Stocks have been soaring in 2024, with the Nasdaq Composite index showing an 8% increase since the new year began. This growth echoes the tech frenzy of the previous year when the same index skyrocketed by over 43%. The enthusiasm around tech-related stocks, particularly in sectors like artificial intelligence (AI), continues to attract investors, boosting the entire tech market. The surge in AI demand is expected to be a significant driver of stock performance in 2024, benefiting numerous companies across various markets.

Just as the saying goes, “The best time to plant a tree was 20 years ago, and the next best time is now.” A similar sentiment resonates in the world of investing.

Advanced Micro Devices: Riding the AI Wave

Advanced Micro Devices (AMD) stands out as a prominent chipmaker with a promising future in 2024 and beyond. The company supplies hardware to a wide array of tech firms, with its chips powering devices ranging from cloud platforms to gaming consoles and AI models. Over the last five years, AMD has witnessed an astounding 240% surge in revenue, coupled with a remarkable 306% increase in free cash flow.

Despite being a dominant player in the industry, AMD continues to invest significantly in AI. The unveiling of its MI300X AI graphics processing unit (GPU) in December 2023 marked a direct challenge to Nvidia’s offerings, attracting giants like Microsoft and Meta Platforms as clients.

In the fourth quarter of 2023, AMD’s revenue soared by 10% year over year to $6 billion, surpassing analysts’ estimates by $60 million. Notably, its AI-focused data center segment recorded a remarkable 38% revenue growth, indicating a positive trajectory for the company.

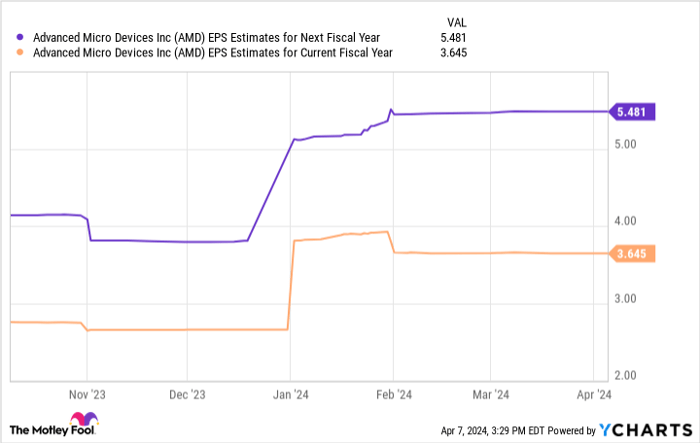

This uptrend in earnings projects a potential earnings-per-share (EPS) figure of slightly over $5 by 2025 for AMD. With a forward price-to-earnings (P/E) ratio of 47, this translates to a projected share price of $257, signaling a potential 51% stock growth by the next year. Therefore, AMD emerges as a compelling investment opportunity in 2024, leveraging its expanding business and the AI boom.

Intel: Regaining Ground in the Chip Market

The tech landscape is witnessing a surge in chip demand, making Intel a valuable option for investors seeking exposure to this growth. Despite grappling with challenges in recent years, including a decline in central processing unit (CPU) market share and the conclusion of a long-standing partnership with Apple, Intel is on a path to resurgence.

A series of strategic moves indicate Intel’s renewed vigor in reclaiming its position. The company’s adoption of an internal foundry model last June, aimed at generating savings of $10 billion by 2025, demonstrates its commitment to transformation. Additionally, Intel’s foray into AI, with the introduction of a range of AI chips like Gaudi3 and Core Ultra processors, reinforces its competitive stance against major players like Nvidia.

Intel’s earnings prognosis outlines an EPS of just over $2 in the upcoming year. With a forward P/E of 28, this translates to a potential share price of $65, reflecting a projected 67% surge by fiscal 2025. Given its current trajectory, Intel emerges as a compelling investment choice at present.

Amazon: Harnessing AI for Future Growth

Amazon’s stock has witnessed an impressive 81% appreciation over the past year, enriching many investors in the process. The company’s robust performance over the last decade, particularly in e-commerce and the cloud sector, with a remarkable 546% increase in annual revenue and a staggering 20,000% growth in operating income since 2014, cements its position as an industry leader.

In 2024, Amazon’s AI initiatives take center stage, leveraging its stronghold as the operator of the largest cloud service, Amazon Web Services (AWS). The company’s colossal cloud data centers position it to tap into the generative AI market successfully. The introduction of new AI tools by AWS in response to the growing demand for AI services holds the promise of substantial earnings growth in the upcoming years.

The EPS projections for Amazon hint at a $5 figure in the next two fiscal years. Calculating this against Amazon’s forward P/E of 44 yields a projected stock price of $237 by fiscal 2025, indicating a potential 28% rise in its stock value. While this growth projection may not match AMD and Intel’s estimates, it still surpasses the S&P 500’s 26% rise over the past year. Therefore, Amazon emerges as a viable investment option currently, offering potential wealth-building opportunities.

Exploring the Prospects of Investing in Advanced Micro Devices

Investors eyeing Advanced Micro Devices for potential opportunities may want to pause and reflect on some critical factors before taking the plunge.

Market Insights and Investment Analysis

Recently, analysts at the Motley Fool Stock Advisor unveiled a list of the top 10 stocks they believe could yield substantial returns in the foreseeable future. Curiously, Advanced Micro Devices did not make the cut. While this exclusion may raise concerns, it is essential to delve deeper into the reasoning behind this decision.

The Stock Advisor platform equips investors with a strategic roadmap for success, offering valuable insights into portfolio construction, regular updates from financial experts, and, most notably, two new stock recommendations every month. The service boasts an impressive track record, having outperformed the S&P 500 index by a remarkable margin since its inception in 2002.

Strategic Considerations for Investors

As investors deliberate whether to allocate funds towards Advanced Micro Devices, it is crucial to evaluate the broader investment landscape. While the lure of innovation and technological advancements within the semiconductor industry may captivate many, understanding the dynamics of the market and the competitive forces at play is paramount.

Historically, the technology sector has displayed both resilience and volatility, with companies needing to navigate rapid shifts in consumer preferences, regulatory frameworks, and global economic conditions. Against this backdrop, astute investors must weigh the risks and rewards associated with investing in a company like Advanced Micro Devices.

Industry Experts and Insider Perspectives

Insightful investors may find it enlightening to consider the perspectives of industry luminaries and experts within the semiconductor domain. Notably, figures such as John Mackey, former CEO of Whole Foods Market, and Randi Zuckerberg, an accomplished executive previously associated with Facebook, bring valuable insights to the table as members of The Motley Fool’s board of directors.

It is worth noting that while reports and recommendations from financial sources like The Motley Fool can provide valuable guidance, individual investors are encouraged to conduct thorough due diligence and tailor their investment decisions to align with their unique financial goals and risk tolerance levels.

Final Thoughts on Investment Strategy

Investing in the stock market is akin to navigating a complex maze, where each decision carries its unique set of consequences and opportunities. As investors assess the viability of investing in Advanced Micro Devices, it is essential to adopt a balanced approach, leveraging expert insights, historical market trends, and individual risk appetites to craft a well-informed investment strategy.