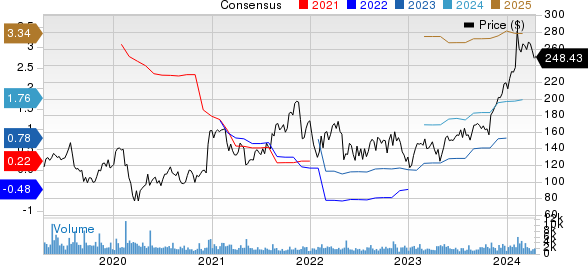

Amid the fluctuating tides of the stock market, CyberArk’s CYBR shares have shown an impressive 13.4% surge in the year-to-date period. This remarkable performance is a testament to investors’ unwavering faith in CYBR’s robust fundamentals and its dominant position in the cyber security sector.

CyberArk has consistently surpassed earnings expectations over the last four quarters, showcasing an average surprise rate of 76.26%. The company also boasts a long-term earnings growth projection of 20%, further solidifying its position in the market.

Positioning for Growth: A Strong Investment Play

Currently holding a Zacks Rank #1 (Strong Buy) and a Growth Score of B, CYBR is positioned as a lucrative investment opportunity. The Growth Style Score encapsulates essential metrics from a company’s financials, providing a holistic view of its growth potential. Stocks with a Zacks Rank #1 or 2 (Buy) coupled with a Growth Score of A or B are considered prime investment prospects.

CyberArk’s Diverse Portfolio and Market Edge

In a landscape where data breaches loom large, CyberArk’s cyber security products are witnessing high demand. The advent of cloud computing has paved the way for sophisticated cyber threats, underscoring the necessity for robust security measures. CyberArk is well-positioned to capitalize on the heightened security budgets of enterprises striving to fortify their security protocols.

The company’s suite of privileged access management (PAM) solutions, including the enterprise password vault and privileged session manager, addresses critical challenges faced by enterprises. These offerings not only enhance CYBR’s competitive advantage but also cater to the evolving security needs of organizations.

As hybrid work models become the norm, the demand for stringent data security measures rises. In response, CyberArk has ramped up customer engagement by providing essential products like the Enterprise Password Vault and Privileged Session Manager, further enriching its product portfolio.

The company’s expertise is reflected in the growth of its customer base, enabling additional product sales to existing users. Multiple significant deals closed in recent quarters have bolstered CyberArk’s revenue streams and visibility. Moreover, timely product updates translate into increased revenue as enterprises strive to keep their threat management systems up-to-date.

Steady Revenue Growth and Market Presence

In the fourth quarter of 2023, CyberArk witnessed a substantial 32% year-over-year revenue increase, reaching $223.1 million. Its non-GAAP earnings of 81 cents per share marked a significant improvement from the previous year, adding to its positive momentum in the market.

Exploring Alternative Investment Options

While CyberArk shines as a compelling investment choice, other notable stocks in the tech sector such as NVIDIA (NVDA), Bentley Systems (BSY), and Dell Technologies (DELL) also present lucrative opportunities. Each of these companies currently holds a Zacks Rank #1, underscoring their potential for growth and profitability in the market.