The Nasdaq’s Steady Streak

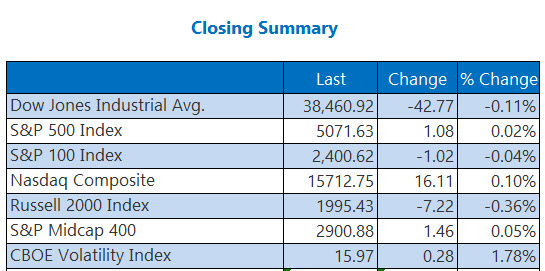

Despite swirling turbulence in the market, the Nasdaq managed to cling on to its winning ways for the third consecutive session. Rise in bond yields acted as a damper on the high spirits instigated by robust earnings reports, with Tesla (TSLA) leading the charge with a remarkable 12% surge post-reveal. The closing bell saw a mixed picture – the Dow trailing, the S&P 500 treading water, and the Nasdaq edging up slightly to notch yet another victory. Market observers are now bracing for tomorrow’s gross domestic product (GDP) reading, anticipated to unveil a brisk growth rate of 2% or more for the U.S. economy in the first quarter.

Capturing the Market Pulse

As trading floors buzzed with activity, nuggets of market insights surfaced. An affordably priced airline stock caught attention, contrasting Enphase Energy’s lackluster earnings performance. Meanwhile, ABNB received a lift from an upgrade, TXN surpassed expectations with a beat-and-raise, and the tantalizing question on traders’ minds lingered around whether it was time to buy the dip in Nvidia stock’s trajectory.

Peering into Market Dynamics

Amidst the flux, pivotal market statistics emerged, hinting at evolving trends. The rising tide of new car sales, propelled by climbing deals and inventories, hinted at a promising year ahead. On the tech front, TikTok’s CEO defiantly vowed to contest any potential U.S. ban, asserting the platform’s unwavering presence. The impending Summer Olympics cast a favorable glow on Airbnb demand, while chip stocks reveled in bullish sentiments post beat-and-raise scenarios. Wrapping up the day, deep dives into stock returns following substantial losses in large market caps provided food for thought.

Market Indicators and Insights

Amidst global developments, investors kept a close watch on the Middle East as U.S. data revealed a decline in weekly gasoline demand. The price choreography unfolded with June-dated West Texas Intermediate (WTI) crude slipping 0.7% to settle at $82.81 per barrel. In the precious metals arena, gold took a dip for the third consecutive day, as June-dated gold futures slid 0.2% to rest at $2,336.90 per ounce.