Reigning AI Titan: Alphabet

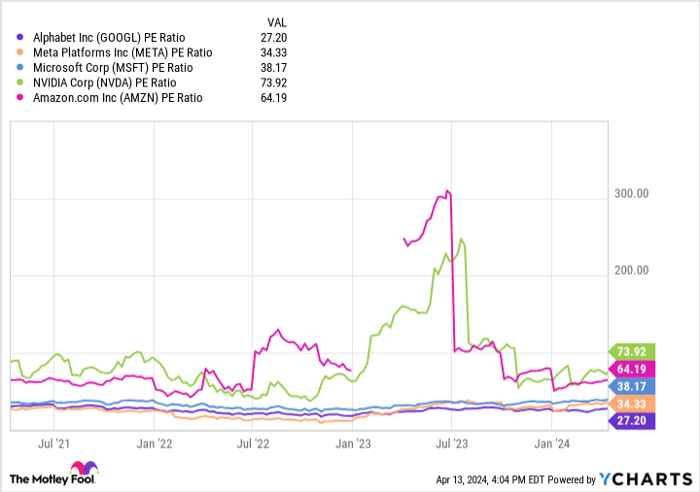

Amidst the AI stock frenzy, Alphabet has stood as a monumental figure since integrating machine learning back in 2001. The recent advancements in AI technology, however, have sparked concerns about its competitive edge, particularly with the emergence of Google Gemini and the integration of ChatGPT by Microsoft’s Bing. Despite these challenges, Alphabet’s consolidation of AI research arms and substantial liquidity of $111 billion position it well for future advancements in the AI realm. As their stock climbs nearly 50% year-over-year to just under $160 per share, trading at a modest P/E ratio of 27, Alphabet presents a lucrative opportunity for investors.

Apple’s AI Evolution

While Apple may not always be top-of-mind in the AI field, the tech giant heavily invests in AI research, evident in products like Siri and FaceID. However, the lack of major product releases in recent years has led to speculation about its standing in the technology sector. Despite this, with $173 billion in liquidity and upcoming generative AI tools, Apple has the potential to reclaim its position as an AI frontrunner. Even as its stock price dipped in 2024, trading at a P/E ratio of 28, Apple’s current value presents a compelling opportunity for investors at around $175 per share.

Alibaba: A Contrarian Choice

Alibaba, often overlooked for its potential in AI, offers a unique value proposition with a price-to-earnings ratio of just 13. Similar to Amazon, Alibaba dominates e-commerce in China and operates a robust cloud-infrastructure platform. However, concerns around its ADR status and challenges in U.S.-China relations have led to a sharp decline in stock value, plummeting from its IPO price. Despite these risks, Alibaba’s price may reflect an overestimation of the current challenges, presenting a significant upside if conditions improve. With shares trading at around $70 at present, Alibaba’s undervaluation could lure in risk-tolerant investors seeking potential gains.

The Motley Fool Stock Advisor Unveils Top 10 Best Stocks for Investors

Top Stock Picks Unveiled

The Motley Fool Stock Advisor analyst team recently revealed what they consider to be the 10 best stocks for investors to buy now, each with the potential to generate substantial returns in the future. Surprisingly, tech giant Alphabet did not make the coveted list.

Leading the Way in Investing Success

Stock Advisor offers investors a user-friendly roadmap to financial success, providing valuable insights on portfolio construction, regular updates from expert analysts, and two fresh stock recommendations every month. Since its inception in 2002, the Stock Advisor service has outperformed the S&P 500 by a staggering margin, more than tripling its returns.*

Redefining Investment Strategies

Investors who follow the recommendations provided by the Stock Advisor service gain access to carefully curated stock selections that could potentially pave the way to significant financial gains. These insightful picks carry the promise of lucrative returns, setting investors on a path towards a brighter financial future.

Stellar Performance Against Market Indices

The consistent success of the Stock Advisor recommendations underscores the valuable expertise and strategic acumen of the analyst team, positioning investors to capitalize on emerging opportunities and navigate the complex landscape of the stock market with confidence.

Disclaimer

*Stock Advisor returns are reflective as of April 15, 2024.