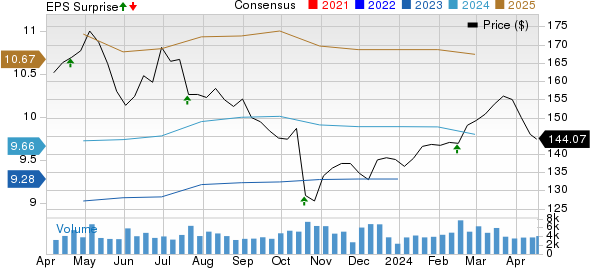

After analyzing Genuine Parts Company’s first-quarter 2024 performance, investors are faced with a mixed bag of results. The company reported adjusted earnings of $2.22 per share, reflecting a 3.74% increase year over year, outperforming the Zacks Consensus Estimate of $2.15 per share. However, net sales of $5.78 billion fell short of expectations, missing the Zacks Consensus Estimate of $5.84 billion.

Segmental Insights

The Automotive segment witnessed a positive trajectory with net sales reaching $3.6 billion, a 1.9% increase year over year, driven by comparable sales growth and acquisition benefits. Despite beating revenue estimates, operating profit of $273 million fell below expectations. The Industrial Parts segment, on the other hand, faced challenges as net sales declined by 2.2% to $2.2 billion due to comp declines and unfavorable forex translations.

Financial Standing

Genuine Parts Company closed the quarter with $1.05 billion in cash and cash equivalents, showing a slight decline from the previous quarter. Long-term debt also decreased to $3.03 billion. The company generated free cash flow of $203 million during the quarter, indicating a healthy cash position.

2024 Projections

Looking ahead to the rest of 2024, Genuine Parts anticipates growth in both automotive and industrial sales revenue. The company expects adjusted earnings in the range of $9.80-$9.95 per share and aims for strong operating cash flow and free cash flow figures, signaling a positive outlook for the upcoming quarters.

Stock Recommendations

Investors eyeing opportunities in the automotive sector may consider adding General Motors (GM), PACCAR (PCAR), and Ford (F) to their portfolios. Each of these companies holds a Zacks Rank #2 (Buy), presenting potential investment prospects in the current market landscape.