While Nvidia’s success in the realm of artificial intelligence (AI) has been akin to spinning straw into gold, the recent fervor surrounding AI stocks sees investors hungry for the next big thing. Nvidia has solidified its position as a prominent provider of computer chips and software for this cutting-edge technology. With a staggering market cap of $2.2 billion, Nvidia stands tall as one of the leading businesses globally. The stock has witnessed a meteoric rise of 500% since the onset of 2023.

Unveiling the SoundHound AI

SoundHound AI, as the name suggests, specializes in voice AI services, catering to businesses with automated voice technology known for its multi-language support and top-notch accuracy. Establishing strategic partnerships with automotive giants and major restaurant chains, SoundHound AI’s technology is likely encountered by individuals driving certain Honda models or dining at White Castle establishments. The integration of voice technology aims to enhance customer experience and streamline operational tasks, such as order processing at fast-food outlets.

Recent collaboration news indicates that SoundHound AI has joined forces with Nvidia to offer on-chip AI solutions utilizing Nvidia’s array of products. This partnership promises individuals access to SoundHound’s voice technology without the need for an internet connection, with a primary focus on automotive systems, where both firms boast a strong presence.

Rapid Expansion, Yet a Lack of Profit

SoundHound AI’s commendable growth trajectory is evident in the 47% revenue surge in 2023, reaching $45.9 million for the fiscal year, notably accelerating to 80% year-over-year growth in Q4. The company continues to announce critical partnerships, including collaborations with a prominent automotive manufacturer, Jersey Mike’s, and the acquisition of SYNQ3 to bolster its restaurant technology suite.

However, the grim reality lies in SoundHound AI’s worrisome financial health, with an operating margin plummeting to a troubling -139% over the past year and a staggering $70 million in free cash flow consumed in 2023. With a modest cash reserve of less than $100 million, SoundHound AI faces the imperative of either securing additional funding or swiftly steering towards profitability. It remains a long and arduous journey for the firm to transition into a profitable entity.

Proceed with Caution in the Investing Landscape

Though the appeal of voice AI technology is undeniable, investors should exercise caution, considering the prior hype surrounding technologies like Apple’s Siri, Amazon’s Alexa, and Alphabet’s Google Assistant, which saw minimal real-world adoption. Despite the seemingly promising prospects in the AI voice assistant sphere, formidable contenders such as Amazon, Google, and Alphabet, armed with substantial research budgets and widespread distribution networks, are likely to lead the fray.

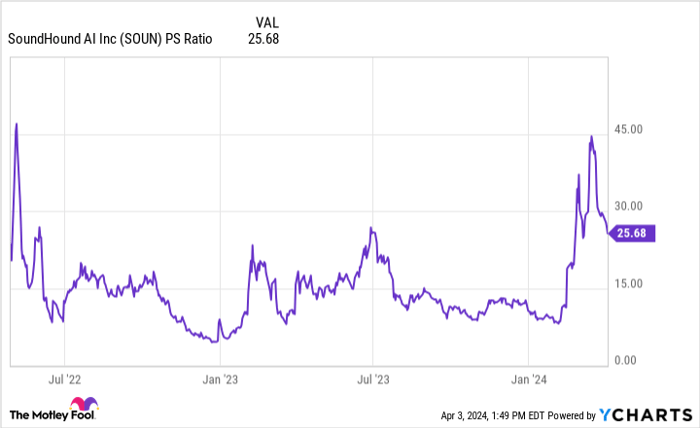

Adding fuel to the skepticism is SoundHound AI’s concerning valuation, with a current stock price indicating a price-to-sales (P/S) ratio of 26, nearly tenfold the S&P 500 average, hinting at a potential overvaluation. Given these factors, investors are advised to steer clear of SoundHound AI stock at present.