-driven technologies has been stellar, with seamless integration of digital assistants, such as Copilot for Microsoft 365, at reasonable price points. Partnering with OpenAI and leveraging its state-of-the-art product, ChatGPT, Microsoft has stamped its authority in the evolving AI landscape.

Moreover, Microsoft Azure, its cloud computing arm, has been outpacing competitors like Google Cloud and Amazon Web Services, hinting at Azure potentially surpassing Amazon as a pivotal player in the cloud domain. As a result of these achievements, the market has slapped a premium on Microsoft’s stock.

The Peril of Premium: Forward-Looking Concerns

Delving into forward price-to-earnings (P/E) ratio offers a structured lens to value a dynamic entity like Microsoft. Strikingly, Microsoft’s forward P/E marginally trails its trailing P/E, suggesting that analysts aren’t overly bullish on its growth prospects in the coming year.

Comparatively, Nvidia, a company witnessing staggering growth, trades at a forward P/E of 38, significantly lower than its trailing P/E of 80. Wall Street anticipates Microsoft to sustain a modest revenue growth of around 6% for the next quarter and approximately 6.4% for FY 2024 closing on June 30, followed by a projected 14% surge next year.

Should Microsoft stumble in meeting these expectations, the ramifications could extend beyond its stock price. Constituting a substantial 7% of the S&P 500, any slump in Microsoft’s stock value could steer the index southwards, adversely affecting a plethora of investors.

Moreover, a downturn in Microsoft’s performance could signify broader economic distress, as the company’s products form the cornerstone of productivity tools for myriad global businesses. A waning demand for its offerings might indicate a slowdown in business expansions worldwide, setting off a domino effect of sell-offs.

Looking Ahead: Navigating the Investment Landscape

While Microsoft is poised for success, the cumulative expectations baked into its valuation render it a precarious investment avenue. With swifter-growing alternatives like Nvidia on the horizon, investors might unearth more promising opportunities to park their capital.

In essence, Microsoft’s journey forward, though laden with potential success, could prove to be a rocky ride amid lofty valuation expectations. Astuteness and strategic diversification could be key to weathering the turbulence ahead.

As the tech titan treads this volatile path, investors must brace for the implications of its evolving valuation dynamics, keeping a vigilant eye on market shifts and strategic portfolio recalibrations.