Revolutionizing AI with ChatGPT

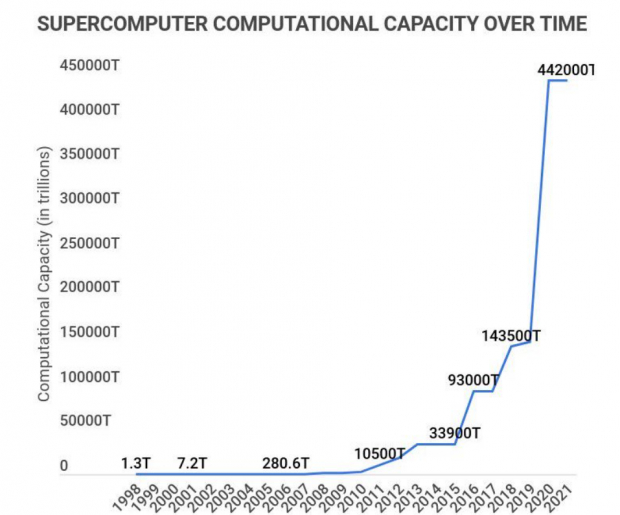

On Wall Street, technological innovation often paves the way for earnings growth and subsequent equity price appreciation. Back in late 2022, OpenAI, backed by tech giant Microsoft (MSFT), unleashed the AI revolution with its ChatGPT “chatbot.” ChatGPT, powered by a large language model (LLM), swiftly garnered 100 million users, marking a significant milestone in the AI space. This transformative event not only demonstrated the vast potential of artificial intelligence but also spurred other tech players like Alphabet (GOOGL) to join the AI race.

The Retreat of AI Titans

The past year witnessed a bullish streak in the market, characterized by soaring equities, record-breaking highs, solid earnings performances, and widespread investor engagement. As is typical in bull markets, sectors experiencing rapid growth tend to take the lead. In the current scenario, AI-related stocks have been the primary drivers of market momentum. Notably, even Tesla (TSLA) CEO Elon Musk highlighted the exceptional pace of AI advancement, emphasizing its unparalleled technological evolution.

Image Source: Zacks Investment Research

Evaluating Risk and Reward for Investors

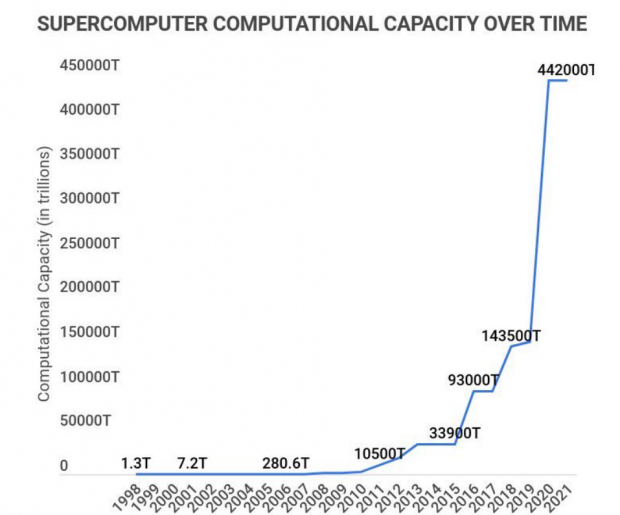

For investors eyeing opportunities in AI stocks, the present moment could signal a generational buying chance. With AI-related companies such as Nvidia (NVDA), Super Micro Computer (SMCI), and Arm Holdings (ARM) experiencing a pullback amid inflation concerns post a higher-than-expected CPI reading, the risk/reward spectrum appears favorable for those looking at the intermediate to long-term investment horizon.

Image Source: TradingView

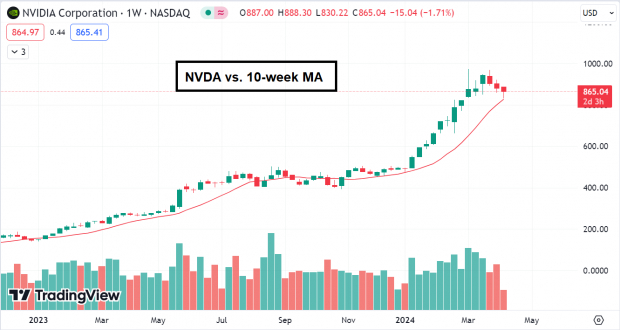

Amid the evolving landscape of AI dominance, robust earnings growth is a key indicator for investor optimism. Companies like Super Micro Computer are projected to witness triple-digit quarterly earnings growth, enhancing their market stature and investor appeal.

Image Source: Zacks Investment Research

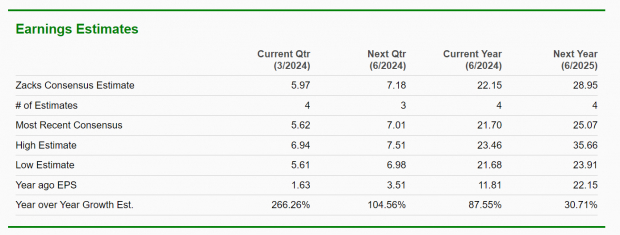

Furthermore, the corrective phase observed in AI stocks recently, such as ARM Holdings, indicates a healthy digestion process post significant gains. This phenomenon underscores investor confidence and suggests a solid foundation for potential future growth.

Image Source: TradingView

Seizing the Opportunity

As market dynamics continue to evolve, amateur investors often anticipate market pullbacks but hesitate to act when presented with the chance. The retreat in AI stocks, however, could offer a promising entry point for those seeking an attractive risk-to-reward ratio.