Anatomy of a Bull Run

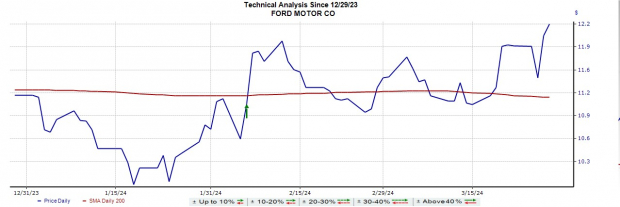

Firing on all cylinders, Ford Motor’s stock thunders onto the Zacks Rank #1 (Strong Buy) list, stampeding ahead as the Bull of the Day. Galloping past its 200-day moving average, Ford’s stock has revved up a +9% increase year to date, hinting at further gains with the company’s attractive valuation.

Fuel Efficiency: Improved Profitability & P/E Discount

Before the pandemic struck, Ford devoted considerable effort to enhance its profitability, reaping the benefits when supply chain disruptions subsided. The company witnessed multi-year EPS peaks of $2.01 per share last year. While a modest slowdown in earnings growth is projected, recent upticks in earnings estimates for FY24 and FY25 bode well for the future.

Accelerating Value: P/S Discount

When it comes to price-to-sales ratio, Ford’s stock revs up a compelling performance. Trading at just 0.31X, Ford’s P/S ratio closely mirrors that of its competitor General Motors at 0.29X, considerably lower than the industry average of 1.5X. With an expected uptick in top-line revenue, Ford’s valuation stands out as notably reasonable.

Electric Shock: EV Surge

Fanning the flames of Ford’s perceived discounts is the surge in EV sales, rocketing 27% higher last quarter to reach record levels. Bolstered by the growing popularity of models like the Mustang Mac-E, F-150 Lightning, and E-Transit, Ford’s EV success defies market expectations. This momentum accelerated Ford’s Q4 sales to $43.3 billion, outstripping estimates by an impressive 14% in early February.

Drive Ahead

The recent uptick in Ford’s stock might just be the tip of the iceberg, considering its enticing valuation and robust EV expansion. Seemingly, the time is ripe to invest, as holding Ford’s stock in your portfolio could yield lucrative returns this year.