In a flurry of recent releases, automotive giants shed light on their U.S. vehicle sales for the first quarter of 2024. According to GlobalData, U.S. vehicle sales experienced a 5.1% growth, hitting 3.75 million units. A promising sign as March is expected to close with a seasonally adjusted annual rate aiming for 15.5 million units, a marked improvement from 2023’s 15.02 million. With light-vehicle retail inventory reaching 1.7 million in March, up 4.2% from February and 39% from the previous year, the industry is showing signs of recovery. Furthermore, average transaction prices dropped marginally by 3.6% to $44,186 in March, indicating a strengthening demand bolstered by enhanced inventory and competitive pricing strategies.

The Q1 performance of major global auto manufacturers has been largely positive, with Japanese automakers like Honda HMC, Toyota TM, as well as German automakers BMW and Volkswagen witnessing year-over-year sales boosts. In the U.S., Ford F boasted a 7% uptick in vehicle sales, contrasting with General Motors GM, which saw a 1.5% decline, and Stellantis STLA exhibiting a 10% decrease in Q1 deliveries.

General Motors: A Mixed Bag of Results

General Motors faced a 1.5% year-over-year reduction, delivering 594,233 vehicles in the U.S. during the first quarter of 2024. This decline was largely attributed to lower fleet deliveries and the discontinuation of the Chevrolet Bolt EV. Despite this, retail sales for GM surged by an impressive 6% year over year. Notably, GM’s brands – Buick, Chevrolet, Cadillac, and GMC – reported retail sales hikes of 10%, 6%, 9%, and 3%, respectively, while GM’s envolve brand witnessed a 23% drop. In China, GM delivered over 441,000 vehicles in Q1 2024, 42.6% of which comprised of new energy vehicles.

Ford’s Hybrid Triumph & Forward Plans

Ford marked a 7% increase in U.S. vehicle sales for Q1 2024, reaching a total of 508,803 units. The surge was fueled by the rising demand for hybrid trucks and SUVs, with the automaker achieving record-breaking quarterly hybrid sales. Furthermore, Ford’s EV sales impressed by skyrocketing 86.1% year over year with the sale of 20,223 electric units in Q1. Even as Ford pushes back the launch of its three-row electric SUV to 2027, it remains committed to unveiling a new electric truck by 2026 and extending hybrid options across its complete internal combustion engine range in North America by 2030.

Toyota & Honda: Electrifying Growth & Success Stories

Toyota surpassed expectations by delivering 565,098 vehicles in Q1 2024, reflecting a robust 20.3% increase from the same period in the previous year. Toyota showcased a strong portfolio of electrified vehicles, with electric vehicle sales climbing by an impressive 74%, constituting 36.6% of total sales volume. On the other hand, Honda successfully sold 333,824 units, marking a 17.3% year-over-year uptick. Notably, the success of Honda’s CR-V and Accord hybrid sales spearheaded record-breaking achievements, with the CR-V seeing over 36,500 units sold in March.

Stellantis: A Tough Start with Future EV Endeavors

Stellantis encountered a setback with a 10% reduction in its U.S. deliveries for Q1 2024, selling 332,540 units. While some brands like Jeep, Fiat, and Chrysler experienced modest gains, others like RAM, Dodge, and Alpha Romeo saw declines. Stellantis is optimistic about its future electric plans, aiming to introduce eight EV models in the U.S. market by the end of 2024. The lineup is set to include innovative models like the Jeep Recon and the Ram 1500 REV.

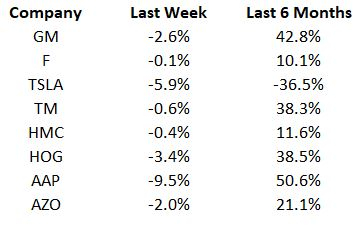

Price Performance & Future Prospects

The future trajectory of the auto industry remains uncertain, with industry observers closely watching China’s vehicle sales for March and Q1 2024 performance. Despite challenges, the sector exhibits resilience and adaptability, paving the way for future growth and innovation.