Unveiling Insider Buys

Curious investors keep a watchful eye on insider purchases. But who exactly are these ‘insiders’?

An insider, as per Section 16 of the Security Exchange Act, encompasses officers, directors, 10% stockholders, or individuals privy to sensitive information due to their association with the company.

Insiders abide by strict regulations, notably maintaining positions for longer durations relative to regular investors.

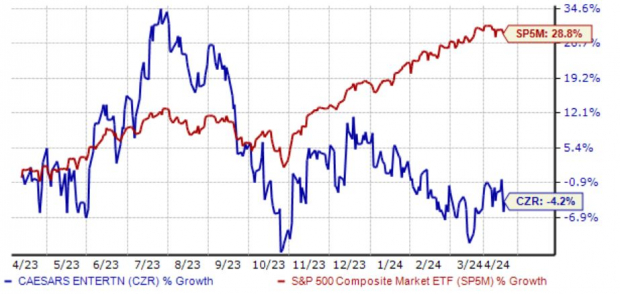

The Story of Caesars Entertainment

Caesars Entertainment, a diversified gaming and hospitality entity, recently witnessed a significant insider move as a director acquired 15,000 shares.

Despite its struggles over the past year, boasting a downturn of approximately 4%, shares notably lagging behind the S&P 500.

Image Source: Zacks Investment Research

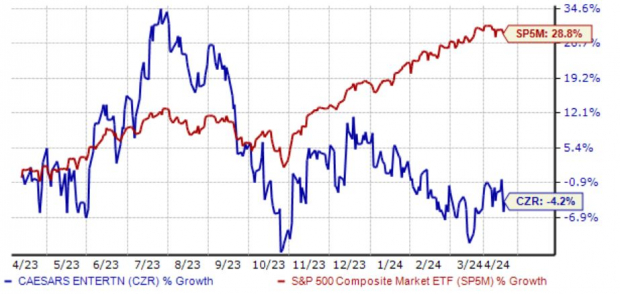

Exploring Greif

Greif, a prominent global producer of industrial packaging solutions, witnessed a buying spree by its VP for 1,925 GEF shares, totaling around $130k.

The stock offers a robust dividend yield of 3.2% annually, displaying consistent dividend growth with a 4% five-year annualized rate.

Image Source: Zacks Investment Research

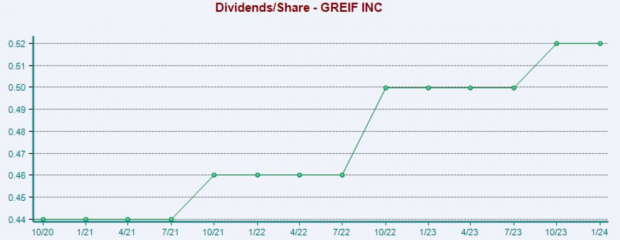

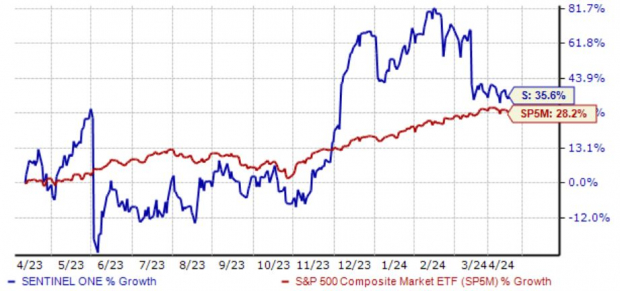

Uncovering SentinelOne

SentinelOne, a provider of an autonomous cybersecurity platform, witnessed a notable insider move when a director purchased a block of 10,000 shares totaling just under $225k.

While the stock exhibited volatility in the past year, it managed to outperform, boasting a 35% increase compared to the S&P 500’s 28% gain.

Image Source: Zacks Investment Research

Deciphering Insider Insights

Insider purchases often offer a peek into a company’s long-term trajectory. If insiders lacked faith in the firm’s future, why would they invest?

These three stocks – Grief GEF, SentinelOne S, and Caesars Entertainment CZR – have recently seen notable insider activity.