Intel‘s (NASDAQ: INTC) journey has taken a tumultuous turn as it grapples with a changing landscape in the chip market. Once hailed as a dominant force in CPUs with a prosperous partnership with Apple, Intel faced adversity when competition grew fiercer and its association with Apple came to an end.

Over the past two years, Intel’s stock has witnessed a descent of about 28%, signaling the market’s acknowledgment of its challenges. In response, Intel has embarked on an ambitious transformation that holds promises of long-term rewards.

An Upsurge with the CHIPS Act

The enactment of the CHIPs Act by President Joe Biden two years ago aimed to fortify the country’s semiconductor manufacturing capabilities by injecting $53 billion into top chip manufacturers worldwide, Intel included. The fruition of this initiative is now underway.

Recently, on April 15, the Biden administration unveiled plans to allocate $6.4 billion to Samsung for the expansion of its U.S. manufacturing sites. Intel is poised to follow suit, with $8.5 billion earmarked for the company to erect four new facilities across the nation.

These investments are anticipated to streamline the process and reduce costs for U.S. tech firms in diversifying their product range, spanning from consumer goods to automotive, data centers, and AI hardware.

Intel foresees monumental savings of up to $10 billion by 2025 with its transition to an internal foundry model, marking a watershed moment in its 55-year history. The pivot is expected to enhance operational efficiency and profitability, potentially resulting in a 60% non-GAAP gross margin and a 40% operating margin.

Intel’s Strategic Maneuver in the AI Realm

Beyond redefining its business structure, Intel has honed in on AI, integrating it significantly into its product portfolio.

The AI industry, valued at almost $200 billion last year, is forecasted to burgeon at a staggering 37% compound annual growth rate until 2030. Intel, leveraging its extensive experience in chipmaking spanning 55 years, commands 63% of the CPU market, despite the ascendancy of rivals like Advanced Micro Devices.

Although Intel’s foray into AI trails behind its CPU legacy and the evolving need for GPUs in AI model development, Intel is gearing up to challenge the dominance of GPU front-runner Nvidia with its own AI GPUs by 2024.

Intel introduced its Gaudi 3 AI GPUs last year, surpassing Nvidia’s GPUs by 50% in inference and 40% in power efficiency upon their launch in April this year, setting the stage for Intel’s potential to harness the tailwinds of the burgeoning AI market for years to come, making it a compelling stock option in the current market climate.

Intel’s Valuable Position in the AI Stock Space

The Nasdaq-100 Technology Sector index has soared approximately 40% in the past year, largely attributed to the AI frenzy. Nevertheless, the sector’s projected expansion indicates that there is still ample opportunity for investment.

Chip stocks emerge as prime avenues to capitalize on AI, serving as the architects behind the very hardware that propels this transformative technology.

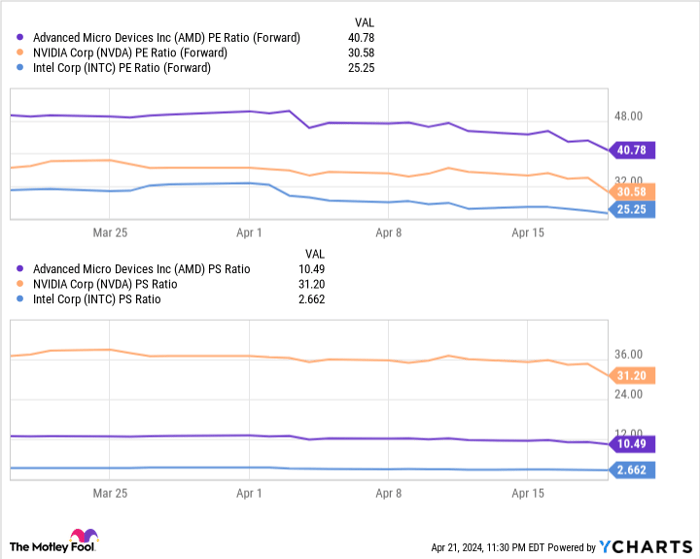

Data by YCharts

Comparatively, Intel emerges as an attractive proposition within the AI chip stock realm. Its forward price-to-earnings and price-to-sales ratios are notably lower than its counterparts like Nvidia and AMD, thus positioning Intel as a budget-friendly avenue for investors seeking exposure to the AI market.

Decision Time: Investing in Intel

Before delving into Intel stock, it’s prudent to ponder the considerations at hand:

The Motley Fool Stock Advisor team recently unveiled their selection of the 10 best stocks primed for a successful investment, with Intel not making the cut. These handpicked stocks harbor the potential to yield substantial returns in the foreseeable future.

Stock Advisor furnishes investors with a roadmap to success, offering insights on building a diverse portfolio, real-time analyst updates, and bi-monthly stock recommendations. Since 2002, the Stock Advisor service has outperformed the S&P 500 by a remarkable margin.

*Stock Advisor returns as of April 22, 2024

Dani Cook holds no position in the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, and Nvidia. The Motley Fool endorses Intel and suggests options related to the stock. The Motley Fool maintains a strict disclosure policy.