The Unveiling of a New Investment Strategy

After years of focusing on individual stocks, a seasoned investor recently made a bold move by allocating 12% of their portfolio into an exchange-traded fund (ETF). This shift marked a departure from the norm and a step towards diversification.

Bridging the Gap in the Market

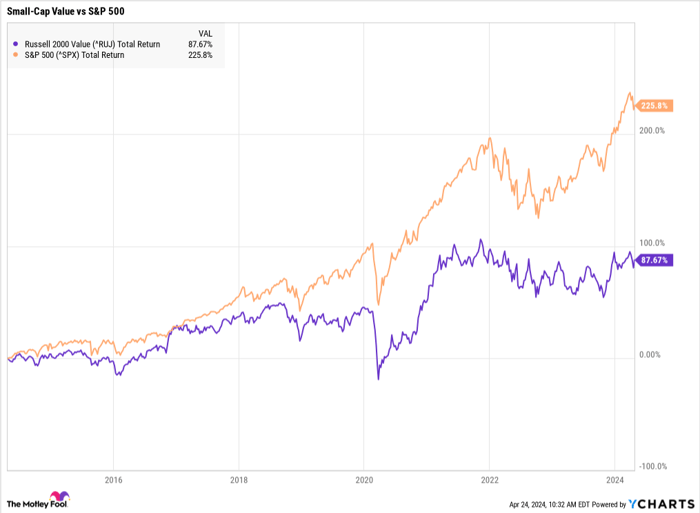

Small-cap stocks, particularly in the value segment, have faced challenges over the past decade, painting a bleak picture of underperformance. This trend has created a significant valuation gap between small-cap and large-cap stocks, offering potential opportunities for investors to capitalize on.

Historically, small-cap value stocks have been top performers, despite recent setbacks. The fundamental rationale behind their strength lies in the inherent risk premium attached to smaller companies, making them promising investments over the long haul.

Unveiling the Thought Process

While large-cap stocks offer transparency and accessibility, delving into small-cap equities requires a deeper level of due diligence and insight due to limited coverage and analyst attention. Opting for an ETF over individual stock selection provides a simpler, yet effective approach to gain exposure to this segment.

By choosing the Avantis U.S. Small Cap Value ETF, the investor embraced an actively-managed fund with a passive selection process. The ETF’s strategy of overweighting stocks with higher expected returns based on current valuations aligns with the investor’s outlook on market opportunities.

A Closer Look at the Chosen ETF

The Avantis U.S. Small Cap Value ETF, with its strategic focus on outperforming the Russell 2000 Value Index, offers a unique investment proposition. Despite being an actively-managed fund, its approach to stock selection remains grounded in passive principles, emphasizing profitability metrics and diversification.

While actively-managed funds often face scrutiny for their fees, the 0.25% expense ratio of the Avantis ETF seemed justified given the potential for market outperformance. Moreover, the ETF’s substantial exposure to the small-cap value segment further strengthens its appeal, setting it apart from other players in the market.

The Rise of American Century ETF Trust – Avantis U.S. Small Cap Value ETF in the Financial Landscape

Investing in American Century ETF Trust – Avantis U.S. Small Cap Value ETF has emerged as a compelling option for those seeking exposure to the small-cap value segment of the market. While it may demand slightly higher fees than its counterparts, the potential for outperformance with Avantis’s selective criteria renders the additional cost a worthy investment.

Exploring the Investment Potential

Before delving into American Century ETF Trust – Avantis U.S. Small Cap Value ETF, it’s essential to consider the following aspects:

The analyst team at Motley Fool Stock Advisor recently unveiled the top 10 stock picks for extraordinary returns, with American Century ETF Trust – Avantis U.S. Small Cap Value ETF missing the list. The 10 stocks highlighted are anticipated to yield substantial growth in the foreseeable future.

Stock Advisor offers a comprehensive investment blueprint, encompassing portfolio creation guidance, frequent updates from analysts, and bi-monthly stock recommendations. Since 2002, the Stock Advisor service has significantly surpassed the S&P 500’s returns, exhibiting exceptional performance.*

*Based on Stock Advisor returns as of April 22, 2024

Adam Levy maintains positions in American Century ETF Trust – Avantis U.S. Small Cap Value ETF. The Motley Fool retains no stake in any of the aforementioned stocks. The Motley Fool adheres to a strict disclosure policy.