Netflix (NASD: NFLX) is on the cusp of revealing its earnings report post-market close on April 18th, with options contracts expiring the following day. Forecasted to deliver earnings of $4.50 per share on $9.26 billion in revenue, this event marks a crucial juncture for the streaming giant.

Historical Insights

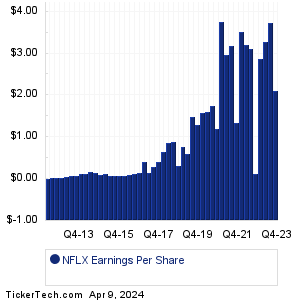

Casting a glance at Netflix’s past earnings, the company has showcased a remarkable trajectory. In recent quarters, earnings have clocked in at $2.110 per share in Q4 2023, $3.730 in Q3 2023, $3.290 in Q2 2023, and $2.880 in Q1 2023, setting the stage for anticipation and analysis ahead of the impending disclosure.

Long-Term Performance

Notably, Netflix boasts a commendable long-term earnings per share chart, depicting steady growth over time. Coupled with this, the company’s revenue history showcases an equally impressive upward trend, underscoring its financial strength and potential for further expansion.

Implications for Traders and Investors

Earnings reports are known to inject unique volatility into a stock’s performance, potentially triggering sharp movements in either direction as market participants interpret the underlying data. For options traders, this volatility presents a lucrative opportunity to capitalize on price fluctuations.

With options contracts set to expire on April 19th, traders keen on leveraging this event should explore Netflix’s options chain available on both the puts and calls sides for strategic insights and potential trading strategies. Platforms like StockOptionsChannel provide a comprehensive look at NFLX options data, aiding traders in making informed decisions amidst the earnings fervor.

Exploring Further

As investors gear up for Netflix’s earnings divulgence, a holistic view of the broader market ecosystem can offer valuable context. By examining historical stock prices, shares outstanding records, and pertinent market videos, individuals can enhance their understanding of the financial landscape and make informed investment choices.