The global media and streaming industry is expanding rapidly, with contenders jostling to etch their presence. Yet, few possess the gravitational pull and extensive heritage of the Walt Disney Company (DIS). Disney has captivated audiences for over a century with its timeless animated treasures and blockbuster franchises like Marvel and Star Wars.

Comparisons between Disney and Netflix (NFLX) are ubiquitous, given their intense rivalry in the streaming content domain. However, Disney’s rich legacy catalog sets it apart from nascent competitors in the field. Despite escalating competition in the entertainment sector, financial markets uphold an optimistic outlook on this experienced player, labeling it a “strong buy.”

Disney, with a market cap of $206.5 billion, has surged by 25% year-to-date, trumping the S&P 500 Index’s 4.7% gain.

The Rise of Disney: A Bullish Narrative

Disney’s journey is one of adaptation and progression. Across time, the company has undergone multiple metamorphoses, diversifying its footprint across various facets of the entertainment realm.

Apart from its unparalleled intellectual property (IP) portfolio encompassing Pixar, Marvel, and Star Wars, Disney’s ventures extend to Disney Experiences like theme parks, resorts, and cruises. This diverse portfolio has enabled a consistent generation of stable income through the years.

In the recent first quarter of fiscal 2024, the diluted earnings per share (EPS) leaped by a notable 49% year on year, reaching $1.04 per share. Total revenue in the quarter stood at $23.5 billion, mirroring the figures of the preceding year.

Disney’s Strategic Maneuvers in the Streaming Sphere

Disney+ unveiled in 2019 denotes the company’s endeavor to establish a foothold in the competitive streaming landscape. Although Disney+ Core subscriptions saw a decline of 1.3 million in Q1, projections foresee a healthy addition of 5.5 million to 6 million subscribers in Q2.

The management eyes profitability in the combined streaming business by the fourth quarter of fiscal 2024, propelled by stringent cost-cutting measures. The company is on track to surpass its annualized cost savings target of $7.5 billion by the fiscal year’s end.

Besides cost optimization, Disney remains committed to rewarding shareholders. Ending the quarter with $886 million in free cash flow, Disney is in a position to distribute dividends.

Disney significantly raised its quarterly dividend to $0.45 per share in Q1, offering a forward dividend yield of 1.6% with a payout ratio of 32%, allowing leeway for future dividend increments. Moreover, the company aims for $3 billion in share repurchases in fiscal 2024.

Analyst Projections and Wall Street Sentiment

In the outlook for fiscal 2024, management anticipates an earnings upsurge of 20% to $4.60, differing slightly from the consensus estimate of $4.69. Analysts foresee a mild 3.3% hike in revenue to $91.8 billion in fiscal 2024, with anticipated increases of 5.4% and 17.5% in revenue and earnings respectively for fiscal 2025.

Comparatively, analysts predict a 14.4% growth in Netflix’s revenue and a substantial 51.5% surge in earnings for 2024.

Analysts’ Take on Disney Stock

Post Disney’s robust first-quarter performance, analysts exhibit optimism towards the stock. Raymond James analyst Ric Prentiss maintains a “buy” rating with a price target of $112, impressed by Disney’s effective shift from a traditional TV business to a streaming juggernaut.

Moreover, Tigress Financial analyst Ivan Feinseth and J.P. Morgan analyst David Karnovsky reiterate their bullish sentiments on Disney, citing the company’s financial resilience, diversified business segments, and content prowess.

