The countdown to the next Bitcoin halving has set off a storm of anticipation in the cryptocurrency universe. This highly-anticipated event, designed to reduce the number of Bitcoins awarded for successfully mining blocks, is a critical factor for investors keen on making sound financial decisions and managing their portfolios effectively.

Delving into the historical repercussions of previous halvings and dissecting current market trends can equip investors with the necessary insights to navigate the impending halving and strategically position themselves amidst the ever-shifting cryptocurrency terrain.

In this collaborative piece, the Investing News Network (INN) has joined forces with crypto authority Peter Eberle to delve into the nuances of the halving process and delve into the potential market volatility that may ensue.

Understanding the Bitcoin halving

Bitcoin is minted through a process called mining, where miners vie with each other to solve a computational puzzle. Upon cracking the code, a new block is added to the blockchain, and the miner victorious in solving the puzzle is rewarded with a predetermined sum of freshly minted Bitcoin. At its inception in 2009, the reward stood at 50 Bitcoin for every block mined.

The Bitcoin halving occurs roughly every four years or after the mining of 210,000 blocks; it is not activated by the passage of a specific timeframe, and the intervals between halvings may see slight variations due to fluctuations in mining difficulty and network hash rate, which gauges the total computational power deployed in mining Bitcoin.

The forthcoming halving, slated for approximately April 20, 2024, is based on this estimate. Following the three preceding halvings in 2012, 2016, and 2020, the reward rate currently stands at 6.25 Bitcoin. The imminent halving is poised to further slash the rate to 3.125 Bitcoin per block.

The principles governing these halvings are ingrained in Bitcoin’s network. By curbing block rewards, the halving decelerates the pace at which new Bitcoins are generated, aiming to stave off inflation and uphold Bitcoin’s value over time. As the halving events unfold, the influx of new coins will diminish gradually until the entire 21 million Bitcoin allocation is in circulation.

Implications for Bitcoin Miners

Bitcoin’s halving yields substantial repercussions for the cryptocurrency’s mining landscape and supply dynamics, primarily revolving around the mechanics of Bitcoin mining.

The mining process, denoted as block time, typically spans around 10 minutes. To maintain a consistent block time, the Bitcoin network adjusts the mining difficulty based on hash rate, which quantifies the computational power harnessed for mining Bitcoin and handling transactions. An uptick in hash rate signifies increased competition among miners to generate new blocks and harvest Bitcoin rewards, thus amplifying the complexity of the puzzle. Conversely, reduced competition among miners eases the puzzle’s complexity to ensure a steadfast block creation pace, irrespective of the miner count.

Traditionally, hash rates have seen an upswing leading to halving events only to dwindle in the weeks following as inefficient miners are phased out.

Peter Eberle elucidated that with existing hash rates at an “all-time high,” spurred by prominent mining entities introducing novel, swifter, and more efficient machinery alongside older equipment that might lapse into obsolescence soon. Mining fraternities have been strategically gearing up for the impending 2024 halving. For instance, on the same day on which Riot Platforms procured new miners, CleanSpark finalized the acquisition of three data centers in Mississippi.

This heightened efficiency benefits investors as miners consistently vend Bitcoin to cover operational costs and amass profits when production expenses undercut the selling price. According to CoinShares’ 2024 Crypto Outlook report, miners could be more financially robust in 2024 owing to diminished debts, larger operational scales, and equity financing avenues. Bitcoin’s price has further received a boost from the sanction of spot Bitcoin ETFs and the impending monetary easing by the US Federal Reserve later this year.

The report, unveiled in January, posited that 2024 would transpire as a “dual-cycle year.” Commencing the year in a rebalancing phase, CoinShares anticipates the trend to endure post-halving, propelling the sector into a mining gold rush as Bitcoin’s value outstrips miners’ capability to deploy fresh hash rates. The firm approximated that mining 1 Bitcoin would incur a cost of roughly US$37,856 subsequent to the halving.

Eberle further expounded, “So, from an investor perspective, the halving’s momentousness lies in miners’ need to fund their ongoing operations—be it electricity expenditure for their facilities or purchasing new equipment. They represent a consistent Bitcoin vendor. As long as their Bitcoin production expenses remain subpar to the selling price, profits accrue. Inefficient miners risk obsolescence if they fail to undertake these upgrades.”

Impact on Bitcoin Price

Bitcoin typically witnesses a surge in the lead-up to the halving; albeit with a mere three halvings in Bitcoin’s annals, pinpointing definitive price trends poses a challenge.

