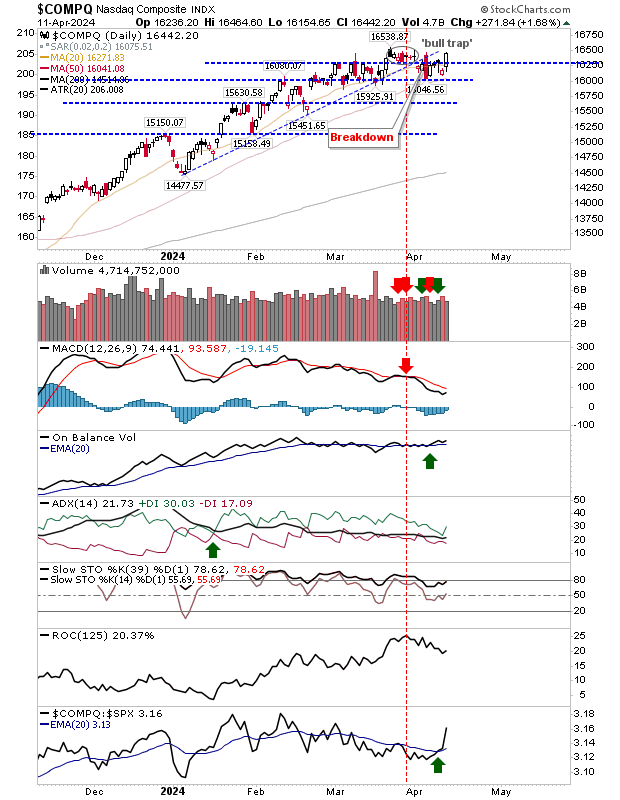

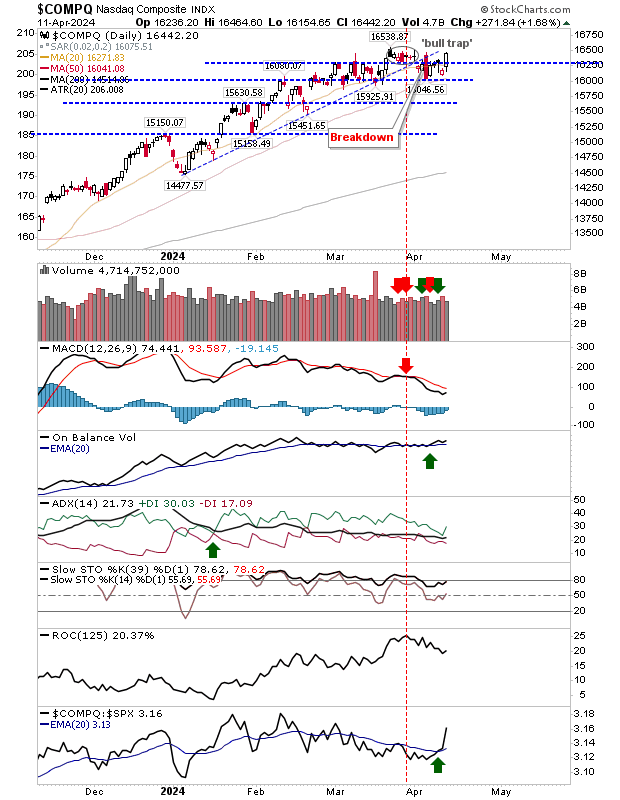

Yesterday, the Nasdaq emerged as a star performer with Apple and Amazon leading the charge. The index is now poised to break free from the ‘bull trap’ that has hindered its progress in recent times.

If the current momentum continues in the coming days, we could witness a confirmed follow-through for the index after a period of consolidation.

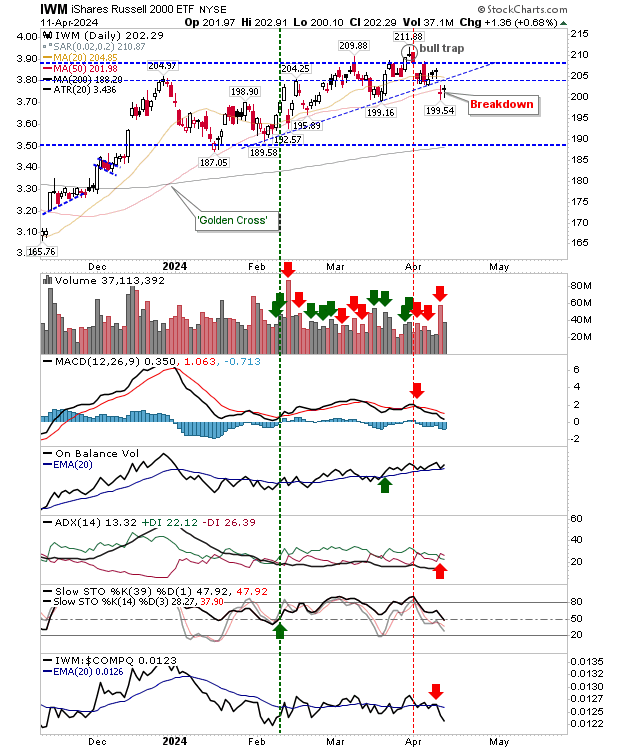

On the flip side, the Russell 2000 faced a setback as it gapped below trendline support, ending the session with a second consecutive doji candle. Despite being deemed as neutral candlesticks, this could signal a failure on the part of sellers to sustain a breakdown.

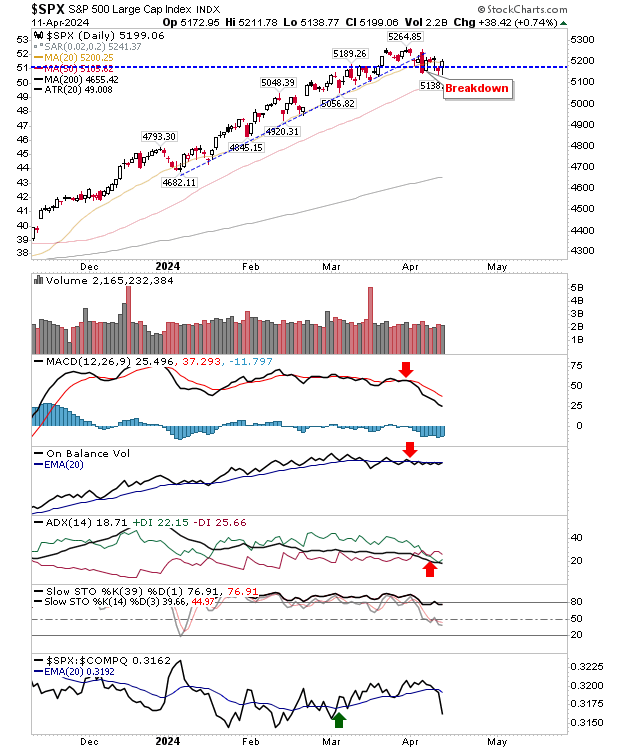

The S&P 500 capitalized on some of the positive vibes from the Nasdaq, reclaiming its position above breakout support. However, it still has ground to cover to challenge its all-time high levels. Despite yesterday’s price gains, key technical indicators remain somewhat bearish with limited improvement.

The markets have shown resilience following a recent sell-off, buoyed by encouraging economic data and the resurgence of Tech sector behemoths. The Nasdaq has swiftly taken the reins as a frontrunner, evident from its robust outperformance compared to its peers. Undoubtedly, all eyes will be on the Nasdaq in the days to come.