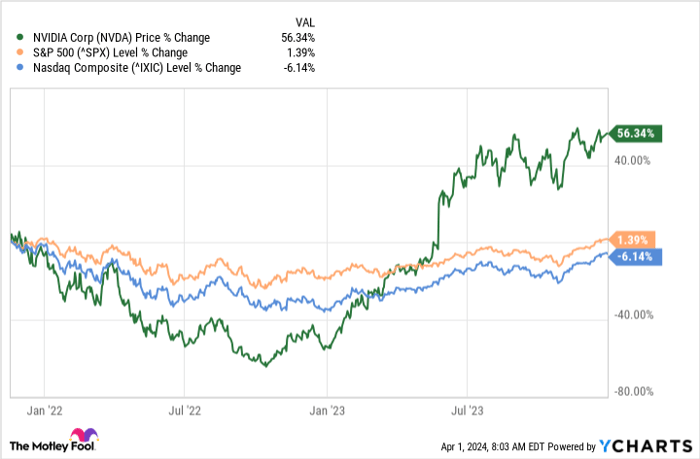

Speculation is rife in the financial world about the lofty heights of Nvidia’s stock price–a rollercoaster ride that has seen euphoric highs contrast against gut-wrenching plunges. The latest nosedive, commencing in late 2021 and mercifully concluding a year later, sent shivers down the spines of staunch investors who weathered the storm.

Data by YCharts.

Fast forward to the present, three months into the year 2024, and Nvidia’s stock has soared over 80% year-to-date, reigniting the perennial debate: is it prudent to dive in or cash out now?

Nvidia’s Dual Domination

Nvidia’s meteoric rise is underpinned by the skyrocketing sales of AI systems. The technology juggernaut is now among the crème de la crème of global corporations in the ‘Magnificent Seven’. With a current market cap hovering around $2.3 trillion, Nvidia’s projected revenue surge to $110 billion and anticipated GAAP earnings per share set to nearly double to $23 are indicators of a forward price-to-earnings ratio of 36.

Investors are banking on Nvidia’s sustained growth trajectory, a not-too-ambitious expectation given the cyclical nature of the company’s semiconductor-based sales. The optimism surrounding Nvidia’s potential for robust growth is grounded in historical data center market upgrade cycles, underpinned by accelerated computing technology like Nvidia’s GPU systems.

CEO Jensen Huang has put forth an intriguing narrative, emphasizing Nvidia’s lead in two major AI markets:

- The $1 trillion existing data center market, ripe for overhaul with accelerated computing hardware for cutting-edge software applications like AI.

- The burgeoning generative AI market necessitates tailor-made data centers enabling businesses to construct bespoke AI solutions with their proprietary data.

The continued evolution of data center technology, underscored by Nvidia’s dominance in GPU systems, forecasts a lucrative future with sustainable hardware sales in the offing.

Chart source: Nvidia.

Navigating the Nvidia Frenzy

Despite the optimism shrouding Nvidia’s growth narrative, investors ought to brace themselves for an eventual deceleration in accelerated computing or even a temporary downturn.

While cues point to another prosperous year in 2024 for Nvidia, uncertainties loom large beyond that horizon. As history often iterates, patience is a virtue that can yield bountiful returns for investors, particularly those with a long-term investment horizon.

For those contemplating fresh positioning in Nvidia, a measured approach like dollar-cost averaging could prove prudent. On the flip side, existing investors eyeing profit realization in the near term, possibly for retirement plans, could explore a reverse dollar-cost averaging strategy to safeguard their gains.

As Nvidia strides into the spring season with unwavering momentum, prepare for a surge in investor fervor. Strap in, hold steady, and weather the storm, come what may. The Nvidia saga continues.

Unveiling the Prospects of Investing in Nvidia

Consider the Circumstances Before Investing

Before delving into Nvidia stock, it’s essential to weigh the factors at hand.

Insights from Research Analysts

The renowned Motley Fool Stock Advisor analyst team has recently disclosed their top picks for investors, highlighting potential opportunities in the current market. Interestingly, Nvidia did not make it to their exclusive list of 10 best stocks.

Stock Advisor’s Track Record and Recommendations

Stock Advisor offers a comprehensive guide for investors, encompassing portfolio construction strategies, regular analyst updates, and bi-monthly stock recommendations. Noteworthy is the fact that the service has significantly outperformed the S&P 500 since its inception in 2002*.

Exploring Further Investment Options

If you are keen on discovering the stocks that secured a spot on Stock Advisor’s exclusive list, including potential future giants, an exploration beyond Nvidia might yield interesting opportunities for your investment journey.

*Stock Advisor returns as of April 1, 2024

The Investment Landscape and Full Disclosure

All information contained herein is to be absorbed judiciously, ensuring a well-informed investment decision. Embrace the potential for growth while remaining cognizant of the risks involved in the ever-evolving market scenario.