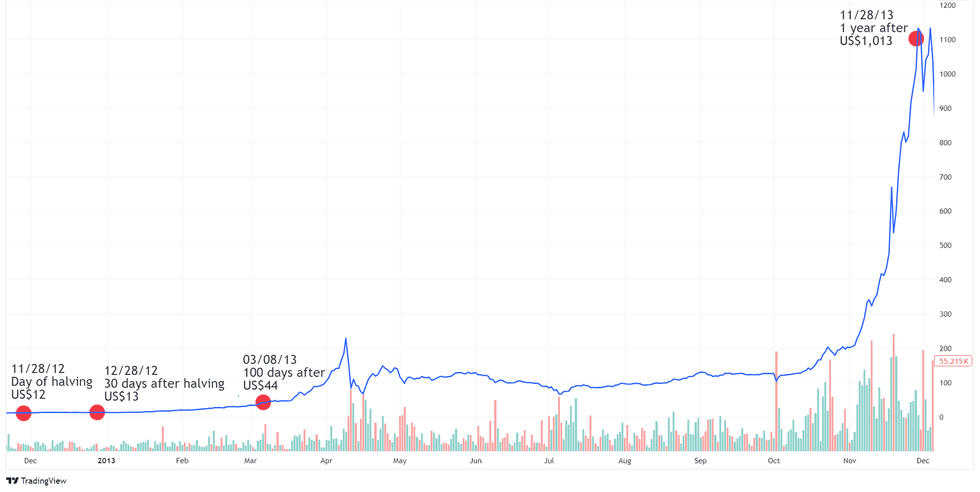

Chart via TradingView

Bitcoin USD price chart 11/21/2012 to 12/05/2013

The initial Bitcoin halving on November 28, 2012, led to a reduction in the mining reward from 50 to 25 Bitcoins. Despite Bitcoin’s niche status at that juncture, it had started gaining mainstream attention, partly spurred by economic uncertainties in Europe. Bitcoin’s valuation had seen a surge from around US$5.50

The Rise, Fall, and Resurgence of Bitcoin

The journey of Bitcoin has been nothing short of a rollercoaster ride. From its modest beginnings in January 2009 to the November 2012 halving, where it reached around US$12, Bitcoin showed a steady rise in interest and adoption. Subsequently, the price surged to US$1,013 within a year after the halving, signaling its potential as an alternative asset class on the brink of mainstream recognition.

The Period of Steady Growth and Mainstream Attention

Post the second halving in July 2016, Bitcoin’s value climbed to US$648 and continued its upward trajectory, breaching the US$2,500 mark by June 2017 fueled by FOMO among enthusiasts. The wave of optimism led by large financial institutions acknowledging the potential of blockchain technology saw Bitcoin reaching an all-time high of US$19,783.21 in December 2017.

The Influence of External Factors and Adoption Milestones

The years that followed witnessed a surge in interest towards cryptocurrencies, but concerns about regulatory clampdowns in 2018 led to a dip in Bitcoin’s value. However, 2020 marked a significant turning point as the COVID-19 pandemic, economic uncertainties, and the rise of decentralized finance (DeFi) pushed Bitcoin into the limelight.

Notably, the year 2020 saw major institutions like PayPal and Square stepping into the crypto space, amplifying the narrative of Bitcoin being the “gold standard” of digital currencies. The endorsement by figures like Rick Rieder of BlackRock further solidified the growing acceptance of cryptocurrencies as a lasting asset class.

The Anticipation and Implications of Future Halvings

Looking ahead, the upcoming Bitcoin halving in 2024 has generated substantial excitement, particularly given the recent approval of spot Bitcoin ETFs. This development provides an easier entry point for risk-averse investors seeking exposure to Bitcoin’s price movements without the complexities of direct purchase.

The encouraging legal outcomes and the promise of spot Bitcoin ETFs in late 2023 reignited optimism in the crypto space after a challenging 2022. Following the recent surge in Bitcoin’s price sparked by the SEC ruling and the record-breaking performance of Bitcoin ETFs, the anticipation surrounding the forthcoming halving continues to be a driving force behind Bitcoin’s value reaching new heights in early 2023.

The Rise of Bitcoin Amidst Impending Halving: Insights and Strategies

In the world of cryptocurrency, the anticipation builds as the Bitcoin halving event looms closer, signaling potential shifts and market movements. An insightful analysis suggests that this time around, the pre-halving dip may be substituted with a rise, thanks to a unique trend in the market.

The Impact of ETFs and Miner Upgrades

Speculation is rife regarding the influence of Exchange-Traded Funds (ETFs) on demand dynamics, with experts noting a particular pattern involving miners upgrading equipment leading to sell pressure prior to halving events. However, in a surprising turn, the current scenario reveals that ETFs are absorbing the additional supply entering the market, setting the stage for possible substantial growth post-halving.

Navigating Bitcoin Halving: Invest Wisely

Analysts and CEOs in the field, such as Peter Brandt and Eberle, provide valuable insights for investors seeking to capitalize on the impending Bitcoin halving. Projections hint at a prospective surge in Bitcoin’s value, with estimations reaching as high as US$200,000, precipitating by a surge in retail activity facilitated by easier access through ETFs.

When considering investment strategies, Eberle suggests incorporating Bitcoin into a balanced portfolio, citing its potential to enhance overall performance. Studies indicate that allocating 3 to 5 percent of a standard 60/40 equity bond portfolio to Bitcoin could reduce volatility and boost expected returns, especially through strategic rebalancing tactics.

For prudent portfolio management, Eberle underscores the importance of maintaining an allocation that aligns with one’s risk tolerance, emphasizing the significance of balance in investment decisions.

In conclusion, amidst the impending Bitcoin halving event, strategic investment approaches focusing on balanced portfolios and calculated risk management are pivotal for maximizing potential gains in the volatile cryptocurrency landscape.