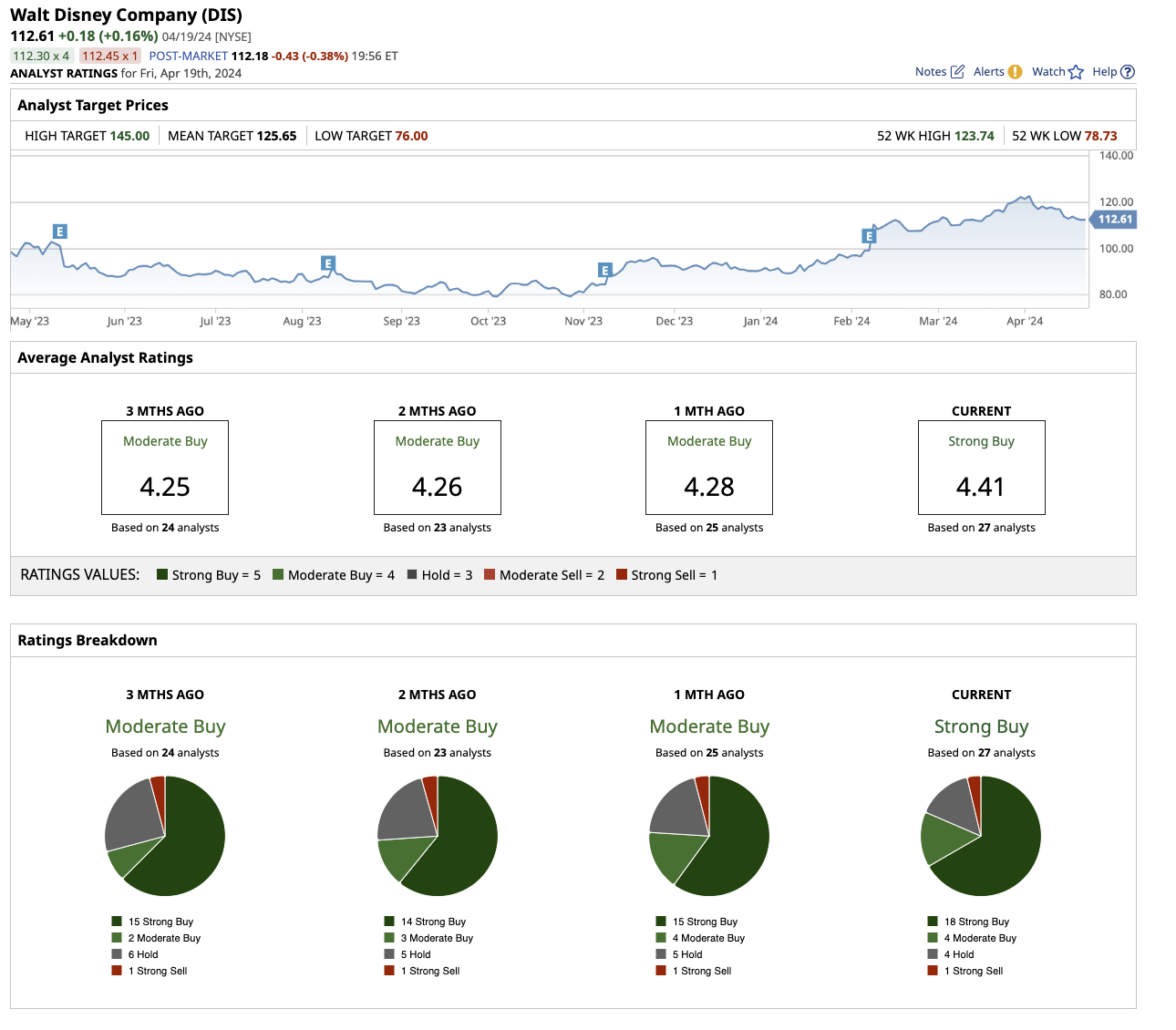

Wall Street resonates with this sentiment, with the majority of analysts rating Disney stock as a “strong buy,” with substantial upside potential projected.

Analysts have pegged a mean price target for Disney stock at $125.65, indicating an 11.6% increase from current levels. The high target price of $145 implies a promising upside potential of nearly 29% in the next year.

A Convincing Case for Investing in Disney Stock

While Netflix surges forward in the entertainment domain, Disney’s entrenched global franchises, cherished brands, and diversified revenue streams position it for resilience and success in the long haul. Thus, Disney emerges as a steadfast investment option, offering growth prospects intertwined with stability.